Top 10 Spain Airbnb Markets to Invest

Spain ranks as the top destination for international tourism in Europe, and the numbers keep climbing. Last year alone, it recorded 138 million international arrivals, a 9.6% increase over the previous year, officially surpassing its pre-pandemic numbers. That’s not just a tourism win. For Airbnb hosts and property managers, it signals one thing: growing demand for short-term rentals.

Spain holds the third-highest number of UNESCO World Heritage Sites in the world and has long been one of the best Airbnb markets in Europe, blending world-class cultural attractions, strong demand and a mature short-term rental market.

But not all cities offer the same potential. Some have affordable property prices and steady cash flow. Others come with tighter regulations and higher property prices, but deliver high nightly rates and strong occupancy year-round.

If you're exploring Airbnb investment opportunities in Spain, this guide breaks down the top 10 markets worth your attention. Backed by market data, rental income trends and key factors like regulations and demand, you'll walk away with real insights to make your next investment decision confidently.

Let’s get into it.

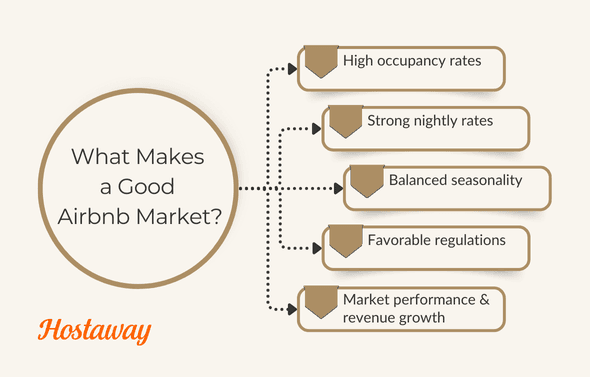

What Makes a Good Airbnb Market?

Not every city with tourists is a good fit for short-term rental investment. To spot high-potential Airbnb markets, you need to look beyond the travel guides and dig into what actually drives performance for Airbnb hosts, property owners and investors seeking long-term returns.

Here are the key factors that separate solid investments from risky bets:

1. High occupancy rates

The occupancy rate is the backbone of your Airbnb business. It shows how often your vacation rental is booked. A healthy average occupancy rate (typically above 70%) means consistent bookings and a reliable stream of rental income. Cities with strong tourism or business travel usually outperform here.

2. Strong nightly rates

It’s not just about being booked, it’s about being booked at the right price. A market with high nightly rates and healthy demand gives you room to build steady cash flow, even with occasional vacancies or cleaning fees cutting into margins.

3. Balanced seasonality

Markets with a long high season or year-round tourism (think coastal cities or urban hubs with cultural attractions) give you more predictable income. While some tourist hotspots suffer from sharp seasonal drop-offs, others maintain high demand thanks to rich history, events, weather or a mix of international and business travelers.

4. Favorable regulations

Local laws, authorities and regional governments all play a role in determining whether you can legally operate a vacation rental. Some cities require licenses or limit the number of days a property can be rented. The best Airbnb markets have clear, stable rules that don’t make you jump through endless hoops or risk fines.

5. Market performance & revenue growth

Always evaluate a city’s market performance before buying. Is there consistent revenue growth in the short-term rental sector? Are new listings gaining traction or struggling to get bookings? Use tools to track occupancy rates, nightly rates and overall revenue potential at the market level.

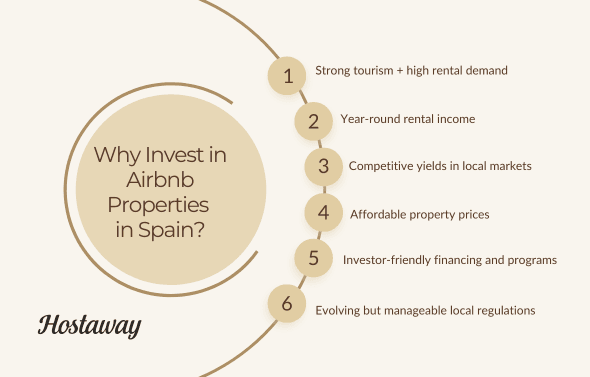

Why Invest in Airbnb Properties in Spain?

