Buying an Airbnb Vacation Rental in Mexico

When it comes to buying Airbnb vacation rentals — Mexico is proving to be a truly remarkable destination far beyond oceanic views, tacos or tequila!

According to Statista, Airbnb travelers contributed an impressive $2.7 billion to Mexico's tourism revenue, making the country one of the top ten countries where Airbnb has made a large financial contribution, meaning Airbnb activity plays a crucial role in boosting its tourism-related income.

Tourism in Mexico

Tourism is a cornerstone of Mexico's economy, making it one of the most popular travel destinations globally. It's the second most-visited country in the Americas, just behind the United States. By 2019, the country welcomed an impressive 97 million tourists, placing it fourth in the world in terms of total visitors. Mexico boasts 35 UNESCO World Heritage sites, including ancient ruins, colonial cities and natural reserves, making it first in the Americas and seventh worldwide for the number of such sites. The country's main attractions include vibrant cultural festivals, charming colonial cities, stunning nature reserves and beautiful coastlines rich in Spanish colonial history and architecture.

Peak Season in Mexico for Airbnb Listings

Tourism in Mexico hits its highest points in December and mid-summer, with smaller spikes around Easter and Spring Break when U.S. students flock to beach resorts.

The majority of tourists in Mexico come from the U.S. and Canada, followed by visitors from Latin America. Europe and Asia also make up a small portion of the tourists.

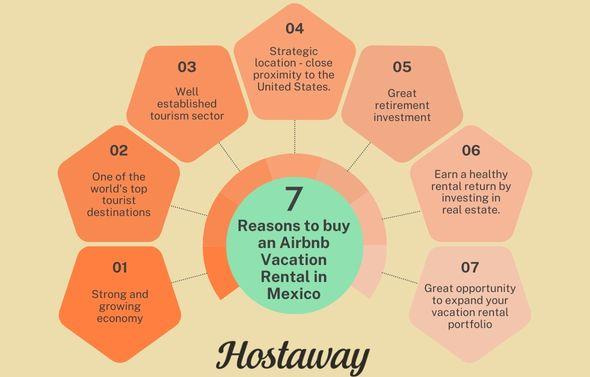

Why Invest in a Vacation Rental in Mexico?

Forbes named Mexico the top country to invest in for 2021, and it's also a hotspot for second home ownership. With its welcoming property laws for foreigners, Mexico has become a favorite for retirees and investors alike.

As Latin America's second-largest economy, it's now one of the top four places globally for owning a second or vacation home. With favorable exchange rates, there's never been a better time to invest.

What You Need to Know Before Buying a Vacation Rental in Mexico

1. Mexico’s best bargain land

Ejido land, communal agricultural land often owned by indigenous communities, can be a great bargain, especially now that some of it includes prime beachfront property. However, buying it requires approval from the entire community and converting it to private ownership, which is a complex process.

Specialized legal firms in Mexico can help with this conversion, but if you're considering buying legally converted ejido land, follow these steps:

Ensure the property is already registered as a freehold title before purchasing.

Have an independent attorney review the title’s history and the legality of its conversion.

Purchase title insurance to protect against potential legal claims.

Side Note: Altogether it’s best advised to avoid ejido land.

2. Foreign ownership is not restricted

Generally, there are no restrictions on the ownership of residential property in Mexico and you can hold the title in your own name.

You can choose to hold it in a trust — for asset protection or estate planning purposes — but it’s not required.

If the property is near the coast or an international border, however, special rules will apply.

3. Special rules for coastal and border property

In Mexico's restricted zone — called the Zona Restringida — which includes areas within 50 km of the coast and 100 km of land borders, non-citizens can't directly own property. However, to encourage foreign investment, since 1973, the government has allowed foreign buyers to purchase property in this zone through a Fideicomiso trust, similar to a Land Trust in the U.S.

