Short-Term Rentals in Chicago: Everything You Need to Know in 2025

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F22bokY8j1MM8XLWkTU3qT8%2F02ee17bddda6452840b44b816d6fc060%2Fchi1__1_.webp&a=w%3D960%26h%3D640%26fm%3Dwebp%26q%3D75&cd=2025-02-27T09%3A43%3A19.314Z)

The Windy City has long been a magnet for tourists, offering a rich tapestry of cultural, historical and modern attractions. In 2023, the City of Chicago witnessed a remarkable surge in tourism — 14% over 2021 — offering lucrative opportunities for short-term rental operators.

Why Chicago Appeals to Tourists

Chicago's status as a top tourist destination is undeniable. With strategic investments in tourism initiatives, a diverse range of festivals and events like Lollapalooza and increased air connectivity, the City of Chicago has become more accessible and appealing to a wide array of visitors. Its unique cultural offerings, affordability and commitment to sustainability further enhance its attractiveness.

In the first half of 2023 alone, hotel revenue in the City of Chicago reached a record-breaking $1.12 billion — up 102% from pre-pandemic 2019 — a testament to the city's booming tourism sector. Such figures not only reflect its vibrant tourism industry but also underscore the potential for short-term rental operations to thrive.

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F7BWtaw3Ff5fvf6OOnqA8nO%2Ff49303d1a72502adff53f1d5f6392dc1%2Fchi4__1_.webp&a=w%3D590%26h%3D393%26fm%3Dwebp%26q%3D75&cd=2025-02-27T11%3A23%3A55.865Z)

The Short-Term Rental Market in Chicago

Skyrocketing tourism in the City of Chicago has created a ripe environment for property managers and hosts. Understanding the demographics and preferences of Chicago's tourists, such as the increasing numbers of millennials and Gen Z visitors drawn to the its cultural and neighborhood appeal, can help vacation rental owners tailor their offerings effectively.

The potential earnings from operating a short-term vacation rental in Chicago are promising. While specific earnings can vary based on location, property type and management efficiency, the overall high demand for accommodations presents a favorable scenario for rental owners.

According to January 2025 data from AirDNA for the City of Chicago:

Average annual revenue is $26.5K

Average daily rate (ADR) is $236.8

Revenue per available room (RevPAR) is $131.3

1-bedroom listings are the most common (49%)

81% of listings are entire homes

30% of listings are available for at least 271 nights of the year

Moderate cancellation policies are the most popular (63.3%)

Minimum stays of 2 nights account for 46.3% of stays while 30+-nights account for 34.3% of stays

Rental Arbitrage Potential in Chicago

For property managers and rental operators looking for rental arbitrage opportunities in Chicago, the opportunities can vary by city and even neighborhood.

According to RentCafe data, the most affordable neighborhoods are The Island, Austin and Fifth City where the average rent is $810 per month, $917 per month and $990 per month, respectively. These are far below the average rent for Chicago of $2,331 per month. Meanwhile, the most expensive neighborhoods are River West, Streeterville and River North, where the average monthly rent is $2,964, $2,973 and $3,040, respectively.

Often, more expensive neighborhoods also command higher rates, so make sure you do the math before eliminating one as a possible rental arbitrage opportunity.

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F1B6sHu639RxMejc7BHYFMr%2F02e2bc5a1689e5c857bd07d0c04e95c8%2Fchi2__1_.webp&a=w%3D590%26h%3D390%26fm%3Dwebp%26q%3D75&cd=2025-02-27T11%3A03%3A14.105Z)

Navigating Chicago's Short-Term Rental Laws: Airbnb Rules in Chicago

Whether you are looking to purchase an entire home or rental arbitrage a short-term rental, to operate successfully, it's crucial for owners, property managers and hosts to navigate Chicago's regulatory landscape. Operators must ensure compliance with housing unit registration, licensing requirements, pay necessary taxes and adhere to safety and health standards.

What is a short-term rental in Chicago?

The Municipal Code defines a short-term rental as a housing unit or part of a home that is rented out to guests for short periods of time. This includes three types of residential rentals:

Shared housing unit

This is when the owner or tenant rents out part of a home to travelers for temporary occupancy, usually through booking sites like Airbnb and Vrbo.

Vacation rental

This is when a dwelling unit is rented out to guests for short-term occupancy.

Bed & breakfast

This is a residential building not more than four stories in height that is occupied by an owner and where 11 or fewer rooms are rented out to guests for 31 consecutive days or fewer.

.webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F6qobK2E4Ft8NAYawOIpFQC%2F0627fe30b68c144402a8d471204a41fd%2Fchi3__1_.webp&a=w%3D590%26h%3D394%26fm%3Dwebp%26q%3D75&cd=2025-02-27T11%3A06%3A59.287Z)

Registration and licensing

The licensing and registration process in Chicago is dependent on the type of housing unit you plan to use.

