Florida Airbnb Laws & Taxes | Guide to Vacation Rental Rules

Did you know that Florida is one of the top locations for Airbnb investments in the entire U.S. market? With its world-famous beaches, vibrant tourist attractions and over 135 million visitors in 2023 alone, the Sunshine State offers an unmatched opportunity for short-term rental hosts to thrive. Even better, Florida boasts some of the least restrictive regulations for short-term rentals nationwide, making it a prime destination for investors and property managers.

However, thriving in this lucrative market isn’t just about finding the perfect property or listing it on platforms like Airbnb or Vrbo. Navigating Florida’s short-term rental laws is essential to avoid legal troubles with local authorities and ensure your business is compliant. From state-level regulations to local rules in the hottest vacation spots, understanding these laws is a critical first step.

This guide will walk you through Florida Airbnb laws and taxes, answering key questions about permits for short-term rentals and the Airbnb restrictions that exist in popular cities.

Whether you’re a new host or an experienced property manager, this comprehensive we’ll equip you with the knowledge and insights you need to build a compliant and successful short-term rental business in Florida.

Florida’s Definition of a Short-Term Rental

If you’re new to the vacation rental world, you’ve probably wondered, “What exactly counts as a short-term rental in Florida?” The answer depends on a few key factors, like how the property is used, where it’s located and how long guests stay.

At its simplest, Florida’s Department of Revenue says a short-term rental is any property rented for less than six months. If your rental falls into this category, you’ll need to collect a 6% state sales tax and send it to the Department of Revenue.

Florida law takes it a step further with Chapter 509 of the Florida Statutes. It defines short-term rentals as housing rented for 30 days or less, more than three times a year. This includes any property advertised or offered for regular, short-term stays.

The official term Florida uses for short-term rentals is “vacation rentals,” and the Florida Department of Business & Professional Regulation (DBPR) breaks them down into two main categories:

Vacation rental condos: These are single units or groups of units in a condo or cooperative that are rented out for short-term stays.

Vacation rental dwellings: Think single-family homes, townhouses, duplexes, triplexes or even quadruplexes rented temporarily.

One thing to keep in mind — timeshare projects aren’t included in the vacation rental category. They follow a whole different set of rules.

Another layer to this is that Florida gives counties and cities a lot of freedom to set their own short-term rental rules. This means the exact definition of an STR and the regulations around it can vary depending on where your property is.

This flexibility in local rules really stands out when you compare how cities like Miami and Fort Lauderdale define short-term rentals (STRs).

Take Miami, for example. Miami describes an STR as “any unit or group of units… that is rented to transient occupants more than three (3) times in a calendar year for periods of less than thirty (30) days or one (1) calendar month.” Fort Lauderdale’s definition is pretty similar but goes a step further by including properties “advertised or held out to the public as a place regularly rented to transient occupants . . . but that is not a timeshare project.”

At first glance, these differences might not seem like a big deal, but they can make a huge difference for anyone trying to start an STR business. Small details like this can affect how you set up and manage your property to stay within the rules.

The rules also get interesting when it comes to home-sharing. For instance, Florida state law says the STR definition doesn’t apply if you’re renting out just part of your home while staying there as a host. So, if you’re thinking about listing a spare bedroom on Airbnb, you’re in the clear as far as state regulations are concerned.

These examples show why it’s so important to get familiar with both state and local rules. Knowing the specifics can help you avoid headaches down the road and set up your rental business for success from the start.

Key Things to Know About Florida’s Short-Term Rental Rules in 2025

Florida’s state-level short-term rental laws leave room for flexibility, but many cities are tightening their own rules to manage STR activity. Local governments often impose restrictions like limiting the number of guests allowed or designating specific areas where vacation rentals can operate.

Take the recently passed bill, SB280, for example. As of February 2024, this law sets a maximum occupancy limit for vacation rentals based on the number of bedrooms in the property. The rule allows two people per bedroom, plus an additional two in a shared living area.

There’s a catch, though — if each person in the bedroom has at least 50 square feet of space, the room can accommodate more than two guests. The final occupancy number, whichever is higher, still includes the extra two allowed in the common area.