4. The notary

In Mexico, a notary is a state-appointed attorney with at least five years of experience who represents you in the buying process, not the seller. They handle title searches, paperwork, transaction processing and recording the new title, as well as collecting taxes and fees.

Ensure your notary is fluent in English if you're not fluent in Spanish. They will translate and explain the documents, so don't rely solely on your real estate agent for translation. Avoid using a notary who doesn't speak your language.

5. The sales contract

In Mexico, all official documents, including your sales contract, are in Spanish. Many realtors provide an English translation, but remember that the Spanish version is the legally binding one. Ensure any changes in the English version are accurately reflected in the Spanish version. You can also have official documents translated by a third party if needed.

Buying the Best Vacation Rental in Mexico

A Quick Guide to Buying a Vacation Rental in Mexico

The notary and your agent will handle the majority of the processes outlined here. Your only responsibility is to sign the documents and pay the fees.

Negotiate a price - This is usually done verbally, either with the seller or through your real estate agent.

The sales contract - This can be called a promesa de compraventa, convenio de compraventa or contrato de compraventa, depending on local custom. Document the terms and conditions of the sale here, including any special payment arrangements and penalties.

The deposit - Normally, this will be 5% to 10% of the sales price.

Initiate creation of the Fideicomiso (if the property is within the restricted zone) - Alternatively, you can transfer the previous owner’s Fideicomiso into your name.

The Foreign Secretary's Office must approve your purchase - You will be asked to sign a statement indicating you will not seek foreign jurisdiction in relation to your property transaction.

Title review and official valuation (Avalúo) - The notary will perform or arrange these activities. The valuation will be used to establish the home’s value for tax purposes.

The Escritura (The Title / Deed) - Sign the Escritura at the notary office and make the closing payment. When signed and recorded, this Escritura will be your title to the property.

Taxes, fees and property registration - All of this is done by the notary. You’ll just need to hand over the money.

Final registration - The property registry will complete and record the final registration within three months.

Closing costs - Closing costs should be about 5% of the purchase price. This includes a 1.5% notary fee, a 2% transfer tax, as well as other fees, including the Fideicomiso setup fees. If you are getting a mortgage, the fees will be higher.

Emerging Mexico Vacation Rental Markets

The following data analyzed by AirDNA gives the emerging markets in Mexico to look out for in a nutshell,

San Cristobal de Casas

Chiapas' go-to home base for exploring southern Mexico is becoming a haven for adventurous travelers and culture buffs alike.

Market Grade: A+ (95/100)

1,337 active rentals.

Saltillo

Desert Oasis in Northern Mexico is just a stone's throw from Monterrey. Centuries-old museums, bohemian cafes and cultural centres are beginning to beckon tourists.

Market Grade A- (84/100).

311 active rentals.

Guadalajara

With over 1.5 million people, Mexico's second city is still very much considered an emerging market.

Market Grade: A (93/100).

3,412 active listings.

Chapala

Lakeside town with a beautiful boardwalk just south of the chaos of Guadalajara.

Market Grade: A (94/100).

544 active rentals.

Oaxaca

Bustling markets, colonial architecture, Aztec ruins, and lush botanical gardens are all on display in Oaxaca. It’s also currently in the top 10 in the country for places with the most long-term stays (28+ days)

Market Grade: A+ (97/100).

2,449 active listings.

Mérida

Just inland from the Gulf of Mexico in the Yucatan, Merida is emerging as an excellent alternative to the overrun destinations in Quintana Roo.

Market Grade: A+ (97/100).

3,511 active listings.

Mexico a Buyers Market But Not For Long!

With foreign investors clamoring to claim a piece of this Haven country, Mexico is clearly a buyer's market, perhaps one of the best in the world when it comes to vacation rentals. It's getting out among the international elite and the market is stabilizing rapidly, even as we speak.

For those looking for foreign investment to expand their portfolio now is the most opportune time and that too at a fraction of the cost! Act now before the window of opportunity closes.