Spain continues to rank among the best Airbnb markets in Europe and for good reason. It offers a rare combination of high tourist volume, relatively affordable property prices and growing opportunities for steady returns. Common cities for Airbnb investments in Spain include Barcelona, Madrid and Seville.

If you’re weighing your next Airbnb investment, here are the key factors that make Spain stand out:

1. Strong tourism and high rental demand

In 2024, Spain welcomed 138 million tourists. That kind of volume fuels strong rental demand across major cities and coastal areas, especially for short-term rentals.

2. Year-round rental income

Many Spanish cities, especially in the south and along the Mediterranean coast, experience low seasonality. With a steady stream of tourists, digital nomads and business travelers, hosts can earn rental income all year without relying solely on peak seasons.

3. Competitive yields in local markets

Top local markets like Valencia, Málaga and Seville offer attractive rental yields between 4% and 10%, depending on property type and location. These cities combine healthy occupancy rates, strong nightly rates and relatively low overhead.

4. Affordable property prices compared to other EU countries

Spain still offers some of the most affordable property prices in Western Europe, especially outside of Madrid and Barcelona. For Airbnb investors seeking lower prices and better margins, this is a major draw.

5. Investor-friendly financing and programs

Spanish banks offer favorable financing options, with mortgage rates starting around 1.8%. For international buyers, the Golden Visa program offers residency for property investments over €500,000, making Spain even more appealing for global property owners.

6. Evolving but manageable local regulations

While regulations vary by region, many areas continue to support the short-term rental market, particularly where tourism plays a central role in the economy. Doing some upfront market research can help you understand local regulations and unlock long-term opportunities.

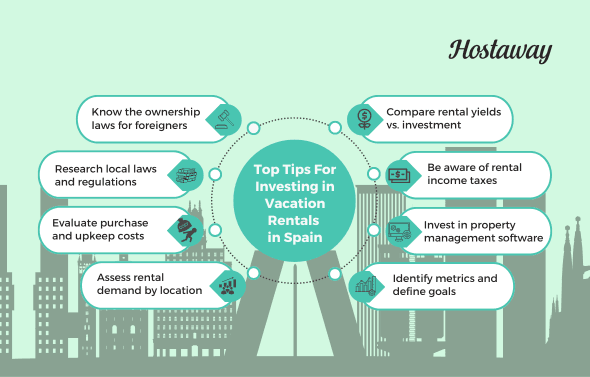

Some Considerations Before Investing in Airbnb in Spain

Before you dive into buying a short-term rental in Spain, it’s critical to understand the full picture from local regulations to property management to upcoming legal changes that affect how you’ll operate. Here are the key factors every Airbnb investor should consider:

1. Understand ownership rules for foreign buyers

Spain allows foreign nationals to purchase property, but there may be additional paperwork depending on your country of origin. Make sure you understand the legal process and any restrictions that apply to non-resident property owners.

2. Navigate local regulations

Local laws in Spain aren’t one-size-fits-all. Each region (and sometimes each city) has its own rules governing short-term rentals. Some require registration numbers, others impose strict caps or zoning rules. Before buying, research the laws in the specific area you’re targeting and be prepared to navigate regulations to avoid fines or shutdowns.

3. Be aware of Spain’s new nationwide short-term rental law

As of July 1, 2025, Spain officially enforces its new nationwide law for vacation rental properties, the first of its kind in the EU. All property owners must now be registered on a centralized government platform and have a valid registration number to list on Airbnb, Booking.com or any other online rental site.

This applies to tourist apartments, seasonal lets and even room rentals. Landlords are also responsible for keeping their property details accurate and up-to-date across all platforms.

If you’re investing in Spain now, compliance isn’t optional, it’s the law. Make sure your listing is registered and in line with regulations before going live.

4. Location is everything

Your rental income will depend heavily on where you buy. Look for neighborhoods close to historic sites, cultural attractions, public transport and local amenities. Properties in city centers or high-traffic tourist zones typically deliver better occupancy and steady demand, but may also face tighter regulations or higher property prices.