The new legislation also gives local governments more authority. For instance, cities can now require vacation rental owners to register their properties and charge a “reasonable fee” for this registration. This means that even if state rules give you the green light, local regulations might add their own twist.

If all this sounds a bit overwhelming, don’t worry — you’re not alone. Short-term rental rules in Florida (or anywhere, really) can be tricky to navigate. But that’s why we’re here. We’ll guide you through everything you need to know to launch your vacation rental business with confidence. Let’s go!

Starting a Short-Term Rental Business in Florida

Launching a successful vacation rental in Florida takes more than just knowing how short-term rentals are defined. To get your business off the ground, there are a few key steps and considerations you’ll need to keep in mind. Let’s dive into what you should prepare for as you start your journey in the Sunshine State.

Getting your Florida DBPR License.

If you’re planning to rent out your property in Florida for fewer than 30 days at a time, more than three times a year or if you’re publicly advertising your property as a short-term rental, you’ll need to obtain a license from the Florida Department of Business and Professional Regulation. This license is a critical step in staying compliant with state regulations. .

Steps to apply for a Florida DBPR License

To secure your license, you’ll need to gather some key information and documents:

Property address: Provide the address of your rental property along with your own home address.

Property type: Determine whether your rental falls under the category of a condominium or a stand-alone dwelling. Each has its own application process, so review the requirements carefully before submitting your application.

Building Classification: If your rental is part of a multi-unit building, you’ll need to indicate its category:

Single License: Covers a single-family home, townhouse or one or more units within the same building that are owned and operated by an individual or entity that isn’t a licensed agent.

Group License: Available to licensed agents and applies to all units within a single building or multiple buildings within a single complex.

Collective License: For licensed agents managing multiple houses or units across different locations. This license can cover up to 75 units but is limited to properties within the same county or district.

Note: It’s best to apply for your license online. Applications are usually processed within 1-2 business days, and the digital license is emailed after approval.

What documents do you need to start a short-term rental business?

No matter which business structure you choose, there are a few key documents you’ll need to have ready when applying for your short-term rental license. These may include:

Florida DBPR online account

Florida DOR registration

Federal EIN

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Certificate of balcony inspection

Certificate of internal inspection

County tax registration

Personal ID

Proof of property ownership

Site plan

Parking plan

Proof of payment of fees

Investors need to make sure that they have all necessary documents before applying for a license in order to avoid delays or rejections

It’s also smart to plan for other permits and licenses you might need down the line. Local governments may have additional requirements depending on where your property is located. We’ll dive into those local specifics in an upcoming section.

Balcony inspection requirements

If your property is in a building that’s three or more stories tall or has balconies 17 feet or higher above ground level, you’ll need to complete a safety inspection. A certified inspector must assess the balconies and provide a signed DBPR HR-7020 certification.

Human trafficking awareness training

In line with legislation passed in 2019, short-term rental operators in Florida must ensure that employees working in housekeeping, reception or front desk roles complete mandatory annual human trafficking awareness training. It’s also a good idea to extend this training to other staff who interact with guests, such as concierge or valet personnel, to foster a safer environment.

Fees and costs

The cost of your DBPR license depends on factors like the number of units you’re renting and the county where your property is located. These fees can be calculated and paid online through the DBPR website.

Some costs are:

Application fees: $50 for a new application.

Hospitality education program (HEP) fee: $10.

License fee: This depends on the type of property and the number of units:

For a single rental unit, the full-year license fee is $170.

For properties with 2–25 units, the fee increases to $180.

Getting your short-term rental license in Florida is typically a straightforward process. However, operating without one can result in penalties — a first violation could cost you up to $500.

Why is it Important to Get Your Short-Term Rental License in Florida

Getting a license for your short-term rental in Florida might seem like just another round of tedious paperwork, but it’s a crucial step that sets the foundation for your business.

For starters, being fully licensed ensures your rental business is legitimate and compliant with state regulations. This legitimacy can save you from legal troubles or fines that could arise from operating under the radar. Plus, having your paperwork in order makes it easier to focus on growing your business without worrying about running afoul of the law.

