10 Best Airbnb Markets in Florida

When it comes to vacation properties, Florida is the crown jewel of the United States. With its sunny weather, stunning beaches and iconic attractions like Disney World and South Beach, the Sunshine State draws millions of visitors year-round. For real estate investors, this means one thing: opportunity.

But while Florida as a whole is a tourist magnet, not every city delivers the same results for Airbnb hosts. Some real estate markets thrive with sky-high nightly rates and year-round bookings, while others struggle with seasonal demand or oversupply.

Knowing where to invest can be the difference between steady passive income and a missed opportunity. In this guide, we’ll break down Florida’s top 10 Airbnb markets, diving into what makes each location unique, profitable and a smart choice for real estate investors.

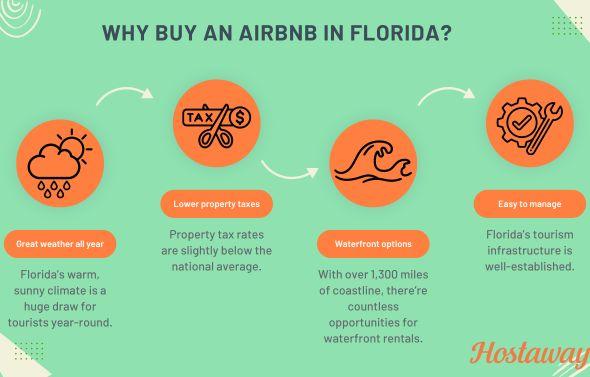

Why Airbnb's in Florida Are Smart Investments

Great weather all year round

Florida's weather ensures a steady stream of visitors no matter the season with mild winters of 52°F in the north and 70°F far south and hot summers (88 °F and 91 °F, respectively), it offers the perfect escape for those looking to avoid colder temperatures.

Lower property taxes

The state's effective property tax rate is 0.8%, slightly below the national average of 0.99%, making it a more affordable place to own vacation rentals. This means lower annual costs, which can significantly increase your overall return on investment.

Combine that with no state income tax and Florida becomes even more attractive for rental property owners.

Waterfront options

Boasting over 1,300 miles of coastline, there are countless opportunities for waterfront rentals in Florida. Whether a beachside condo or a lakefront home, properties with water views tend to attract higher rates and more frequent bookings.

Easy to manage

Florida's tourism infrastructure is well-established with a variety of property management companies and services designed specifically for vacation homes, making it easy for Airbnb real estate investors to find support for everything from maintenance to marketing.

Plus, utilities are often tailored to part-time residents, further simplifying the logistics of running a vacation rental business.

Things to Consider When Investing in Florida

Florida Airbnb regulations

One of the biggest perks of investing in Florida is that many cities are Airbnb-friendly, but regulations can vary depending on the location.

Some cities have relatively straightforward rules, while others, like Miami and Key West, impose stricter requirements.

Key things to keep in mind:

Licensing requirements: Most cities require short-term rental operators to obtain a license through the Department of Business and Professional Regulation (DBPR).

Local zoning laws: Some neighborhoods or HOA communities restrict short-term rentals, so always check before purchasing.

For instance, in areas like Indian Harbour Beach, zoning laws and community preferences can have a bigger impact. That said, be sure to research local regulations to ensure compliance and protect your long-term profitability.

Taxes: Florida requires short-term rental hosts to collect and remit lodging taxes, which may include both state and local taxes.

Understanding and complying with these rules will save you headaches and help you operate your Airbnb investment legally.

Weather and climate

Florida is famous for its sunny beaches and tropical weather, but it also comes with unique challenges.

Hurricane season: Running from June to November, hurricane season can bring strong storms to areas like Miami, Key West and the Florida Keys. This means you’ll need additional insurance and storm preparedness plans.

Humidity and maintenance: Florida’s humid climate can lead to wear and tear on your property, such as mold or rust, so regular upkeep is essential.

Property types

Choosing the right type of property is key to attracting your ideal guests and maximizing your ROI. Here’s a quick breakdown of property types that perform well in Florida:

Beachfront condos: These are perfect for travelers seeking beachfront convenience, offering stunning views and a relaxing atmosphere. They’re especially popular with couples and small families looking for a cozy getaway by the water.

Family homes: Ideal for families traveling with children, these properties offer ample space, family-friendly amenities and proximity to popular tourist attractions or recreational activities.

Larger homes with three bedrooms to four bedrooms or more are particularly attractive to multi-generational families or larger groups seeking Florida vacation rentals that feel like a home away from home.

Luxury villas: High-end travelers often look for upscale finishes, private pools and additional amenities that create a lavish and memorable stay. These properties cater to those seeking exclusivity and comfort.

Urban apartments: Professionals and urban explorers appreciate modern, centrally located Airbnb rentals that provide convenience, parking spots, and easy access to dining, shopping and entertainment.

Match the property type to the location’s tourist profile to maximize bookings.

Property management

Deciding how to manage your Airbnb is a critical part of your investment strategy.

