Vacation Rental Trends: What Changed Between Summer 2024 and Summer 2025

.png?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2FIVQoBNr0c84dCp4n4kOrD%2F371417869fe80c914033c1d22859a2bf%2F2657808_SummerSnapshotReport%C3%A2__Blog-socialandemaillaunchassets_Blog_2_100125__1_.png&a=w%3D960%26h%3D502%26fm%3Dpng%26q%3D75&cd=2025-10-17T14%3A20%3A22.086Z)

Key Takeaways

2025 summer outperformed 2024: ~40% of operators increased both occupancy (OR) and average daily rates (ADR), 37.5% grew direct bookings, and about 35% saw higher guest ratings.

Direct channels are gaining: investments in branded sites, SEO, and loyalty programs are reducing reliance on OTAs.

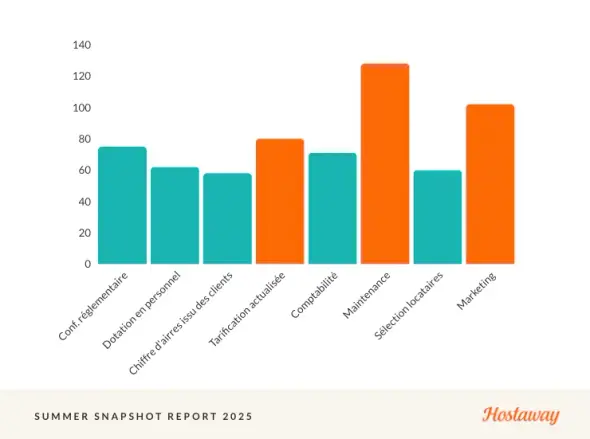

Maintenance is the top operational pain: property condition/cleanliness drove the most guest complaints; rising competition and constant price adjustments add pressure (with staffing/turnover issues for larger portfolios).

Regulations eased as a headwind: 40% reported no regulatory impact in 2025, while macroeconomics bit harder — 40% cited inflation and rising costs as a big/severe impact.

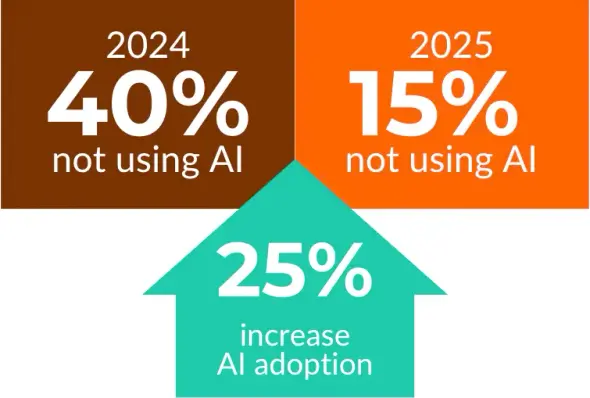

Tech and AI went mainstream: AI adoption jumped to 84% (from 60% in 2024), with strong uptake in dynamic pricing, home automation, accounting, and AI-driven guest comms and ops.

Outlook to 2026 is cautiously optimistic: 61% are confident; 54.5% expect OR and ADR to rise, with events like the 2026 FIFA World Cup expected to lift demand.

What to do now: double down on direct booking strategy, proactive maintenance, dynamic pricing, and targeted AI/automation to boost guest satisfaction, resilience, and profitability.

Three out of four short-term rental operators reported higher guest ratings this summer compared to 2024. It’s one of several signs that the industry is not just holding steady but finding ways to thrive despite mounting pressures.

According to Hostaway’s 2025 Summer Snapshot Survey, which gathered insights from 320 property managers and owners across 51 countries, the short-term rental sector is showing resilience in the face of inflation, regulatory challenges, and intensifying competition. Operators are leaning into technology — especially AI in property management — while also grappling with the timeless headaches of property maintenance and guest satisfaction.

This year’s findings paint a picture of an industry at a crossroads: performance metrics are trending upward, but so are guest expectations and economic uncertainties. In this article, we unpack the key data points, highlight operator perspectives, and share actionable strategies drawn from the survey results.