A license can also open doors for future opportunities. For example, if you ever need to apply for a business loan or want to set up separate bank accounts to manage your rental income, being a properly registered business will make the process smoother.

Ultimately, getting licensed isn’t just about following the rules — it’s about building a strong, professional foundation that will help your short-term rental business thrive in the long run.

Renewing Your Florida Short-Term Rental Business License

Once you’ve secured your short-term rental license, keeping it active is just as important as obtaining it in the first place. Florida requires all short-term rental licenses to be renewed annually to ensure your business remains compliant.

The good news? Renewing your license is typically straightforward. Most of the process can be done online, making it easy to update your information and handle the renewal quickly.

To get started, head over to the Florida Department of Corporations website and submit your business’s annual report. You’ll also need to pay a renewal fee, which can range from $25 to over $400, depending on the type of business structure you have.

The annual renewal date depends on the region your short-term rental is located in and is as follows:

District 1 (Miami): October 1

District 2 (Fort Lauderdale): December 1

District 3 (Tampa): Ferbuary 1

District 4 (Orlando): April 1

District 5 (Jacksonville): June 1

District 6 (Panama City): June 1

District 7 (Ft. Myers): December 1

Staying on top of your license renewal each year ensures your short-term rental business can keep running smoothly without interruptions. Renewals can be done online and do not require any additional information. The fees include the $10 HEP fee + the full-year or half-year license fee mentioned above.

Setting Up Your Florida Short-Term Rental: LLC or Corporation?

Navigating Florida’s ever-evolving short-term rental laws can feel like a full-time job. That’s why it’s often a smart move to consult with professionals like lawyers or accountants when establishing your rental business. They can guide you through the process of choosing the right business structure, whether that’s:

A Corporation

A Limited Liability Company (LLC)

A Limited Partnership

A General Partnership

A Limited Liability Partnership

Or a Sole Proprietorship

While it’s always best to get personalized advice from a legal expert, many rental owners opt to set up their business as a Limited Liability Company (LLC) — and for good reason.

Why consider an LLC?

An LLC provides a layer of protection for your personal assets by keeping them separate from your business assets. If your short-term rental business ever faces a lawsuit or financial challenges, your personal property, like your home or savings, is generally shielded from liability.

Beyond asset protection, LLCs offer flexibility in how you manage your business operations and profits. They also have fewer state reporting requirements compared to corporations, which can save you time and hassle.

However, the tax implications of an LLC — and any business structure — can vary. For more details about taxes and compliance, it’s a good idea to check out resources from the website of Florida Department of Revenue or speak with a tax professional.

Understanding Florida Vacation Rental Tax Rules

If there’s one thing you can always count on, it’s taxes — and short-term rental owners in Florida are no exception. On average, you can expect to pay more than 10% of your rental income back to the state and your local county in taxes.

However, the exact tax obligations you’ll face depend heavily on the municipality where your property is located. Let’s take a quick look at the key tax considerations for Florida vacation rental owners, including state and federal requirements.

Tax rules for Florida short-term rentals

From federal requirements to state and local taxes, understanding what’s expected can help you stay compliant and maximize your earnings.

Federal tax guidelines

Your property is considered a short-term rental for federal tax purposes if:

You rent it out for at least 14 days in a year.

You use the property for personal stays no more than 14 days annually — or less than 10% of the total days it’s rented.

Meeting these criteria opens the door to several tax benefits, including deductions for:

Repairs and maintenance

Insurance premiums

State and local taxes, such as Florida’s transient rental tax (more on that in a moment!)

Utilities like water, gas and electricity

Supplies, from linens and towels to kitchenware or pool toys

Professional fees, including legal and accounting services

To make the most of these deductions, it’s smart to work with a qualified accountant. And remember — save your receipts! They’ll help you track deductible expenses when it’s time to file your taxes.

Local transient rental tax

Under Florida Statute 212.03, all short-term rental properties in the state are subject to a transient rental tax. This tax is set at 6%, matching the state’s sales tax rate and applies to the rent collected from guests. As a short-term rental owner, you’re responsible for collecting and remitting this tax to the state.

