The Ultimate Guide to Buying an Airbnb Vacation Rental Property in Boston

Are you thinking about investing in an Airbnb vacation rental in Boston? Whether you're a first-time real estate investor or just getting into short-term rentals, Boston is an exciting market with strong demand, rich history and vibrant tourism. In an evolving industry, buying the right property — and making it profitable — requires careful planning.

This guide will walk you through everything you need to know about purchasing an Airbnb property in Boston, from choosing the right neighborhood to navigating city regulations and maximizing your return on investment.

Why Buying a Short-Term Rental in Boston is a Smart Investment

Boston isn’t just a city — it’s a destination filled with history, culture and endless things to do. Boston consistently attracts visitors year-round, from its cobblestone streets and iconic landmarks to its thriving job market and world-class universities. But beyond its charm and popularity, there are several strong reasons why investing in short-term rental units here can be a great financial move.

1. A strong and stable economy

Boston is one of the fastest-growing cities in the U.S. and serves as the economic and political hub of Massachusetts. Its economy is fueled by major industries like education, healthcare and technology, creating a strong job market and a steady influx of professionals resulting in a consistent demand for short-term rentals, whether from business travelers, relocating professionals or tourists.

2. A top tourist destination year-round

Boston’s rich history, stunning architecture and famous landmarks make it one of the most visited cities on the East Coast. Whether it’s exploring the Freedom Trail, catching a game at Fenway Park or attending major events like the Boston Marathon, there’s no shortage of reasons for visitors to book a stay here. Plus, Boston’s prime location makes it a gateway to other popular destinations like Salem, Cape Cod and New Hampshire, further boosting its appeal to travelers.

3. A hub for higher education

Home to prestigious institutions like Harvard, MIT and Boston University, the city draws thousands of students, visiting professors and academic professionals every year. This steady flow of people means ongoing demand for short-term housing, particularly from families visiting students, researchers attending conferences and prospective students touring campuses.

Market Insights: Airbnb Vacation Rental Potential in Boston

According to February 2024 AirDNA data for Boston, Airbnb hosts in the city enjoy an:

Average annual revenue of $33,200

Average occupancy rate of 60%

Average Daily Rate (ADR) of $328.5

Revenue per Available Rental (RevPAR) of $184.7

According to Zillow, the average home value in Boston is $739,121, up 4.4% over the past year.

Understanding Boston’s Airbnb Laws and Regulations

Before you dive into the world of Airbnb investing, it’s essential to understand Boston’s Airbnb regulations. The city has put strict rules for short-term rentals in place to balance the benefits of tourism with the needs of local residents. To avoid any legal headaches, here are the key regulations you should know:

1. Owner-occupancy requirement

In most cases, Boston requires that short-term rental properties be owner-occupied. This means that if you’re planning to rent out an entire home or apartment, it typically needs to be the owner's primary residence. If you were hoping to purchase a property solely for Airbnb, this rule is an important one to consider.

2. Mandatory registration

All short-term rental properties in Boston must be registered with the city. This ensures that hosts follow zoning and safety laws. Skipping this step could lead to fines or legal issues, so be sure to complete the registration process before listing your property.

3. Some properties are off-limits

Not every building in Boston allows short-term rentals. Large apartment complexes and multi-unit buildings often have restrictions due to city laws or landlord policies.

4. Rental limits on non-primary residences

If the property you’re considering isn’t your primary residence, you may be limited in how many days per year you can rent it out. These restrictions can impact profitability, remember to bostofactor them into your investment strategy.

Stay up to date on regulations

Local laws are subject to change, so before making any investment decisions, check the City of Boston’s official website for the latest rules and compliance requirements. Staying informed will help you avoid unexpected challenges and keep your Airbnb business running smoothly.

Airbnb Taxes in Boston

Boston short-term rentals are subject to both city and state taxes that are collected and remitted by Airbnb on behalf of hosts. These include:

State excise tax of 5.7%

Boston excise tax of 6.5%

Convention center finance fee of 2.75%

Community impact fee of up to 3%

How to Register Your Airbnb Vacation Rental in Boston

If your property meets the city’s eligibility criteria, the next step is registering it as a short-term rental. Boston has a well-defined rental registry process to ensure that all Airbnb properties comply with local laws and safety regulations. Here’s a step-by-step guide to getting your rental legally listed:

Step 1: Check if your property is eligible

Before applying, confirm that your property is eligible under Boston’s short-term rental registration requirements. The city allows certain types of rentals but restricts others, especially in buildings with residential use designations. Check with Inspectional Services to see if any zoning laws affect your rental plans.

Step 2: Apply for a short-term rental license

If your property qualifies, you’ll need to apply for a short-term rental license. Boston recognizes three types of short-term rental categories:

Limited share unit – Renting out one or more rooms in your primary residence, while you remain on the property for the duration of each stay.

Home share unit – Renting out your primary residence, while being present for part of the rental period.

Owner adjacent unit – If you live in a multi-unit property, you can rent out one full unit while residing in another.

As part of the application, you must submit two forms of documentation to verify your primary residence — such as a state-issued identification, utility bill or voter registration.

