Buying Property in a Ski Resort vs Beach Town

Thinking of investing in property, but can't decide whether to invest in a ski or beach town? Look for a property benefiting both your mind and your wallet. Ski towns are quite tempting especially during a busy winter month while you might also think that a beach is great for a reliable income stream and just maybe the perfect spot for a summer vacation getaway.

Either way, whether you are thinking of investing in a ski or beach town, the goal is to have an impressive return on investment. With that said, the article will guide you through:

What are the best real estate investment tools to use before buying a property?

The pros and cons of both ski or beach towns

What are the best towns for both ski or beach towns?

What Are The Best Real Estate Investment Tools To Use Before Buying A Property?

1. Education Real Investment Tool

Information is the key to making every decision - both in the real estate investing business and beyond. With the power of knowledge, it allows you to make the right decisions, resulting from being ahead of other competitors. Moreover, knowledge can easily be found online that offers an abundance of information from how to identify the best places to invest to tips and tricks in real estate investing given by experienced professionals and experts in the field.

Tip: Check out the variety of real estate blogs, podcasts, YouTube videos, e-books.

2. Real Estate Heatmap

What is a heatmap? While others may have heard of it, a heatmap is an analysis tool that shows a visual representation of data with different color codes.

How does it work?

It conducts market analysis through identifying the most profitable locations and neighborhood analysis. Keep in mind, collecting data can take days or even weeks as you collect all the real estate comps and other data required.

Furthermore, a heatmap allows real estate investors to find properties by filtering out in finding the best areas for buying a rental property such as:

Property listing price

Rental income

Cash on cash return

Occupancy rate

3. Online Property Finders

With the evolution of technology, finding real estate properties has never been easier. Using software tools like Mashvisor or AirDNA helps real estate investors to find properties that meet all the expectations and criteria for a return on investment. It is simple to use by filtering your requirements in narrowing down your property search such as:

Locations of real estate market

Budget

Rental strategy

Property type

Number of bedrooms and bathrooms

Doing so will help obtain the best possible investment properties required to your needs as well as patterns observed among other investors. Apart from that, Property Finder tools will give you access to the highest cash on cash return and a cap rate of multiple listings, foreclosures, and off-the-market properties.

4. Investment Property Calculator

To find out how much income you make in real estate is through an investment property calculator- a quick, efficient, and accurate tool. The tool will make use of the rental comps data from the local housing market to perform investment property analysis. Doing so shows the potential cost-effectiveness of any real estate property in the market.

With that said, the readily available analysis includes:

Start-up costs and repeated monthly costs

Rental income

Occupancy rate

Cash flow

Cash on cash return

Cap rate

Rental strategy

5. Property Marketplace

For any real estate investor, always take benefit in Property Marketplace, a one-stop shop for all your needs in buying a lucrative investment property as well as selling properties. With that said, this tool allows investors to:

List properties for sale

Analyze investment properties for sale

Connect with property owners

Find below the market value off-market properties

What Are The Pros And Cons Before Investing In A Ski Or Beach Town?

Ski town pros

1. Clientele - Be aware that you’ll be dealing with investors with money at their disposal investing at luxury ski town properties or possibly a second home.

2. A tailored market - Ski properties have a built-in market meaning that real estate investors are a niche itself. Therefore, investing in a vacation rental property can expect higher returns.

3. Potential Return of Investment (ROI) is higher - Ski town property figures range from six-figure which is equivalent to a potentially high return of investment especially at re-modeled properties.

4. Predictable market - Ski town property markets are more likely foreseeable for three things- seasonal, the overall state of the economy, and specific geographic location. For example, investing in a vacation rental property at the beginning of ski season is likely risky as more competitors are in the market. Although, if you choose to invest in a vacation rental property at a popular location, it will lead to higher business value and the least time on the market.

5. Timeshare option - Most vacationers tend to stay for at least two to three months. Therefore, consider investing in vacation rental properties that offer fractional opportunities as it is a solid market in the industry.

Ski town cons

1. Property Maintenance - It is your responsibility to maintain the vacation rental and added to that, if you remotely live far, a property manager is required.

2. Association Fees - It is expected to pay association fees if you invest in ski resort vacation rentals such as condominiums or part of co-ops.

3. Risks - There is a huge potential risk in investing in high-end luxury vacation rental properties. Chances are things could go wrong resulting in a loss in investment. Therefore, the right location and right time are vital to invest in a vacation rental property.

Beach town pros

1. Rental Income - An advantage of owning a beach vacation rental is the potential of generating higher rental income in comparison to traditional rental properties.

2. Tax Benefits - The benefit of owning a vacation rental is that you are allowed to eliminate mortgage interest, property management fees, marketing costs, insurance, property taxes, and repair costs. Moreover, to find out what tax reductions may be applied, speak with your local real estate attorney.

3. Property Appreciation - In the long-term, the value of the real estate property located at the beach will be worth much more especially with an increase in inflation.

4. Personal use and enjoyment - In the long run, investing in a beach house can save costs and serve as a second home during your vacations. And while not in use, it can be turned into a vacation rental for extra income.

Beach town cons

1. High down payment - It is expected to give a 20-30% down payment and in addition, credit score requirements could potentially be higher for a vacation rental property.

2. High maintenance and repair costs - Ideally, maintenance of vacation rentals has higher costs due to back-to-back guests, resulting in a higher chance of amenities being damaged.

