Top 10 USA Spots to Buy Vacation Rental Investment Properties in 2025

The vacation rental industry has never been more competitive — or more full of potential. Whether you're dreaming of turning your vacation home into a reliable income stream or expanding your short-term rental property portfolio, where you invest in 2025 could make or break your strategy.

And with the market shifting yet again, one thing’s clear, the best locations aren’t just the prettiest. They’re the places with steady guest demand, strong cash flow and room for growth.

In fact, the best place to start an Airbnb may not be a big-name destination like Aspen or Palm Springs. According to Jamie Lane, an economist at AirDNA, high-performing short-term rental markets are often regional destinations with strong tourism and a need for temporary housing — think traveling nurses, grad students or remote workers looking for mid-term stays.

So, how do you spot those hidden gems before the rest of the market catches on? That’s exactly what this article is about.

Why 2025 Is a Prime Year for Vacation Rentals in the U.S.

If you've been in the short-term rental market for a while, you'll know it moves fast — and 2025 is no exception. The good news? This year brings a unique mix of opportunity and stability that hasn’t been seen in a while.

Here’s the scoop, after a post-pandemic boom, the pace of new vacation rental listings is finally cooling off. AirDNA reports that new listings across Airbnb and Vrbo rose just 6.8% in 2024 — a big drop from 14.4% in 2023 and over 22% the year before. That slower growth means less saturation and a better shot at standing out, especially in emerging markets.

Meanwhile, according to Vacasa, the housing market is shifting too. Inventory is ticking up after years of record-low listings, giving buyers more options and more negotiating power. While prices are still high in many areas, some markets are already leaning toward buyer-friendly conditions.

That said, it’s not all sunshine and beaches. Cap rates are feeling the squeeze as operating costs climb — from HOA fees and insurance to utilities and maintenance costs. And although interest rate cuts in 2024 helped, continued volatility is expected through 2025.

Bottom line? It’s no longer about just owning a vacation rental property — it’s about owning one in the right place, with a plan that supports long-term rental income and manageable operating costs.

What Makes a Location Ideal for a Short-Term Rental?

Before diving into the top vacation rental markets for 2025, it’s worth stepping back to ask what makes a place a smart choice for a short-term rental property.

Here are the key ingredients that make a market worth your time (and money):

Key factors that influence short-term rental success

Factor | Why it matters | What to look for |

Tourism & attractions | Drives steady demand and bookings | Beaches, ski resorts, national parks, festivals or cultural landmarks |

Temporary housing demand | Boosts off-season or mid-week occupancy | Colleges, hospitals, seasonal workers, traveling nurses, military bases |

Local regulations | Impacts whether vacation homes are legal — or profitable | Permit rules, zoning laws, caps on nights, HOA restrictions |

Occupancy rate | Shows how often your rental is booked | Look for 60–80% annual occupancy in stable markets |

Average daily rate (ADR) | Affects cash flow and gross revenue | Higher ADRs matter — but only if demand stays strong |

Seasonality | Determines how income varies throughout the year | Some fluctuation is fine — avoid markets with only one strong season |

Affordability & entry cost | Shapes your initial investment and ongoing expenses | Look for areas with moderate home prices, reasonable taxes and solid ROI |

Property management options | Helps streamline operations and guest experience | Local property managers or an easy-to-use platform like Hostaway |

While you might not find a market that checks every single box, the best places to buy a vacation rental property will hit at least three or four of these — especially demand drivers like tourism and temporary housing needs, paired with favorable local regulations.

Remember, even high-demand cities can be a bad bet if the cost of ownership, property taxes or seasonal fluctuations eat too far into your profits.

Vacation Rental Investment Strategies

A smart investment strategy separates a profitable vacation rental from one that just breaks even. Whether you're chasing consistent rental income, long-term appreciation or both, the key is to understand how to evaluate, manage and optimize your property.

Here are the essentials to keep in mind before you buy:

Location drives profitability

The biggest factor in a vacation rental’s success is location. But it’s not just about popularity — it’s about year-round demand, reasonable entry prices and regulation-friendly zones.

Run the numbers

To understand income potential, focus on three core metrics:

Occupancy rate – How often your property is booked

RevPAR (Revenue per available rental) – Tracks pricing and demand over time

Gross yield – (Annual income ÷ property price) × 100 — a quick way to gauge return

A yield above 10% is considered strong. If a market is trending up in RevPAR and occupancy, it’s worth a closer look.