.png?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F2ZdbgJCND1ldhoZjkw5IY7%2F28e35e2751049297cd469221ca990375%2F2025-05_-_Short_Term_Rental_Report_2024__1_.png&a=w%3D960%26h%3D84%26fm%3Dpng%26q%3D75&cd=2025-10-03T16%3A55%3A52.237Z)

Performance Trends — Occupancy, Rates, and Guest Experience

For many operators, 2025 was a stronger summer than the year before. Around 40% of survey respondents reported an increase in occupancy rates (OR) and average daily rates (ADR), while more than one in three (37.5%) said they generated more direct bookings compared to 2024. Perhaps most telling: three-quarters of operators reported higher guest ratings, signaling not only stronger demand but also better guest experiences.

This marks a continuation of last year’s momentum, where operators began to rebound from post-pandemic volatility. But unlike 2024, when performance was more uneven, the 2025 data points to broader stability across the sector.

“I’m confident because I know I have done a lot of improvements to my property and services.” — Survey respondent

The growth in direct bookings is particularly noteworthy. As operators look to reduce dependence on online travel agencies (OTAs), investments in branded websites, SEO, and guest loyalty are starting to pay off. Higher guest ratings suggest that operators are not just filling nights but elevating experiences — a factor that feeds back into occupancy and ADR gains.

Actionable takeaway: To capture this momentum, operators should continue investing in direct booking strategies, from user-friendly websites to email marketing. Meanwhile, focusing on guest satisfaction through communication, cleanliness, and service excellence can help ensure that higher ratings translate into repeat bookings and stronger revenue.

Top Challenges — Maintenance and Competition

If there’s one thing short-term rental operators agree on, it’s that keeping properties in shape is harder than ever. Four in ten respondents ranked property maintenance among their top three challenges in 2025, making it the single biggest operational hurdle this summer.

Guest feedback reinforces this pain point: Property Condition and Cleanliness topped the list of guest complaints, outpacing issues like communication, check-in access, and amenities. In a market where guest ratings directly influence bookings and revenue, even small lapses in upkeep can quickly erode performance gains.

“Summer is declining mainly not because of occupancy but because of increasing costs and more competition.” — Survey respondent

Beyond maintenance, operators pointed to rising competition and the pressure to constantly adjust pricing. With more listings entering the market and guest expectations climbing, standing out has become an ongoing battle. Operators managing larger portfolios (50+ properties) cited staffing and turnover as additional pain points, underscoring how scale amplifies operational complexity.

Actionable takeaway: Proactive maintenance planning, regular inspections, and leveraging smart home automation tools can reduce guest complaints and unexpected costs. Meanwhile, using dynamic pricing software can help operators respond more efficiently to competitive pressures without constant manual adjustments.

Regulations & Economic Pressures

For years, regulations have been a looming concern for short-term rental operators. But in 2025, the story is shifting: 40% of survey respondents said regulations had no impact on their business this year, suggesting operators are becoming more adept at navigating permitting, compliance, and local restrictions.

The greater threat came from macro-economic factors. Inflation, rising costs, and lingering travel restrictions weighed heavily on operators, with 40% reporting that these pressures had a “big” or “severe” impact on their business. For some, this translated into tighter margins; for others, it meant difficult choices around staffing, investment, and pricing flexibility.

“The global situation is not very optimistic.” — Survey respondent

Compared to 2024, when regulatory concerns dominated headlines, the narrative in 2025 underscores just how much economic volatility has become the primary headwind. Even operators with stable occupancy and strong guest ratings are bracing for uncertainty, especially in markets heavily exposed to fluctuations in travel demand and political shifts.

Actionable takeaway: Operators can buffer against macro pressures by diversifying their demand sources, investing in repeat guest loyalty programs, and building more resilient cost structures. Beyond reacting to external forces, strengthening direct booking strategies and adopting short-term rental software that improves efficiency can help maintain profitability in leaner times.