That said, there are specific scenarios where this 6% transient rental tax can be waived:

Long-term stays: If you rent your property to a single tenant or group for more than six months, it’s no longer considered a short-term rental under Florida law.

Military and veteran renters: Rentals to active-duty service members or military veterans are exempt.

Full-time students: If your guest is enrolled in postsecondary education full-time, this tax doesn’t apply.

For exemptions like the latter two, it’s important to request proper documentation. For instance, you can ask for a student’s enrollment letter from their college or university or official military orders to confirm eligibility.

Keeping these details in mind ensures you stay compliant while taking advantage of any available tax breaks.

Discretionary sales surtax

On top of the transient rental tax, Florida counties may impose an additional discretionary sales surtax, typically ranging from 0.5% to 1.5%. This tax applies to short-term rentals of less than 182 days and includes fees like cleaning or reservation costs.

Local option transient rental taxes

In addition to the statewide transient rental tax and the discretionary sales surtax, counties in Florida can impose their own local option transient rental taxes on short-term rental properties. Known as the local option transient rental tax, this includes the County Tourist Development Tax, which varies depending on the county. The local transient rental tax rates can vary widely across Florida. Counties like Broward, home to Fort Lauderdale and Duval, where Jacksonville is located, have some of the highest rates, matching the state’s 6%. On the other hand, smaller counties like Calhoun and Lafayette, each with populations under 15,000, don’t impose this tax at all.

To stay compliant, it’s essential to track the tax rates for the county where your short-term rental is located. Equally important is knowing where and how to make your payments.

In most cases, you’ll pay local transient rental taxes directly to the county. However, about 20 counties, including Bradford and Washington, require these payments to go through Florida’s Department of Revenue. Make sure to check the rules for your specific county to avoid any hiccups.

General Rules for Short-Term Rentals in Florida

If you’ve made it this far, you’re well on your way to launching your short-term rental business in Florida. You’ve tackled some big steps — understanding the licensing requirements and getting familiar with the taxes you’ll need to manage.

Now, it’s time for the next phase: diving into the key rules and regulations that apply to short-term rentals across the state.

We’ll also take a closer look at city-specific rules, fees and regulations. Remember, while the state lays the foundation for STR operations, each city can have its own requirements. Taking the time to understand these local rules — or hiring a professional who can guide you — will help ensure your business stays compliant and runs smoothly.

Common rules and regulations for short-term rentals in Florida

Across Florida, cities have established key rules to maintain a balance between the needs of tourists, residents and the local community while ensuring the safety and satisfaction of both guests and hosts.

Here are some of the most common regulations you’ll encounter in major Florida cities:

City registration and fees

In many of Florida’s major cities, short-term rental owners are required to register their business or property with the local government. These registrations often come with associated fees, which can vary significantly depending on the city.

Additionally, some municipalities may require your short-term rental business to obtain city-specific tax identification numbers (more on this later).

Occupancy rules

Many Florida cities have specific occupancy rules to regulate short-term rentals. One common requirement is that you, as the host, must own the property you’re renting out. If your property is in a condominium or governed by a Homeowners Association (HOA), you’ll typically need written approval from the HOA before listing it as a short-term rental.

In these cases, the HOA itself may also need to have a valid Business Tax Receipt (BTR) number to comply with local regulations.

Cities may impose additional restrictions, such as:

Dwelling location: Larger cities like Miami Beach and Fort Lauderdale often designate specific zones where short-term rentals are allowed.

Occupancy limits: Most cities cap the number of guests per property. These limits usually allow for two adults per bedroom and an additional two people in a common area but can vary depending on local rules.

As always, it’s important to check the specific requirements for your city to ensure your property meets local guidelines.

Safety regulations

Maintaining safety and security for your guests is essential — not just to keep guests happy but also to stay compliant with licensing requirements. Ensuring your property is up to code, clean and meeting all safety standards is a critical part of obtaining and renewing your DBPR license. Falling short in these areas can lead to fines, complaints or even the revocation of your license.

Here are some key steps to help you stay on top of safety regulations:

Post emergency information clearly:

Make sure your rental includes visible signs showing the location of fire extinguishers, emergency exits and other safety equipment. It’s also helpful to post emergency contact numbers, like the fire station, the closest hospital and the local police station, especially for international guests who may not be familiar with local emergency services.