Know your costs

Recurring expenses like property taxes, utilities, cleaning, repairs and platform fees can eat into your rental income fast. The more accurate your cost estimates, the more realistic your profit expectations.

In short, the best strategy is the one that aligns with your goals, budget and bandwidth. Get the numbers right early and the rest becomes a lot easier to scale.

Top 10 U.S. Vacation Rental Locations in 2025

Choosing the best place to buy a vacation rental property isn’t just about finding the most scenic spot on the map. It’s about balancing market performance, property prices, demand and your strategy.

Here’s what we know going into 2025, the short-term rental market continues to evolve — and the strongest opportunities aren’t always in big-name destinations.

In fact, small and mid-sized cities led short term rental growth last year, with rural areas seeing a 16% bump in listings and mid-sized cities growing by 10.3%. These trends show a shift in investor attention — and guest demand — toward markets with more affordability and room to grow.

Yes, home prices are still climbing (projected to rise 4.9% this year) and mortgage rates remain above 6%, which can be a hurdle for first-time buyers. But here’s the upside, occupancy rates and ADRs are expected to increase in 2025. That means vacation homes could bring in more revenue — helping offset rising acquisition costs.

Add in a projected 6.5% increase in international tourism to the U.S. and the result is a vacation rental landscape full of opportunity for hosts and property managers who know where to look.

So let’s take a closer look at the U.S. markets poised to offer strong rental income, reliable occupancy and long-term potential in 2025.

Market comparison table

City | Avg. Revenue | Listing Growth | Gross Yield | Occupancy | ADR | RevPAR (RevPAR Growth) |

Peoria, IL | $31,131 | 21.1% | 15.3% | 59.8% | $171.63 | $105.75 (7.7%) |

Fairbanks, AK | $48,459 | 17.5% | 12.6% | 66.5% | $157.15 | $104.41 (6.2%) |

Akron, OH | $31,207 | 33.2% | 12.6% | 55.2% | $245.42 | $135.45 (11.5%) |

Columbus, GA | $29,866 | 20.5% | 13.4% | 56.1% | $187.04 | $112.81 (5.5%) |

Crescent City, CA | $51,318 | 11.3% | 11.9% | 63.3% | $220.96 | $170.33 (8.9%) |

Shreveport, LA | $36,086 | 10.7% | 12.2% | 57.3% | $196.04 | $106.00 (12.6%) |

Page, AZ | $41,243 | 9.7% | 11.0% | 62.1% | $303.96 | $188.72 (11.2%) |

Rockford, IL | $35,826 | 22.1% | 12.7% | 58.3% | $231.98 | $160.37 (8.9%) |

Dayton, OH | $35,456 | 17.1% | 11.7% | 58.3% | $191.25 | $111.42 (8.1%) |

Frankfort, KY | $46,368 | 6.4% | 13.1% | 56.1% | $203.56 | $170.18 (6.1% ) |

1. Peoria, Illinois

Peoria may fly under the radar, but it punches above its weight in regional tourism and Midwestern charm. Located along the Illinois River, it offers a walkable downtown with vibrant nightlife, farm-to-table dining and frequent events.. Families love the Glen Oak Zoo and the Peoria PlayHouse Children's Museum, while conventions and medical centers draw business travelers.

For investors, Peoria is a standout, it offers the highest gross yield of any ranked market at 15.3% and the average for-sale listing price is just $202,930 — making it one of the more affordable markets. With a low regulation risk and consistent demand, it's a smart move for hosts targeting families, business stays and weekend leisure travelers.

2. Fairbanks, Alaska

If you’re looking for a market with built-in wonder, Fairbanks delivers. It’s one of the best places in the world to see the Northern Lights, especially between August and April — and it draws thousands of visitors chasing that bucket-list experience. In summer, guests flock to Chena Hot Springs, gold panning tours and wilderness hikes under the midnight sun.

Fairbanks also offers the highest occupancy rate among all the locations in the list at 66.5%, giving hosts excellent booking consistency. It’s a top choice for eco-tourists, international travelers and digital nomads seeking a remote yet rewarding escape.

3. Akron, Ohio

Akron blends affordability with rich cultural experiences, making it ideal for vacation homes serving both locals and out-of-town guests. Travelers come to visit the Akron Art Museum, tour the historic Stan Hywet Hall & Gardens or hike the Cuyahoga Valley National Park, just a short drive away.