Technology & AI in Property Management

If 2024 was the year operators began experimenting with AI, 2025 is the year it went mainstream. AI adoption surged to 84% of operators, up from 60% just a year earlier. In fact, adopting new AI tools was the single most reported change across the industry this year.

The core tech stack remains unchanged — Property Management Systems (PMS) and Channel Managers continue to be the backbone of daily operations. Beyond that, operators pointed to Dynamic Pricing (62%), Home Automation (46%), and Accounting Software (42%) as essential tools, with Website Builders (29%) rounding out the top five. But AI is increasingly the connective tissue, enabling everything from automated guest communication to predictive pricing and smarter maintenance scheduling.

“I expect AI will help us optimize tasks that we struggle to manage manually.” — Survey respondent

This adoption isn’t just about efficiency; it’s becoming a competitive advantage. Operators who deploy AI for guest messaging, reputation management, and pricing are freeing up time for higher-value activities while also improving the guest experience. As competition intensifies, this edge will only widen.

Actionable takeaway: Operators should prioritize AI in areas with the highest impact — guest communication, dynamic pricing, and operational automation. Combining short-term rental software with AI-driven tools can not only reduce costs but also boost guest satisfaction, leading to higher occupancy and stronger direct booking performance.

Outlook for 2026 — Confidence and Caution

Despite economic uncertainty, most operators are looking ahead with optimism. 61% of survey respondents said they are confident about their business over the next 12 months, while just over half (54.5%) expect occupancy rates (OR) and average daily rates (ADR) to rise.

When asked what drives their confidence, operators pointed to business optimization, property strengths, and major upcoming events such as the FIFA World Cup in 2026, which is expected to generate significant travel demand in host cities. For some, confidence stems from the improvements already made to operations and guest experience.

“I do not expect any negative changes. New openings and events will bring more business.” — Survey respondent

At the same time, economic and political uncertainty remained the most frequently cited source of caution, with market competition a close second. While global events and technological adoption are cause for optimism, operators are keenly aware that the STR market is becoming more crowded and less forgiving of missteps.

Actionable takeaway: To prepare for 2026, operators should build resilience by optimizing costs, diversifying revenue streams, and positioning their properties to benefit from upcoming demand spikes. Leveraging AI in property management and doubling down on direct booking strategies will be key to staying competitive.

Actionable Takeaways for Operators

The 2025 Summer Snapshot Survey reveals an industry that is adapting quickly, innovating boldly, and bracing for uncertainty. Performance metrics are rising, but so are guest expectations and operational pressures. Technology — especially AI in property management — is no longer optional but essential for staying competitive.

Here are the top takeaways for short-term rental operators:

Invest in Direct Bookings: With 37.5% of operators reporting growth in direct reservations, building independent demand channels is one of the clearest paths to sustainable revenue.

Prioritize Property Condition: Maintenance and cleanliness are the top sources of guest complaints. Proactive upkeep pays dividends in reviews, occupancy, and repeat stays.

Adopt AI with Purpose: From guest communication to dynamic pricing, AI adoption jumped from 60% to 84% in just one year. Operators who integrate AI strategically are gaining a competitive edge.

Plan for Economic Resilience: Inflation, rising costs, and competition remain major headwinds. Diversification, cost control, and repeat guest strategies can help operators weather volatility.

Stay Optimistic, Stay Prepared: With major global events like FIFA 2026 on the horizon, the demand outlook is strong. Operators who are ready will be positioned to capture the upside.

As one survey respondent put it:

“I’m confident because I know I’ve built the right foundation for growth.”

Closing

The short-term rental market is evolving quickly, but the direction is clear: operators who embrace technology, focus on guest experience, and build resilient business models will be the winners in 2026 and beyond.

📊 For a deeper look at the data, charts, and insights from 320 operators worldwide, download the full 2025 Summer Snapshot Report here.

And if you’re ready to see how Hostaway’s short-term rental software can help you manage properties more efficiently, optimize performance, and scale with confidence, book a demo today.

Ready to find out how Hostaway can transform your business?