Step 3: Add your registration number to your listing

Once your application is approved, the city will issue a registration number that must be included in your Airbnb listing. Be sure to use the full number, including the ‘STR’ prefix, to stay compliant with Boston’s short-term rental laws.

Step 4: Obtain a business certificate

To legally operate your Airbnb, you’ll also need a business certificate from the City Clerk’s office. This can be done by mail or in person and is valid for four years. This step ensures that your rental is recognized as an official business entity within Boston.

Step 5: Notify your neighbors

Short-term stay hosts must inform their neighbors within 30 days of registration. The city provides a mailing tool to make this process easier. This step helps prevent potential disputes and keeps your property from being flagged as a problem property by local authorities.

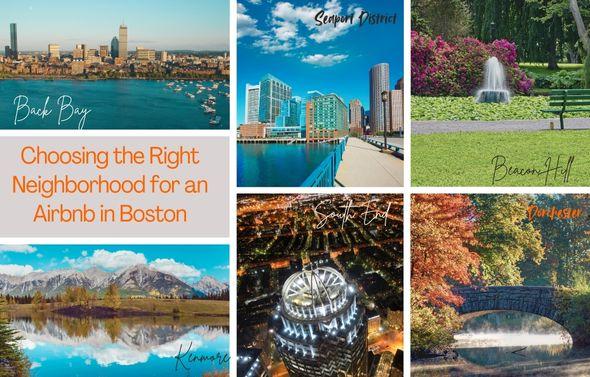

Choosing the Right Neighborhood

Not all parts of Boston are equally suitable for Airbnb rentals. Here’s a look at some of the best neighborhoods for short-term rental investments:

Back Bay

One of Boston’s most iconic and upscale neighborhoods, Back Bay attracts business travelers and tourists alike. Properties here are expensive, but high demand allows for premium rental rates.

Beacon Hill

With its historic charm and proximity to downtown, Beacon Hill is a sought-after area for Airbnb guests. However, strict zoning and high property prices can be challenges.

South End

A trendy, artsy neighborhood with a mix of brownstones and modern condos, South End is great for short-term rentals but has strict regulations.

Fenway/Kenmore

Home to Fenway Park, this area attracts sports fans and tourists year-round. It’s a prime location for short-term rentals.

Seaport District

A newer, rapidly growing waterfront area, Seaport offers high-end accommodations and attracts business travelers attending conferences.

Dorchester

If you're looking for a more affordable entry point, these neighborhoods have lower property prices and strong demand, particularly from visitors seeking a local, residential feel.

What to Look for in a Property

Choosing the right property is crucial for your success as an Airbnb host. Consider these factors:

Legal compliance: Make sure the property meets Boston’s short-term rental laws. Multi-unit buildings may have their own restrictions.

Proximity to attractions: Properties near public transportation, universities, hospitals and tourist hotspots tend to perform better.

Size & layout: Studio and one-bedroom apartments tend to have high occupancy rates, but larger properties can command higher nightly rates.

Amenities & design: Modern appliances, stylish decor and strong Wi-Fi are key selling points for guests. Consider adding a workspace for remote workers.

Costs & Financing: What Investors Should Know

Investing in an Airbnb property isn’t just about finding the right home — it’s about making sure the numbers work. From the purchase price to ongoing expenses, understanding the full financial picture will help you set realistic expectations and avoid surprises. Here’s a breakdown of the key costs:

1. Purchase price & mortgage

Boston’s real estate market is competitive, with median home prices often exceeding $600,000. If you’re financing your purchase, expect to put down 20-25% for an investment property loan. Interest rates and loan terms can vary, explore different lenders to find the best option.

2. Closing costs

On top of the purchase price, you’ll need to budget for closing costs, which typically range from 2-5% of the home’s value. These costs cover essential fees such as attorney fees, title insurance, lender fees, etc.

3. Furnishing & setup

An empty house won’t attract bookings, so be prepared to invest in making your space guest-ready. Depending on the size of your property and the level of luxury you want to offer, expect to spend anywhere from $10,000 to $30,000.

4. Ongoing expenses

Once your Airbnb is up and running, there are recurring costs to factor into your budget:

Property taxes – Boston has relatively high property tax rates, so check local rates before purchasing.

HOA fees – If you’re buying a condo, homeowners association fees can add a significant expense.

Utilities & maintenance – Guests expect fast Wi-Fi, heating, air conditioning and well-maintained spaces.

Cleaning & restocking supplies – Whether you hire a cleaning service or handle it yourself, keeping your property spotless is key.

Airbnb service fees – Airbnb charges a percentage of each booking, so don’t forget to account that.

Is an Airbnb in Boston the Right Investment for You?

Buying an Airbnb property in Boston can be a rewarding investment if done correctly. The city’s steady demand, strong tourism industry and growing real estate market make it a great choice for first-time investors. However, it requires careful planning.

If you're ready to take the plunge, do thorough research, crunch the numbers and consider working with a local real estate expert who understands short-term rentals. With the right approach, you can turn your Boston Airbnb into a profitable business.