The city also attracts healthcare workers, college visitors and remote workers thanks to its proximity to Cleveland and strong internet infrastructure. A diverse guest pool and rising RevPAR make Akron a sleeper hit in the Midwest STR scene.

4. Columbus, Georgia

Columbus is a vibrant Southern city that mixes small-town warmth with high-adrenaline activities. It’s best known for the Chattahoochee RiverWalk, a scenic 22-mile path ideal for walking, biking and rafting — it’s home to the longest urban whitewater course in the world.

Fort Moore (formerly Fort Benning) drives steady military-related travel, while events at the RiverCenter for the Performing Arts and Columbus Museum attract cultural visitors.

From an investor perspective, Columbus shines with a gross yield of 13.4% and a moderate average listing price of $298,039, offering a strong balance between cost and return.

5. Crescent City, California

Located along California’s rugged North Coast, Crescent City is a top pick for travelers seeking quiet, nature-filled escapes. It serves as a gateway to Redwood National and State Parks, drawing hikers, photographers and park tourists from all over the world.

Visitors also love the Battery Point Lighthouse and Tolowa Dunes State Park, which offer stunning views without the crowds of more commercial destinations. The numbers back it up, Crescent City boasts a gross yield of 11.9% and an average annual revenue potential of $51,318 — making it a quiet powerhouse for California investors.

6. Shreveport, Louisiana

Shreveport is a vibrant city with deep musical roots, historic charm and a surprising entertainment scene. Guests come for its riverboat casinos, the Red River Revel Arts Festival and the Louisiana Boardwalk Outlets. Families enjoy the Sci-Port Discovery Center, while foodies explore a growing culinary scene with Southern, Cajun and Tex-Mex influences. It’s a versatile market with appeal to both families and nightlife-seekers — a strong choice for hosts who want steady, year-round bookings in an affordable, regulation-friendly city.

7. Page, Arizona

Page is a tourism magnet in the heart of the American Southwest. It’s home to two of the most iconic natural wonders in the U.S. Antelope Canyon and Horseshoe Bend. Visitors often use Page as a base for exploring Lake Powell, Glen Canyon and national parks like Zion and Bryce. The city attracts international tourists, road-tripping families and photographers — making it a strong market for visually appealing listings and experiences tied to local tours and guides.

8. Rockford, Illinois

Rockford is one of Illinois’ fastest-growing secondary cities — and it’s quietly becoming a tourism hub. The city offers attractions like the Anderson Japanese Gardens, the family-friendly Discovery Center Museum and seasonal events such as Stroll on State, a beloved winter festival. Close proximity to Chicago also makes Rockford attractive for weekend escapes. It’s an ideal location for hosts targeting families, regional travelers and guests looking for unique, off-the-beaten-path stays.

9. Dayton, Ohio

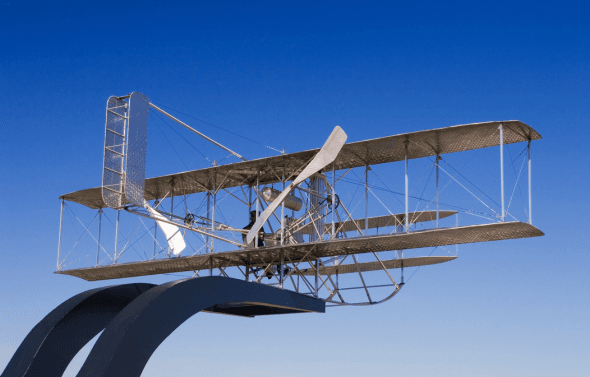

Dayton is a city of innovation, culture and aviation history. It’s home to the National Museum of the U.S. Air Force, the largest military aviation museum in the world and a thriving performing arts scene led by the Schuster Center. Guests also come for the Wright Brothers National Museum and university events at Wright State and the University of Dayton. With strong year-round draw, it’s a dependable market for hosts looking to serve both tourists and academic or military-connected travelers.

10. Frankfort, Kentucky

As the capital of Kentucky and a cornerstone of Bourbon Country, Frankfort has both political significance and laid-back, small-town charm. Guests come for historic walking tours, scenic riverfront views and distillery visits to names like Buffalo Trace. The city also hosts seasonal events like the Kentucky Bourbon Festival, drawing connoisseurs and casual sippers alike. Frankfort is an ideal market for couples, solo travelers and history buffs looking for cozy, culture-rich stays with a uniquely Kentucky flair.