5. Run the numbers

Before making any investment decision, look at the full cost picture:

Purchase price

Renovations or furnishing costs

Ongoing maintenance

Utilities, internet and cleaning fees

Property management fees (if you don’t plan to manage it yourself)

Compare your projected expenses against average occupancy rates, nightly rates and estimated rental income in your target city. If you’re serious about profitability, focus on revenue growth and cash flow, not just appreciation.

6. Understand the tax side

If you own and operate a vacation rental property in Spain, you’ll need to pay taxes on your earnings. That includes:

Rental income tax

Local taxes depending on your municipality

Potential VAT or tourist tax obligations

Talk to a tax professional who understands Spanish property laws to avoid surprises down the line.

7. Plan for management and exit

Will you be managing the rental remotely or hiring a property manager? Will you use the property part-time or treat it purely as an income-generating asset? What’s your exit plan if you want to sell in 5–10 years?

These aren’t afterthoughts, they shape everything from how you market your Airbnb listing to what kind of multi-family buildings or individual units you should be looking for.

How Does Tourism Contribute to the Spanish Economy?

Tourism is one of Spain’s biggest economic engines. Last year, it accounted for 12.8% of the national GDP, according to data from Spain’s National Institute of Statistics (INE). The industry also supported over 2.5 million jobs, spanning hospitality, transportation, entertainment and property services.

With record-breaking numbers last year, Spain continues to draw a steady stream of global visitors. That’s why Airbnb investors, property owners and short-term rental operators see the country as a magnet for consistent rental income, especially in tourism-heavy markets.

How Is Tourism Affecting Local Communities in Spain?

While tourism boosts the economy, it also brings tension, especially in neighborhoods where short-term rentals have surged.

In places like Barcelona, Palma de Mallorca and San Sebastián, residents have protested the rapid growth of Airbnb properties, citing higher property purchase prices, housing shortages and overcrowding. Local governments have responded with regulatory challenges, including caps on licenses, stricter local rules and increased oversight by authorities.

This doesn’t mean short-term rentals are off the table, it means investors need to be thoughtful. Following regulations, understanding rental limits and operating transparently are now key parts of a smart Airbnb investment strategy in Spain.

What are the Best Short-Term Rental Markets in Spain?

From sun-soaked coastlines to buzzing urban centers, Spain offers a wide range of Airbnb investment opportunities but not all markets deliver the same returns. Below, we’ve ranked 10 standout cities based on occupancy rates, rental income, local regulations and overall performance of the market. Whether you're after high yields, high demand or long-term revenue growth, these are the Spanish markets worth watching.

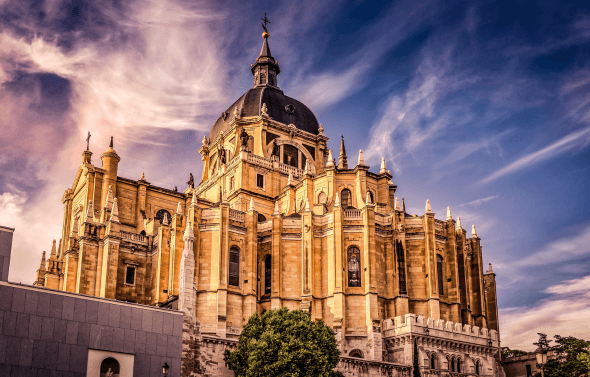

1. Madrid

Madrid, Spain's vibrant capital, is a city where tradition meets modernity, creating a magnetic pull for visitors worldwide. Whether it's the royal grandeur of the Palacio Real or the lively buzz of Gran Vía, Madrid offers something for everyone. With a population of around 3.3 million, the city is always alive and draws over 10 million tourists each year.

Madrid is a top-tier Airbnb market with a strong score of 99, driven by high rental demand and lenient local regulations. Hosts must register their Airbnb properties and meet specific safety standards, with new licenses restricted, especially in central areas, to balance tourism with local life. While investors should watch for moderate revenue growth and seasonal changes, Madrid's regulation makes it a dependable and welcoming choice for short-term rentals. Whether in the city center or neighborhoods like Malasaña, opportunities for success are plentiful.