If you list a single rental or shared housing unit, that is part or the whole of a single-family home or a building with two to four dwelling units that is your primary residence, you must register with the city.

You can also list not more than one-quarter or a maximum of six, whichever is less, of a building with five or more housing units that is not your primary residence.

You may be able to operate a shared housing unit in a single-family residence that is not your primary residence or a building containing two to four dwelling units that is not your primary residence, if the commissioner grants an adjustment.

If you are approved to operate more than one rental, you also have to obtain a Shared Housing Unit Operator License as part of the registration process. This is valid for two years and must be renewed biennially.

If you operate a bed and breakfast, you must obtain a Bed and Breakfast License which also permits serving breakfast and foods requiring minimal preparation. The license must be renewed every two years.

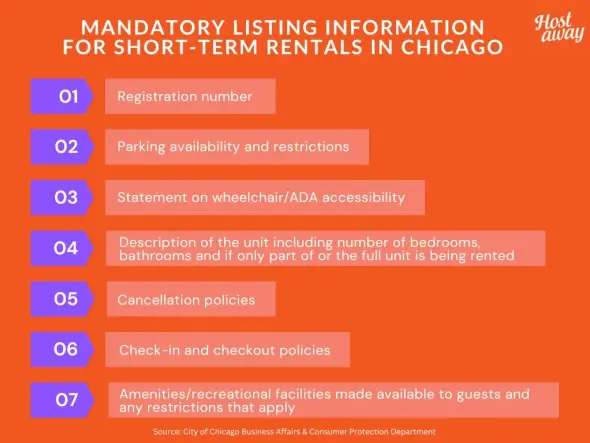

Listing information

The City requires all hosts to include the following information in every listing of their housing unit(s):

Cancellation and check-in and check-out policies

A statement on wheelchair/ADA accessibility

Parking availability and restrictions

Availability/restrictions of any amenities or recreational facilities applicable to guests

A description of the unit including number of sleeping rooms and bathrooms and if the full or only a portion of the unit is being rented

Registration number

Short-term rental hosting requirements

All short-term vacation rental hosts operating in Chicago must:

Notify Chicago police immediately if they know or suspect of any illegal activity including public nuisance.

Provide soap as well as clean and good-quality bath cloths, towels and linens that are changed in between guests.

Clean and sanitize all dishes, utensils, pots, pans and other cooking utensils between guests. And dispose of any food, alcohol or other beverages left by previous guests.

Include and conspicuously display the registration number in all advertisements, listings, rental agreements and bookings.

Conspicuously display contact information of a local contact near the entrance as well as an evacuation diagram.

Install smoke alarms and carbon monoxide detectors in the short-term rental property. Fire extinguishers must be serviced and easily accessible.

Maintain records of guest registration for three years including name, contact information, dates and signature.

Comply with the all applicable food handling and licensing requirements of the City Code and Department of Public Health rules if they provide food to guests.

Not serve or provide alcohol to guests or their invitees.

Have property insurance including a minimum coverage of $1 million in commercial general liability.

Comply with the requirements of the Chicago Municipal code including noise ordinances

Occupancy limits

Chicago permits a maximum short-term rental occupancy of:

Two persons per guest room, not including guests' children under 18, or

One person per 125 square feet of floor area of the unit, or

Actual allowed occupancy of the unit based on the building code,

whichever is less.

Chicago tax laws

Short-term vacation rental businesses operating in Chicago incur a number of specific taxes including:

Chicago Hotel Accommodation Tax (4.5%)

Chicago Vacation Rental and Shared Housing Surcharge (4%)

Domestic Violence Surcharge (2%)

Cook County Hotel Accommodation Tax (1%)

Illinois Hotel Operators Occupation Tax (5.98-6.17%)

All taxes are calculated for the total listing price including cleaning fees and are applicable to reservations of 29 consecutive days or fewer.

Airbnb collects and remits all of the above taxes on behalf of its hosts.

Other considerations

The City of Chicago prohibits operating a short-term rental if you are not permitted to do so by the Homeowner's Association (HOA), condo board or other tenant organization to which your property belongs.

Capitalizing on Short-Term Rentals in Chicago

Chicago's tourism boom presents a golden opportunity for short-term rental operators to capitalize on the increasing number and demographics of visitors. By offering a unique and high-quality lodging experience, understanding the market dynamics and adhering to local regulations, property managers and hosts can tap into the city's thriving tourism industry. As Chicago continues to draw visitors from around the globe, the potential for short-term rentals to flourish alongside the city's tourism sector is significant.