Guesty Pay vs. Stripe: What Hosts Should Know

Payment processing is a crucial part of the guest experience, profitability and daily operations. So when Guesty introduced their own solutions, Guesty Pay, it naturally raises some questions, How does it compare to established providers like Stripe? Is the convenience it offers worth it?

Guesty Pay has been gaining attention for its integrated approach, providing hosts with a built-in option for managing transactions directly within the PMS. For some, this might seem like a convenient all-in-one solution. But for others, especially those scaling or managing multiple properties, flexibility, data ownership and financial transparency are essential.

This article provides a clear, side-by-side comparison of Guesty Pay and Stripe. Whether you're exploring Guesty Pay for the first time or weighing your options, this guide is here to help you make an informed decision based on what matters most to your business.

What Is Guesty Pay and Why Is It Getting Attention?

Guesty Pay is a payment processing tool built into the Guesty PMS. It’s designed to offer a seamless way for short-term rental operators to accept payments, manage payouts and handle chargebacks all from within the Guesty platform.

The appeal is clear, instead of integrating a third-party provider like Stripe, property managers can manage everything in one place. For some, that kind of simplicity is a plus. There’s no need to set up a separate payment account or deal with outside tools. Everything stays under the Guesty umbrella.

But, this convenience also comes with trade-offs, particularly when it comes to transparency, control and portability. Because Guesty Pay is tightly coupled with the PMS, users often have limited visibility into how disputes are handled, when funds are released or how payment data can (or can’t) be moved if they switch platforms later on.

The growing buzz around Guesty Pay likely stems from this promise of convenience, but as we’ll explore, convenience comes at a cost.

Stripe vs. Guesty Pay: Key Differences That Matter

At first glance, both Guesty Pay and Stripe aim to help property managers accept payments, process refunds and handle disputes. But once you get into the details, the differences start to show, especially when it comes to control, transparency and day-to-day performance.

1. Payout timing and cash flow

Stripe gives property managers faster access to funds, with payouts typically arriving in as little as two business days for most standard accounts. Guesty Pay, on the other hand, has been known to hold funds longer, especially during disputes or manual reviews. For fast-moving operations, that delay can create real cash flow headaches.

Note: Stripe also offers instant payouts in some countries (for a small fee).

2. Dispute and chargeback handling

With Stripe, chargeback fees are refunded if the dispute is resolved in the host's favor. The platform provides a detailed dashboard to manage the entire process. Guesty Pay charges a non-refundable $15 fee, even if the case is decided in the host's favor. That can add up quickly, especially if you’re managing high booking volumes.

3. Support and communication

Stripe offers 24/7 support and clear visibility into all payment activity. Guesty Pay users, on the other hand, have reported slower response times and unclear communication, especially when something goes wrong. Waiting on messages like “help.guesty.com needs to respond,” or “waiting for help.guesty.com to respond” isn’t just frustrating, it can be disruptive to your business.

4. Customization and automation

Stripe is known for its developer tools and API flexibility which Hostaway users can take advantage of to create custom payment rules, triggers and automations. Guesty Pay offers a more rigid experience, with fewer customization options and limited integration outside its own ecosystem.

Guesty Pay vs. Stripe: Side-by-side comparison

Feature | Guesty Pay | Stripe (via Hostaway) |

Payout timing | May delay funds, especially during manual reviews or disputes. | Fast payouts, typically within 2 business days |

Chargeback fees | $15 per dispute, non-refundable, even if resolved in the host's favor. | Fee refunded if the dispute is won |

Dispute management | Limited visibility, slower communication | Clear dashboards and support throughout the dispute process |

Customer support | Reports of slow response times and unclear updates | 24/7 specialized Stripe support |

Customization & automation | Limited - tied closely to Guesty’s system | Highly customizable with Hostaway + Stripe automations |

Portability | Vendor lock-in: credit card data stays with Guesty | You own your Stripe account |

Industry trust | Relatively new, limited visibility outside Guesty | Used by Airbnb, Shopify, Booking.com and trusted in 120 countries worldwide |

Can You Trust Guesty Pay with Your Payouts and Disputes?

In any payment system, things will occasionally go wrong, a guest cancels at the last minute, a chargeback gets filed or a transaction is flagged for review. How these situations are handled can make a huge difference to your cash flow, your stress levels and your trust in the system.

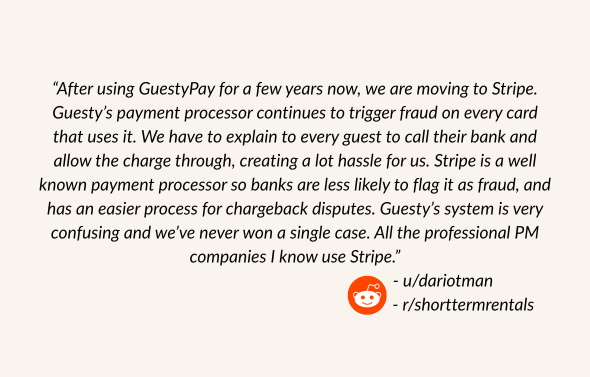

Guesty Pay users have raised concerns about how disputes and chargebacks are managed. Since the platform charges a non-refundable $15 dispute fee, regardless of the outcome, even if you win the case, you're still out of pocket. Beyond that, hosts have reported slow response times and a lack of visibility into how and when funds will be released. Messages like “help.guesty.com needs to review” and “waiting for help.guesty.com to respond” don’t exactly inspire confidence, especially when you’re in the middle of a busy check-in day.