Typically a short-term rental in Madrid is booked for an average of 303 nights per year. The earning potential for an Airbnb investment property in Madrid is:

Average daily rate: €109 ($118)

Occupancy rate: 83%

Best month: May

Yoy revenue change: 9.62%

Average monthly revenue: €2,592 ($2,788)

2. Barcelona

Barcelona, the jewel of Spain's tourism crown, is a prime location for Airbnb investors. As the beating heart of Catalonia, it offers a rich mix of culture and attractions, from Gaudí's iconic architecture to the beaches of Barceloneta. With over 12 million tourists annually, Barcelona is a top-tier destination, ensuring high demand for short-term rental properties and consistent rental earnings. Its diverse neighborhoods and vibrant atmosphere make it a standout choice for tourist rentals.

Barcelona is a growing Airbnb market with a market score of 98, fueled by high rental demand, although revenue growth is moderate. The city's Airbnb regulations are strict, carefully balancing the preservation of its charm with profitable investments.

Keep in mind that short-term rentals are to be banned completely by 2029, so current hosts should consider transitioning from short-term lets back to mid or long-term rentals or exploring other accommodation markets with stable rules and regulations.

A short-term rental in Barcelona is usually booked for an average of 307 nights a year. The earning potential for an Airbnb investment property in Barcelona is:

Average daily rate: €146 ($158)

Occupancy rate: 84%

Best month: May

Yoy revenue change: -3.02%

Average monthly revenue: €3,470 ($3,732)

3. Valencia

Valencia, where old-world charm meets futuristic innovation, offers a unique blend of experiences for visitors and residents alike. Known for its avant-garde City of Arts and Sciences and the vibrant old town, Valencia is a city that pulses with energy. With a population of about 800,000 and drawing over 2 million tourists annually, it's a city on the rise.

Valencia shines in the Airbnb market with a market score of 98 and strong rental demand. While offering excellent potential, investors should navigate local regulations, seasonal fluctuations and moderate rental earnings growth.

While the short-term rental market is thriving, offering great investment potential, investors must navigate strict regulations, including a property license online mandatory registration, safety standards and specific restrictions in residential areas and tourist establishments, like minimum stay requirements during peak seasons. Valencia's vibrant neighborhoods attract many guests and investors need to stay informed and compliant to avoid significant fines.

A typical vacation rental in Valencia is booked for 270 nights per year. The earning potential for an Airbnb investment property in Valencia is:

Average daily rate: €99 ($107)

Occupancy rate: 74%

Best month: May

Yoy revenue change: -2.48%

Average monthly revenue: €2,177 ($2,341)

4. Málaga

Málaga, the gateway to the Costa del Sol, seamlessly blends beach life with cultural heritage. Renowned for its year-round sunshine, stunning beaches and vibrant arts scene, it attracts visitors seeking the best of both worlds. With a population of approximately 580,000 and drawing over 4 million tourists each year, this city is a magnet for sun-seekers and culture lovers alike.

Málaga's Airbnb market thrives with a perfect score of 100, fueled by strong rental demand and revenue growth. Its historic charm and beachside appeal ensure consistent tourist interest, making it ideal for short-term rentals.

However, investors need to navigate regulations, including mandatory registration of tourist rentals with the Andalusian Tourism Registry and obtaining a full tourist license here. Adhering to these rules is important, as non-compliance can lead to significant fines. Managing these requirements and seasonality effectively will help maximize returns in this flourishing market.

A short-term rental in Malaga is typically booked for 303 nights per year. The earning potential for an Airbnb investment property in Málaga is:

Average daily rate: $98

Occupancy rate: 83%

Best month: May

Yoy revenue change: 11.38%

Average monthly revenue: €2,561 ($2,754)

5. Seville

Seville, the capital of Andalusia, blends rich history, Moorish architecture and a vibrant arts scene into one of Spain�’s most culturally magnetic cities. With landmarks like the Real Alcázar, Seville Cathedral and flamenco-filled streets of Triana, it draws millions of tourists every year and remains a favorite for those seeking an authentic Spanish experience.

The city has a market score of 91, making it a solid pick for Airbnb investors looking for a mix of affordability and strong rental demand. Compared to higher property prices in Madrid or Barcelona, Seville offers property at affordable Airbnb property prices with attractive rental yields, especially in well-located areas like Santa Cruz or La Macarena.

While local regulations are in place, they’re relatively manageable. Short-term rental property owners must register with the regional tourism authority and meet basic habitability and safety requirements. Enforcement is increasing, especially in the historic center, but the system is still open and workable for compliant hosts.