Designate an emergency contact

If your rental is unhosted, assign a local contact person who can be available to handle urgent situations, such as noise complaints or lost keys. Some cities, like Naples, require you to officially name a local on-call contact to ensure someone is available if issues arise.

Follow local building and safety codes:

Regularly maintain your property to meet all local codes and Florida regulations. This includes providing proof of safety inspections, such as a balcony inspection for DBPR licensing. Some cities have additional requirements, like fire marshal inspections in Miami Beach or property surveys in Jacksonville, as part of the short-term rental permitting process.

Keeping your property safe and well-maintained not only helps you comply with state and local laws but also ensures a better experience for your guests — building trust and encouraging positive reviews.

Neighborhood restrictions

Many Florida cities include short-term rental regulations designed to protect the quality of life for local residents. These neighborhood-focused rules aim to maintain a balance between welcoming visitors and preserving the peace in residential areas. Common restrictions include:

Noise regulations

Short-term rentals must comply with local noise ordinances. In Holmes Beach, near Tampa, city code Section 4.11 requires that STRs display the following message: “You are vacationing in a residential area. Please be a good neighbor by keeping the noise to a respectful level during the day and night. Excessive and unreasonable noise can deprive neighbors of the peaceful enjoyment of their private property.

Parking limitations

Cities like Fort Walton Beach impose parking restrictions for STRs, particularly in areas near popular beaches, to address local congestion issues.

Florida Short-term Rental and Airbnb Regulations by City

Now that we’ve covered general neighborhood regulations, let’s dive into the unique requirements for short-term rentals in specific Florida cities. We’ll explore how rules, fees and expectations can vary, giving you a clearer picture of what to expect based on your property’s location.

Clearwater Beach

Nestled along Florida’s Gulf Coast, Clearwater Beach offers a serene alternative to bustling Tampa, making it a prime destination for sun-seekers. According to AirDNA, short-term rental properties in the area boast average annual returns of over $12,700.

However, setting up a short-term rental business in Clearwater Beach comes with its challenges.

Short-term rental laws in Clearwater Beach

The city enforces strict rules for STRs, particularly in residential areas. Under CDC Sections 1-104.B and 3-919, short-term rentals of 30 days or less are prohibited in residential districts. This aligns with broader restrictions from Pinellas County, which governs much of Clearwater Beach and nearby Saint Petersburg.

That doesn’t mean STRs are off the table entirely. Properties in residential zones can still be rented out for periods longer than a month. Additionally, short-term rentals are allowed in areas designated as tourist districts or commercial districts, as defined by the city.

For properties located in these permitted zones, Clearwater Beach keeps the process relatively straightforward. Owners are required to obtain a City of Clearwater Beach Business Tax Receipt (BTR) but are not subject to additional local permits. Instead, the city defers to the state’s general requirements for licensing and compliance.

Destin and Fort Walton Beach

Stretching along Florida’s northern Gulf Coast, Destin and Fort Walton Beach are bustling beach destinations that attract visitors year-round. To balance tourism with local living, these communities have implemented specific rules for short-term rentals (STRs).

Short-term rental laws in Destin

Destin has formalized its STR regulations through Article VI of the Destin Code of Ordinances. To operate a short-term rental in Destin, owners must:

Obtain a City of Destin Short-Term Rental Permit.

Provide key documents, including:

Proof that the property is in an approved zone (as noted in city documents).

A valid DBPR license.

A Florida Department of Revenue Resale Certificate.

A bedroom/parking Affidavit issued by the city.

Capacity limits

Destin enforces occupancy limits for STRs. Properties may host up to 24 guests total, with a maximum of two people per bedroom plus an additional four occupants per property. For example, a four-bedroom home can accommodate up to 10 guests.

By adhering to these rules, STR owners in Destin can navigate local regulations while offering visitors a welcoming experience in this beautiful coastal community.

Jacksonville

As Florida’s largest city, Jacksonville combines major attractions with a thriving business scene, making it an excellent spot for short-term rental (STR) opportunities.

