Rental Arbitrage in Orlando: Everything You Need to Know

There’s more than one way to get into the Airbnb property management game.

With the rental arbitrage model, you can start hosting properties without owning them, and in a prime location like Orlando, Florida, the option is more accessible than ever.

Rental Arbitrage: A Low Investment, High Reward Strategy

Rental arbitrage involves renting a property for the long-term and then subletting it as a short-term vacation rental. This strategy capitalizes on high tourist demand in areas like Orlando, where vacation rental demand frequently outweighs supply.

It's an appealing approach for those seeking entry into the short-term rental market without the substantial initial cost of property ownership. However, success in this arena requires a nuanced understanding of Orlando's market dynamics, local regulations, legal considerations and proficient property management.

To initiate your rental arbitrage venture, you'll need to understand the Orlando market, identify the right properties and negotiate with landlords.

Why Choose Orlando for Your Short-Term Rental Venture

Orlando is synonymous with world-class attractions, particularly families. From theme parks and national parks to boat rides and top-notch golf courses, it’s a hub for entertainment that drives tourist traffic year-round.

According to June 2024 data from AirDNA, key metrics for the Orlando vacation rental market include:

Average daily rate (ADR) of $228.7

Revenue per available rental (RevPAR) of $136.5

Average annual revenue of $22,900

Navigating Legalities: Short-Term Rental Laws, Regulations and Taxes in Orlando

Success in rental arbitrage in Orlando necessitates navigating its legal, regulatory and tax landscape.

Zoning laws

Orlando's zoning laws determine where short-term rentals can operate. Certain areas are designated specifically for short-term rental activity while others have restrictions or outright bans. Check Orlando's Official Zoning Map to make sure you are looking at the right neighborhoods.

%20(1).webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F1i8Dk3TCvpiEEIwhOeByZs%2F497e317f1b274981f9435dc7c21494d2%2FOrlando_zoning_map__1___1_.webp&a=w%3D590%26h%3D337%26fm%3Dwebp%26q%3D75&cd=2024-07-09T05%3A15%3A01.911Z)

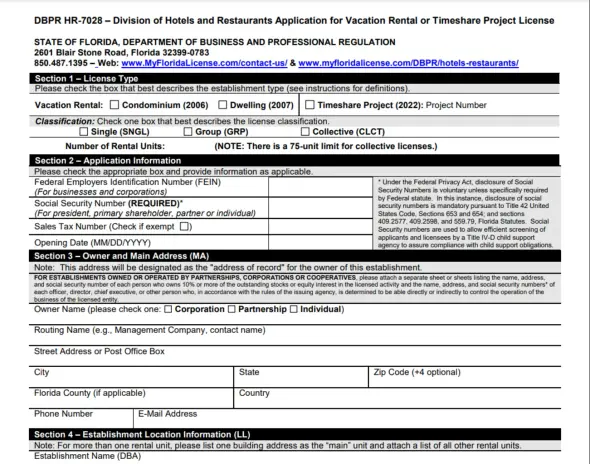

Vacation rental license

In Florida, anyone renting out a property on behalf of the owner is deemed a 'licensed agent' and is required to obtain a vacation rental license from the Department of Business and Professional Regulation (DBPR).

There are two main types of licenses:

Group license: This covers all units within a single complex or building licensed to a particular agent. It's possible to have multiple group licenses for different agents within the same property.

Collective license: Issued for a group of houses or units in different locations but represented by the same agent. Each collective license can include up to 75 units or houses restricted to one district.

Florida law also distinguishes between vacation rental condominiums (units within a condominium complex or cooperative) and vacation rental dwellings (single-family houses, townhouses, duplexes, triplexes, etc.). These cannot be combined under the same license.

The license must be renewed annually, displayed at the rental or presented upon request.

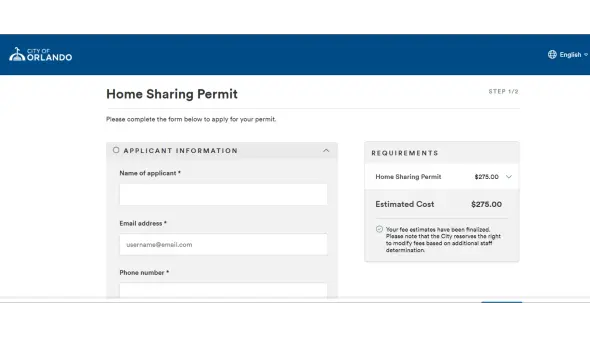

Hosted rental license

For hosts renting out individual rooms rather than the entire unit, a vacation rental license from DBPR is not required. Instead, a short-term rental permit from the city of Orlando will do.

Requirements include:

Notarized permission from the property owner

The host must be present during bookings

Limiting rentals to half of the total bedrooms

Only one booking at a time

Approval from the homeowners association is needed if the property is within a mandatory association.

Health & safety regulations

As a licensed host, you're responsible for compliance, including:

Maintaining clean, well-lit and ventilated halls and entrances

Sanitizing dishes and glassware to public food service standards

Providing a kitchen sink with hot and cold running water

Installing smoke alarms and having a charged, accessible fire extinguisher

Conducting balcony inspections every three years for rentals three stories or higher

Sticking to these rules isn't just about keeping things legal – it's also about making sure your guests are safe and have a great time.

And let's be honest, a happy guest means positive reviews. Keeping up with these standards is key to building a solid rep and really making your property management business shine.

Key to Success in Orlando's Rental Arbitrage Market

Starting out in rental arbitrage in Orlando is pretty exciting but it's not all fun and games – you need to be on the ball, especially with the legal stuff.

It's about getting the right licenses and making sure your place ticks all the boxes for health and safety.

Every step you take is important to build a rental business that's not just good for now but for the long haul. The rental world is always changing, so keeping up and being ready to adapt is very important.