A vacation rental in Sevilla is usually booked for about 288 nights per year. Earning potential for an Airbnb investment property in Seville is:

Average daily rate: €123 ($133)

Occupancy rate: 79%

Best month: April

Yoy revenue change: 10.38%

Average monthly revenue: €2,833 ($3,047)

6. Marbella

Marbella, nestled in Spain's glamorous Costa del Sol, is a haven where luxury and leisure converge. Known for its upscale resorts, pristine beaches and vibrant nightlife, Marbella attracts a sophisticated international crowd year-round. Whether strolling through the charming streets of the Old Town or enjoying the yacht-studded marina of Puerto Banús, visitors are captivated by Marbella's blend of charm and opulence. With millions of tourists annually, it remains a premier destination for travelers seeking sun, style and relaxation.

Marbella is an Airbnb market powerhouse, boasting high rental demand and strong seasonal returns. With relatively straightforward regulations, hosts must register their properties with the Andalusian Tourism Registry and meet basic safety standards, making compliance manageable for investors. The market thrives on the luxury segment, offering opportunities in beachfront villas, modern penthouses and traditional Andalusian homes. While peak summer months bring the highest returns, Marbella's year-round appeal ensures steady occupancy, making it a standout choice for Airbnb investment.

In Marbella a vacation rental is often booked for an average of 237 nights per year. Earning potential for an Airbnb investment property in Marbella is:

Average daily rate: €169 ($182)

Occupancy rate: 65%

Best month: August

Yoy revenue change: 8.09%

Average monthly revenue: €3,287 ($3,535)

7. Alicante

Alicante, with its golden beaches, historic sites and vibrant nightlife, stands out as a gem of the Costa Blanca. Known for its sunny climate and welcoming atmosphere, Alicante attracts both domestic and international travelers, drawing over 1.5 million tourists annually. The city, home to around 330,000 residents, offers a perfect blend of relaxation and activity.

Despite Alicante's Airbnb market performing moderately with a Market Score of 50, driven by a rental demand score of 53 and moderate revenue growth of 46, it remains a strong investment option due to its consistent tourist appeal and strategic Mediterranean location. However, investors need to be mindful of seasonality and moderately stringent regulations. These regulations include mandatory registration with municipal authorities and local authorities here, the Valencian Community Tourism Registry and adherence to specific guest and safety rules. Non-compliance with local rules can result in fines, making it crucial for investors to navigate the market carefully and adhere to local laws to succeed.

Whether you're considering a beachfront condo or a historic property in the old town, Alicante's enduring popularity makes it an excellent choice for property owners and investors in the Airbnb market.

Typically a holiday rental in Alicante is booked for 270 nights per year. The earning potential for an Airbnb investment property in Alicante is:

Average daily rate: €87 ($94)

Occupancy rate: 75%

Best month: May

Yoy revenue change: 14.86%

Average monthly revenue: €1,881 ($2,023)

Pro Tip : Top areas in Alicante for Airbnb investment include Alicante Old Town, Santa Bárbara Castle, Explanada de España, Playa del Postiguet and San Juan Beach.

8. Adeje

Located on the southwestern coast of Tenerife in the Canary Islands, Adeje is a rising star in Spain’s short-term rental market. Known for its sunny year-round climate, luxury resorts and proximity to local attractions like Siam Park and Playa del Duque, Adeje attracts both international travelers and domestic holidaymakers seeking relaxation and warm weather.

What sets Adeje apart is its steady stream of guests throughout the year, thanks to minimal seasonal dips, the average occupancy rate here stays consistently high. The area also offers a mix of affordable property and high nightly rates, especially in coastal zones popular with families and retirees.

For Airbnb investors, Adeje presents one of the most reliable opportunities for steady cash flow in Spain. The municipality enforces tourism regulations at the island level, but as of now, Airbnb properties are still legal and active in designated tourist areas. However, local regulations are evolving and it’s crucial to stay up to date with local authorities before purchasing.

If you’re looking for a laid-back market with strong rental demand, high revenue potential and warm weather all year, Adeje is one of the best vacation rental markets in Spain to consider for Airbnb investment.