Stripe takes a different approach. Dispute fees are refunded if the case is resolved in your favor and you have access to detailed timelines, evidence upload tools and real-time notifications. Stripe also uses machine learning to flag and prevent fraudulent charges before they happen, a level of proactive fraud prevention that Guesty Pay doesn’t yet match.

The result? Fewer surprises, fewer delays and a system that puts hosts in the driver’s seat rather than leaving them in the dark.

Are You Locked In? Why Portability and Data Ownership Matter

One of the most overlooked, but most important aspects of choosing a payment processor is who really owns your data. Specifically, what happens to your payment infrastructure if you ever decide to switch platforms?

With Guesty Pay, the answer is a bit restrictive. Because the payment system is built into the Guesty ecosystem, your customer's credit card data stays there. If you decide to move to another PMS, that data doesn’t go with you and that can make switching platforms more complicated than it should be.

Stripe takes a more open, host-friendly approach. When you use Stripe, you retain ownership of your Stripe account. That means your customer data, payment history and transaction tools stay with you even if your business evolves or you choose a different platform down the line.

It’s not just about flexibility, it’s about future-proofing. As one property manager noted in a recent Reddit thread, “All of the professional PM companies I know use Stripe.” One big reason? They want control of their payment infrastructure, no matter where their business goes next.

How Professional Hosts Future-Proof with Stripe

For property managers thinking long-term, it’s not just about what works today, it’s about building a setup that can evolve with your business. And that’s where Stripe really stands out.

Professional hosts value platforms that offer control and transparency and Stripe checks all those boxes. You can customize payout rules, automate workflows, integrate with dozens of third-party tools and most importantly, take your payment setup with you when your business grows. There’s no lock-in, no surprises and no risk of getting stuck behind a closed system.

Guesty Pay, by contrast, has a more closed-loop structure. If you��’ve ever come across messages like “verify you are human” you’ve seen firsthand how system-level blockers can stall even basic actions. When platforms start reviewing the security of your connection before proceeding with something as simple as logging in or checking a payout, it signals a lack of reliability that most professional teams can’t afford.

It’s no surprise, then, that experienced hosts lean toward Stripe. It’s not just about reputation, it’s about having a reliable, future-ready payments engine that supports growth rather than limits it.

When your operation is growing and your margins matter, every delay from a verification successful message to a held payout chips away at your efficiency. Stripe offers a smoother, more predictable path forward.

Choose a Payment Processor That Grows With You

Choosing a payment processor isn’t just a technical decision. It’s a strategic one. While Guesty Pay might offer convenience for some, it’s important to weigh that against what you might be giving up in terms of flexibility, control and long-term scalability.

Stripe, offers a level of transparency, portability and reliability that professional hosts consistently trust. It gives you faster payouts, clearer dispute handling and the confidence that you’re building on a platform designed to support growth, not limit it.

And when Stripe is used through Hostaway, it opens the door to powerful automation. You can trigger automatic receipts, manage cancellations, flag failed payments or customize payout rules. It’s one less thing to manually manage and it gives hosts more time to focus on guests instead of backend tasks.

Whether you're just starting out or managing dozens or even hundreds of listings, the systems you choose now will shape how smoothly you operate later. A tool that gives you freedom, not friction, is always worth considering.

FAQ

1. What are the risks of relying on an in-house payment solution like Guesty Pay?

The main risks involve lack of portability, limited transparency and slower access to support. Since Guesty Pay is tied to the Guesty platform, your payment data stays locked within that system. If you ever need to switch platforms or scale differently, migrating your payment infrastructure could be difficult or even impossible.

2. Can I migrate guest credit card data from Guesty Pay to Stripe?

No, due to PCI compliance and data privacy restrictions, guest credit card data stored within Guesty Pay typically cannot be exported or migrated to Stripe or another payment processor. This is one of the key portability limitations to be aware of when committing to an in-house payment system like Guesty Pay.

3. Are there any volume-based discounts available for using Stripe?

Yes, Stripe offers custom pricing for businesses with large transaction volumes or unique business models. If you're processing a high number of bookings or significant monthly revenue, you can reach out to Stripe’s sales team to explore reduced processing rates, custom fee structures or enterprise-level support.

4. What happens if I need to dispute a guest payment manually through Stripe?

Stripe provides a robust interface for manually handling disputes. You’ll be notified of the chargeback, given a deadline and able to upload supporting evidence directly in your Stripe dashboard. Stripe also gives guidance on how to respond, increasing your chances of a successful resolution. It’s worth reviewing this workflow before you face your first chargeback.

5. Does using Stripe mean I have to handle all my payment issues directly?

Not necessarily. When you use Stripe through a PMS like Hostaway, much of the integration and payment flow is handled within the platform. However, if you need to troubleshoot a dispute, review a transaction or set up automations, you’ll still have access to Stripe’s full dashboard and support tools. You’re not left alone, but you do get full visibility and control when you need it.

Ready to find out how Hostaway can transform your business?