Short-term rental laws in Jacksonville

Jacksonville follows Florida’s definition of a short-term rental: any property rented more than three times per year for stays of 30 days or less. STRs are allowed in residential areas, including single-family homes, duplexes, two-family homes and townhouses, as long as the property owner secures a Short-Term Vacation Rental Certificate.

How to apply for a Short-Term Vacation Rental Certificate

To operate an STR in Jacksonville, you’ll need to complete an application for a Short-Term Vacation Rental Certificate for each property. Your application must include:

A local tax receipt and tourist tax registration for Duval County.

A Florida Department of Revenue Certificate and DBPR License.

Detailed property documentation, including:

A sample lease.

A boundary survey.

Proof of ID for the property owner.

The total cost includes a $150 annual fee for the certificate and an additional $79.20 for the local business tax. With these steps completed, you’ll be ready to launch your Jacksonville STR business.

Miami Beach

Miami Beach, like many major Florida cities, heavily restricts short-term rentals (STRs), limiting them to specific zones. In much of the city, STRs are prohibited entirely. However, if your property is located in an eligible district, you can operate a short-term rental by meeting the city’s strict requirements.

To legally operate an STR in Miami Beach, you’ll need a valid DBPR license and the following:

Miami Beach Business Tax Receipt (BTR):

To operate a short-term rental (STR) in Miami Beach, you’ll need a Business Tax Receipt (BTR) issued by the city. Applying for a BTR requires submitting the following:

Articles of Incorporation (if applicable).

Proof of Ownership for the STR property.

A completed and notarized BTR affidavit.

Insurance documentation for your business.

You’ll also need to pay the registration fees, which include:

$69 for the license fee.

$45 for the application fee.

$57.50 for the fire inspection fee.

Fees may be prorated depending on when you apply, as the Miami Beach fiscal year begins on October 1.

Miami Beach Resort Tax Certificate

Once you’ve obtained your BTR, the next step is to register for a Miami Beach Resort Tax Certificate. This certificate is required to remit monthly taxes to the city. To apply, you’ll need:

Your BTR.

Driver’s license number.

Social security number.

Employer Identification Number (EIN) and tax documentation (if operating as a business).

Tax obligations

All short-term rentals in Miami Beach are subject to:

A 4% resort tax on room rental fees.

A 2% tax on food and beverage sales related to the rental.

These taxes must be filed and paid monthly through the city’s online tax portal.

While completing the process for these licenses and certificates may take some time, it’s a crucial step for legal compliance. Having both your BTR and Resort Tax Certificate ensures your property meets Miami Beach requirements and is eligible to be listed on platforms like Airbnb.

City of Naples

For many years, the City of Naples prohibited short-term rentals (STRs) entirely. However, recent changes to local legislation have opened the door to STRs, making Naples an emerging market for vacation rentals in Florida.

Setting up an STR in Naples is now relatively straightforward. Beyond obtaining a DBPR license and paying the Collier County Tourist Development Tax, all STR properties must be registered with the city.

Short-term rental registration in Naples

As of January 2, 2022, all short-term rentals — including single-family homes, multi-family units and condos — must be registered with the City of Naples. To complete the registration process, STR owners must submit:

Proof of a valid Florida DBPR License.

A completed Collier County Short-Term Vacation Rental Application, including 24/7 contact information for a responsible party to address renter or neighborhood concerns.

Proof of registration with Collier County to confirm tax compliance.

A one-time $50 registration fee.

Once the application is approved, STR owners will receive a registration number to verify their property’s compliance with city regulations.

As the home of Florida’s most iconic theme parks, Orlando attracts millions of visitors each year — over 74 million in 2022 alone, according to Visit Orlando. While this may seem like a prime opportunity for short-term rentals (STRs), the city has some of the strictest regulations in the state.

Short-term rental laws in Orlando

Before 2018, all STRs were banned in Orlando. Today, the city allows two types of short-term rentals, each with specific restrictions:

Home-sharing: If you’re a homeowner and full-time resident, you can rent part of your property as an STR, but only under these conditions:

The property must be your primary residence.