Frankfort is also showing signs of rapid STR growth, with a 64.7% surge in new listings year-over-year — a clear signal of investor confidence and rising guest interest. Ideal for couples, solo travelers and history buffs looking for cozy, culture-rich stays with a uniquely Kentucky flair.

Emerging Vacation Rental Markets of 2025

Not all high-performing vacation rental locations are headline grabbers. Some of the best places to invest in 2025 are quietly building momentum, with a combination of steady guest demand, lower property prices and favorable regulation environments.

The five emerging markets below offer just that, monthly income potential in the $3,000 – $4,000 range, low competition and access to either outdoor experiences or major metro spillover. Whether you're a first-time buyer or expanding your portfolio, these overlooked towns are worth serious consideration.

1. Highland Park, Pennsylvania

Tucked just outside Pittsburgh, Highland Park blends neighborhood charm with quick access to the city’s hospitals, universities and cultural districts. The area appeals to guests seeking peaceful, longer-term stays with city access — including visitors to UPMC, academic travelers and traveling nurses. Proximity to Highland Park itself — complete with trails, a reservoir and a seasonal pool — adds to its local appeal.

Metric | Value |

Median property price | $443,000 |

Number of short-term rental comps | 218 |

Monthly income | $4,533 |

Cash on cash return | 6.97% |

Cap rate | 7.06% |

Average daily rate | $197 |

Occupancy rate | 51% |

2. Winter Haven, Florida

Located between Orlando and Tampa, Winter Haven is home to Legoland Florida Resort, over 50 freshwater lakes and a growing snowbird population. The area offers reliable demand from families, retirees and theme park visitors looking for quieter alternatives to Orlando. With modest regulation and year-round appeal, it’s a solid choice for hosts who want both seasonal and steady bookings.

Metric | Value |

Median property price | $386,487 |

Average price per square foot | $194 |

Number of short-term rental comps | 164 |

Monthly income | $4,011 |

Cash on cash return | 6.95% |

Cap rate | 7.06% |

Average daily rate | $162 |

Occupancy rate | 77% |

3. Visalia, California

Serving as the “Gateway to the Sequoias,” Visalia is the closest city hub to Sequoia and Kings Canyon National Parks. That alone makes it a magnet for nature tourists, international travelers and road-trippers doing the Southern Sierra loop. Its walkable downtown and access to California’s Central Valley also bring in business guests and weekenders. Regulation is moderate, but competition is still low compared to California’s coastal zones.

Metric | Value |

Median property price | $430,516 |

Average price per square foot | $279 |

Number of short-term rental comps | 175 |

Monthly income | $4,442 |

Cash on cash return | 6.91% |

Cap rate | 7.00% |

Average daily rate | $164 |

Occupancy rate | 86% |

4. Homosassa, Florida

For guests seeking manatees, springs and small-town Florida charm, Homosassa is the place to be. The Homosassa Springs Wildlife State Park draws eco-tourists and families year-round, while river access supports boating and fishing-focused stays. Its affordable housing, relaxed vibe and low regulation risk make it a strong play for rustic-style listings and nature-focused experiences.

Metric | Value |

Median property price | $440,894 |

Average price per square foot | $236 |

Number of short-term rental comps | 175 |

Monthly income | $4,014 |

Cash on cash return | 6.53% |

Cap rate | 6.62% |

Average daily rate | $201 |

Occupancy rate | 57% |

5. Cape Carteret, North Carolina

This small coastal town sits near the southern tip of the Crystal Coast, offering a quieter, more residential alternative to nearby Emerald Isle and Atlantic Beach. Guests come for water activities, family beach trips and regional events — and many visit family stationed at nearby Camp Lejeune. With seasonal peaks and solid midweek demand, Cape Carteret gives hosts a mix of leisure, military and family travel opportunities.

Metric | Value |

Median property price | $556,333 |

Average price per square foot | $237 |

Days on market | 75 |

Number of short-term rental comps | 325 |

Monthly income | $4,321 |

Cash on cash return | 5.67% |

Cap rate | 5.74% |

Average daily rate | $297 |

Occupancy rate | 51% |

Vacation Rental Markets to Approach with Caution in 2025

Not every beautiful destination makes a great vacation rental location — especially in 2025. With rising home prices, stricter short-term rental regulations and cooling occupancy rates in some areas, it's critical to know where not to buy (or at least, where to tread carefully).