In Adeje a vacation rental is booked for 299 nights on average per year. The earning potential for an Airbnb investment property in Alicante

Average daily rate: €111 ($120)

Occupancy rate: 82%

Best month: January

Yoy revenue change: 22.52%

Average monthly revenue: €2,724 ($2,930)

9. Granada

Granada, nestled in the Sierra Nevada mountains, is where history truly comes alive. The city, home to the iconic Alhambra, attracts millions each year who are captivated by its blend of old-world charm and lively neighborhoods. With a population of around 230,000 and welcoming over 2.7 million tourists annually, Granada may be small, but it leaves a big impression with its stunning vistas and rich cultural heritage.

Granada is an attractive market for Airbnb investors, boasting a high market score of 99, with strong rental demand and seasonal appeal. The city's rich history, vibrant student life and proximity to skiing make it a top destination, keeping properties in demand. Whether you're looking at a charming Albaicín apartment or a modern flat near the university, Granada's cultural and natural beauty enhances its appeal.

However, investors must navigate strict regulations, including property registration certificate tax obligations, registration, safety standards and restrictions on renting entire homes tourist apartments in certain areas. Staying compliant is crucial to ensure compliance, avoid fines and ensure success in this thriving market.

A short-term rental in Granada is on average booked for about 241 nights per year. Earning potential for an Airbnb investment property in Granada

Average daily rate: €89 ($96)

Occupancy rate: 66%

Best month: April

Yoy revenue change: -1.42%

Average monthly revenue: €1,695 ($1,823)

10. Canary Islands

The Canary Islands, a breathtaking archipelago off the northwest coast of Africa, are where natural beauty meets year-round sunshine, creating a paradise for visitors and residents alike.

From the dramatic volcanic landscapes of Tenerife to the golden dunes of Gran Canaria, the islands offer an unmatched blend of adventure and relaxation. With over 13 million tourists visiting annually, the Canary Islands are a magnet for sunseekers and outdoor enthusiasts.

The Canary Islands are a premier Airbnb market, boasting high occupancy rates and a consistent stream of visitors through most of the year. Regulations are relatively lenient, requiring hosts to register their properties and adhere to basic safety standards, making it easier to enter this thriving market. While revenue growth is steady, investors should note the seasonal peaks that coincide with the influx of European winter travelers

A holiday rental in Canary Islands is usually booked for about 285 nights a year. The earning potential for an Airbnb investment property in the Canary Islands is:

Average daily rate: €77 ($91)

Occupancy rate: 78%

Best month: January

Yoy Revenue change: 18.96%

Average Revenue: €1750 ($2047)

How to Make the Most of Your Airbnb Investment in Spain

Once you’ve chosen your market, the next step is making that investment work for you. Whether you’re managing the property yourself or working with a team, small decisions can make a big impact on your rental income, occupancy rate and long-term performance.

To maximize your Airbnb investment in Spain, it pays to think beyond the purchase. Start by analyzing average rental yields in your target area, this gives you a realistic picture of your potential returns and helps shape your long-term investment strategy. But it doesn’t stop there. Applying competitive pricing strategies can give you an edge, especially in saturated local markets where many listings underperform. Smart pricing tools and clear positioning can boost your occupancy rate and drive stronger rental income.

Location also matters, but not always in the way you think. While city centers are attractive, proximity to urban hubs can make nearby suburban or coastal areas just as valuable. These areas often offer affordable property prices and steady demand, especially when well-connected to transit and local amenities. With the right market research and a bit of strategic thinking, your short-term rental property can outperform the local average and deliver real, long-term value.

Why Spain is a Great Choice for Airbnb Investments

Spain offers a perfect mix of culture, beauty and solid financial opportunities, making it a top pick for Airbnb investors. Whether you're captivated by the vibrant energy of Barcelona or the serene charm of Málaga, Spain has a spot that fits every investor's dream. The country's diverse locations let you choose between bustling city life or a peaceful getaway, depending on what you're looking for.

To make things even easier, tools like Hostaway can help you manage your properties effortlessly, so you can focus on enjoying the rewards of your investment. With its endless appeal to tourists and a variety of opportunities to rent out your space, Spain is the ideal place to dive into the Airbnb market and watch the income from your investment grow.