You can only rent to one group of guests at a time.

No more than half of your home’s bedrooms can be rented out.

Occupancy is capped at two people per room, with no more than four non-relatives per dwelling.

The benefit of home-sharing is that it’s allowed in any zoning type within the city, but the restrictions significantly limit STR opportunities.

Commercial dwelling units: If you own a commercial property, such as a vacation rental condominium, you can rent the entire unit. However, these rentals are not permitted in residential zones.

Permit requirements:

To operate an STR in Orlando, you must apply for a permit. The city charges a $275 fee for the initial permit, which is renewable annually for an additional $100. Once approved, you’ll receive a permit number that ensures compliance with city regulations.

.jpg?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2F5BRAX7EnAol7zbCVNNDbqQ%2F5d49babebed42f5ebb4cb267180c067e%2FTampa__1_.jpg&a=w%3D590%26h%3D377%26fm%3Djpg%26q%3D75&cd=2025-01-12T09%3A59%3A26.764Z)

Tampa

Unlike many other Florida cities, Tampa has a relatively unregulated short-term rental (STR) market. Governed primarily by state laws, Tampa is an appealing destination for STR investors, as long as they ensure their property is properly licensed and tax-compliant.

Short-term rental laws in Tampa

While the city itself imposes few restrictions, Hillsborough County, which encompasses Tampa, has additional rules. Properties rented for seven days or less must be located in specific zones designated for short-term rentals.

Beyond these zoning requirements, Tampa remains an inviting and flexible market for STR owners, offering opportunities for those looking to enter Florida’s vacation rental industry.

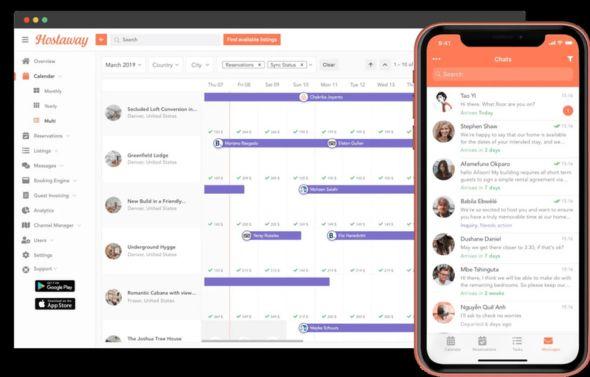

Simplify Florida Short-Term Rental Management with Hostaway

Feeling uncertain about managing your short-term rental? You’re not alone — it can feel daunting to build an STR business from the ground up. Keeping up with Florida’s regulations while juggling the demands of daily life can be overwhelming. That’s where vacation rental software like Hostaway comes in to make your life easier.

Hostaway is a top-rated platform designed to streamline the management of your short-term rental properties. With its all-in-one system, you can oversee every aspect of your rental business from one place. Hostaway lets you:

Create a custom direct booking website to simplify reservations.

Sync your booking calendars across platforms like Airbnb and Vrbo for seamless coordination.

Manage all your properties from a single dashboard

Download and unlimited number of reports to analyze data

Automate multiple aspects of property management to save time and reduce error.

If you’re ready to take the stress out of managing your Florida short-term rental business, Hostaway has you covered. Sign up for a free trial and discover how easy STR management can be.

Florida’s Thriving Short-Term Rental Market in a Nutshell

Florida offers something for everyone — whether it’s the relaxed beach vibes, thrilling theme parks or opportunities to explore its underwater wonders. This diversity ensures a steady demand for short-term rentals, making the Sunshine State an ideal place to start your STR business.

While setting up an STR in Florida can feel overwhelming at first, many of the challenges come early in the process. Navigating licensing, permits and compliance might seem like a lot, but once you’ve cleared those hurdles, running your rental business becomes much smoother.

The best part? Each step gets easier with experience. Your first permit may take time, but the next one will be faster — and so will the ones that follow. With perseverance, your STR business in Florida can grow into a rewarding venture, offering both financial benefits and the satisfaction of hosting guests in one of the world’s most sought-after destinations.

So, why wait? Dive into Florida’s short-term rental market and start building your success story.