3. Other costs - Ideally, a vacation rental property comes with a variety of expenses such as permits, vacation rental fees, utilities, and transport costs (if you live out of state).

4. More risks - Keep in mind, owning real estate on the beach is at risk of natural disasters such as hurricanes and flooding. Therefore, it is important to insure your property covering every possible risk.

5. Maintenance and management can be time-consuming - Vacation rentals require day-to-day tasks and operations such as guest check-in and check-out, restocking amenities, cleaning, guest communication, and so forth. Moreover, if you live out-of-state, a property manager will be needed however this will be an additional cost.

What Are The Best Towns To Invest In?

Ski Town | Snowshoe, West Virginia

A separate community in Pocahontas County, West Virginia, situated in the Allegheny Mountains. Snowshoe is a unique take on ski vacation rental and a largely untapped opportunity for real estate investors as list prices are unbelievably low. Moreover, it’s great for skiing with its scenic view and mountaintop festivals.

Market Data: Average Daily Rate: $270 Occupancy Rate: 42% Revenue: $2,788

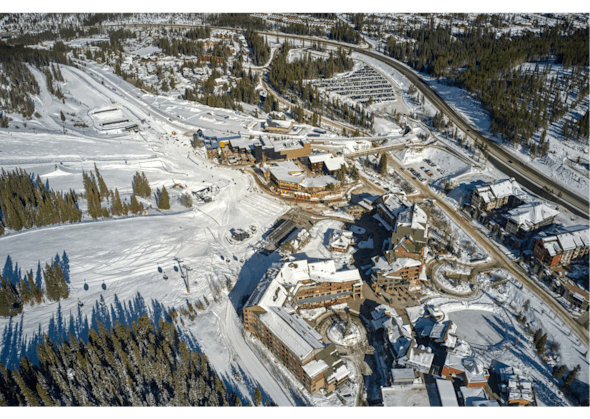

Ski Town | Winter Park, Colorado

Winter Park is home to Winter Park Resort located in southeastern Grand County. It is a historic ski town where vacationers can enjoy cross-country skiing opportunities, mountain biking, concerts, hiking, and fishing. Furthermore, there is a huge opportunity for consistent occupancy rates as it is close to Denver- year-round sightseeing.

Market Data: Average Daily Rate: $285 Occupancy Rate: 50% Revenue: $3,223

Ski Town | Killington, Vermont

Killington’s charm dominates vacationers and skiers, especially during ski season. It is situated in the Green Mountains of central Vermont, known for the Killington and Pico Mountain downhill ski resorts. There is a huge opportunity for real estate investors as you can find cheap townhouses close to the ski mountains.

Market Data: Average Daily Rate: $390 Occupancy Rate: 44% Revenue: $3,614

Related article: Airbnb Rules in Vermont| Airbnb Laws, Taxes, and Regulations

Ski Town | Salt Lake City, Utah

Salt Lake City, the capital of Utah is home to historic, religious attractions, along with nearby skiing and mountain adventures such as Park City and Deer Valley in less than an hour away. Salt Lake City is a great option for ski investors due to its less market competition and year-round occupancy.

Market Data: Average Daily Rate: $138 Occupancy Rate: 80% Revenue: $2,305

Related Article: Buying an Airbnb Vacation Rental in Park City

Beach Town | Myrtle Beach, South Carolina

It is the heart of South Carolina’s Grand Strand coast and is best known for its exciting attractions. It’s no surprise it is home to vacation rentals and Myrtle Beach’s median home price is $213,950. Although, an option would be Hilton Head Island, Myrtle Beach offering with a lesser price and still have the same benefits as the city. And if you are looking for affordability, check out properties in North Myrtle Beach offering homes with easy access to golf courses and the ocean.

Market Data: Average Daily Rate: $194 Occupancy Rate: 73% Revenue: $2,930

Find out more on Guide to buying a Myrtle Beach Vacation Rental Property.

Beach Town | Harbor Springs, Michigan

Harbor Springs is a city and resort community in Emmet County, Michigan where it offers a collection of art galleries, culinary attractions, and the deepest freshwater harbor in the Great Lakes.

Market Data: Average Daily Rate: $330 Occupancy Rate: 68% Revenue: $4,369

Beach Town | Dauphin Islands, Alabama

Located in a town in Alabama, on the Gulf Coast island of the same name. Dauphin Island stretches with white sand separating the mouth of Mobile Bay in the Gulf of Mexico and is reached by a three-mile-long high-rise bridge. Vacationers enjoy the beautiful beachfront parks and not forgetting it is the only pet-friendly beach in the region.

Market Data: Average Daily Rate: $276 Occupancy Rate: 77% Revenue: $4,578

Beach Town | Cocoa Beach, Florida

Cocoa beach is best known for its beach and surf breaks located an hour’s drive east of Orlando on Florida’s Space Coast offering vacationers endless ways to enjoy both leisure and recreation. The median home price is $370,406.

Market Data: Average Daily Rate: $211 Occupancy Rate: 77% Revenue: $3,300

Check out: Florida Airbnb Laws & Taxes | Guide to Vacation Rentals

Conclusion

Whether you are considering investing in a ski or beach town, firstly deliberate all the facts and information gathered such as listing prices, rules and regulations of both towns, return of investment, occupancy rates and so much more.

And if you are expanding your real estate portfolio or live out-of-state, consider investing in Hostaway, a leading vacation rental software property management that will help you in simplifying managing your day-to-day operations and management tasks through automation saving you time and costs.