The markets below are popular with travelers — but not always profitable for hosts. Whether it’s high entry costs, declining RevPAR or outright rental bans, here are a few places to keep on your watchlist — or off your shortlist.

1. New York City, NY

Why avoid: Extremely strict short-term rental regulations As of 2023, NYC began enforcing Local Law 18, which essentially bans unhosted vacation homes under 30 days. Hosts must live in the property and be present during the stay — with heavy fines for violations.

RevPAR: Down 8% YoY (AirDNA) Takeaway: Too restrictive for traditional STR models.

2. San Francisco, CA

Why avoid: Very high cost of entry + strict regulation With median home prices still around $1.2 million, San Francisco has one of the highest break-even points for short-term rental profitability. On top of that, it enforces 90-night caps on STRs and a tough permit process.

Average listing price: $1.22M Gross yield: ~3.2% (well below the national average of 8.8%) Takeaway: Luxury price, budget returns.

3. Sedona, AZ

Why approach with caution: Oversaturation and rising hostility Sedona has been a popular STR destination, but locals have pushed back. While Arizona state law restricts full STR bans, Sedona has imposed aggressive regulation proposals,and over 20% of homes are vacation rentals, creating high competition and local resistance.

RevPAR growth: Flat YoY Takeaway: Great for guests, risky for new hosts.

4. Lake Tahoe, CA (South Lake Tahoe & El Dorado County)

Why avoid: Tight regulations and permit lottery El Dorado County, which includes South Lake Tahoe, has implemented caps, permit lotteries and zoning limits on STRs. Investors are subject to zoning restrictions and frequent changes in legislation.

Permit acquisition chance: <25% (based on 2024 lotteries) Regulation status: High risk, politically volatile Takeaway: Regulatory uncertainty outweighs income potential.

5. Oahu (Honolulu), Hawaii

Why to avoid: Harsh short-term rental laws In 2022, Honolulu passed Bill 41, increasing the minimum rental period for unhosted stays to 90 days (up from 30), effectively eliminating most STRs in residential zones. Enforcement has intensified and STR permits are difficult to obtain.

Occupancy rate: 49% Gross yield: Below 4% Takeaway: Unless you offer 90+ day stays, this market is nearly off-limits.

Final thoughts on high-risk vacation rental markets

While these areas are tougher for traditional short-term rental properties, they’re not off-limits. Investors may still succeed by adjusting their strategy.

Options include:

Mid-term rentals (30–90+ days) that follow local rules

Hosting from your primary residence or own home

Running niche or premium rentals with longer stays

If your goal is passive income from a standard vacation rental, these markets may require more effort, higher risk tolerance and a solid grasp of local regulations.

How to Maximize Your Vacation Rental Investment

In 2025, owning a great property is just the start. To stay competitive, experienced hosts are leaning on automation, analytics and AI to run smarter, not harder.

Here’s what matters most:

Tactic | What it does |

Use dynamic pricing tools | Adjust nightly rates in real time based on demand, seasonality and competitor trends. |

Centralize operations | Manage calendars, automate guest messaging and sync channels using a platform like Hostaway. |

Let AI do the heavy lifting | Write listings, answer guest questions and analyze market trends faster and more accurately. |

Set smart pricing rules | Create strategies for peak seasons, last-minute bookings and extended stays to increase revenue per guest. |

Track performance metrics | Monitor KPIs like RevPAR and occupancy to make informed, data-driven decisions. |

The best-performing hosts in 2025 aren’t doing more — they’re doing it better, with the right tools and a scalable system behind every listing.

What It Takes to Win in the Vacation Rental Market in 2025

Success in today’s short-term rental industry isn’t about luck — it’s about strategy. Whether you’re buying your first property or expanding your portfolio, the hosts who thrive in 2025 are those who:

Choose markets with strong fundamentals — not just name recognition

Understand their numbers — from occupancy and RevPAR to yield and cash flow

Leverage the right tools and tech — especially automation, analytics and AI

Adapt quickly — to guest expectations, market shifts and local regulations

There’s no one-size-fits-all approach to vacation rental investing. But with the right plan, platform and perspective, you can build a vacation rental business that’s not just profitable — but built to last.