Self-management: This is more hands-on but allows you to save on property management fees. It’s a great option if you live locally or have experience in hosting.

Professional management companies: For investors with multiple properties or those who live out of state, a property management company can handle everything from guest communication to maintenance.

Tech tools: Property management software or Airbnb management software like Hostaway or Airbnb-specific accounting software can make self-management easier and more efficient.

Regardless of the approach, having a well-equipped kitchen, fast Wi-Fi and easy check-in options can elevate the guest experience and increase positive reviews.

Florida Airbnb Investment Metrics

Knowing your numbers is essential for evaluating the potential success of an Airbnb investment. Here are the key metrics to track:

Annual Occupancy Rate

The occupancy rate is the percentage of nights your property is booked over a year.

In Florida, this varies by city and season, but a good target is above 50%. For example, cities like St. Pete and Sarasota often hit higher occupancy rates due to their mix of year-round attractions.

Coastal areas like Santa Rosa Beach also attract consistent bookings thanks to their serene charm and popularity among families and couples seeking a quieter vacation.

Equally important is understanding your nightly revenue potential, which brings us to ADR.

ADR (Average Daily Rate)

Your average daily rate (ADR) dictates how much you can charge per night and is influenced by location, property type and the amenities you offer.

Prime locations like Key West and Sarasota boast higher ADRs such as $546.10 and $373.10, respectively, driven by their upscale appeal and limited inventory.

Conversely, cities like Tampa and Jacksonville offer more affordable ADRs, making them great for investors targeting budget-conscious travelers or mid-range vacationers. Properties that strike a balance between amenities and competitive pricing often achieve rates above the average price in their market, maximizing revenue potential.

And if your property has standout features — think private pools, direct beach access or being just a short walk from popular tourist attractions — you can command even higher nightly rates, making your investment even more lucrative.

Market supply

The number of active vacation rentals in a market gives you insight into its competitiveness and growth potential.

Cities like Pensacola and Panama City Beach are expanding their short-term rental market, signaling strong demand and opportunities for new investors to enter the real estate market.

On the other hand, Miami’s saturated market requires a more strategic approach, such as focusing on unique property features or luxury accommodations, to stand out.

Limited-supply markets like Key West, benefit from high demand and premium rates, making them particularly appealing despite higher property prices.

Number of vacation rentals

The overall number of vacation rentals in a market impacts pricing, demand and investor opportunity.

High-supply cities like Orlando, with thousands of listings catering to theme park visitors, offer broad appeal but more competition. Meanwhile, smaller cities such as Key West have fewer active listings, driving up both ADR and occupancy rates.

Understanding how the number of vacation rentals aligns with visitor demand in your target market can help you identify whether there’s room to enter or if the area is already saturated.

Seasonality

While Florida’s tourism industry thrives year-round, seasonal trends still play a major role in pricing and bookings.

During the winter months, snowbirds flock to warmer regions like Sarasota, filling properties with longer-term stays.

Spring break ushers in a surge of visitors to cities like Panama City Beach and Miami, making it a high-profit period for short-term rentals.

Summer keeps the demand steady in family-focused markets like Orlando and Jacksonville, where families flock to theme parks and kid-friendly attractions.

Adjusting your pricing and marketing strategies based on these seasonal trends can help you optimize your property’s profitability.

Top 10 Airbnb Markets in Florida

1. Fort Walton Beach

Fort Walton Beach is a treasure along Florida’s Emerald Coast, boasting family-friendly attractions and some of the beautiful beaches in the U.S. Visitors come for the Gulfarium Marine Adventure Park, annual events like the Billy Bowlegs Pirate Festival and world-class fishing.

For Airbnb hosts, Fort Walton Beach is a profitable city, with $80.5K in average annual revenue, a 62% occupancy rate and a daily rate of $407.60.

It’s not just for vacationers — proximity to Eglin Air Force Base keeps professionals booking year-round. Add affordable property prices and an Airbnb-friendly environment and you’ve got the perfect market for passive income.

Fort Walton Beach is also known for being Airbnb-friendly, making it an excellent spot for both new and seasoned investors.

2. Jacksonville

Jacksonville combines coastal charm with big-city amenities, making it an ideal spot for diverse travelers.

From its 22 miles of sunny beaches to vibrant arts districts and attractions like the Jacksonville Zoo, the city appeals to families, couples and solo adventurers alike.

With $55K in average annual revenue, 57% occupancy rate and a daily rate of $271.10, the numbers speak for themselves.

Plus, Jacksonville’s property market is more affordable compared to other Florida hotspots, giving new Airbnb investors a chance to break into the market without stretching their budget. The city’s local regulations are straightforward, making it easy to get started.

3. St. Petersburg

Sunny St. Pete is a favorite for both domestic and international travelers.

Known for its artsy vibes, waterfront parks and must-visit spots like the Salvador Dalí Museum, the city caters to culture lovers and beachgoers alike. Its downtown buzzes with trendy restaurants, craft breweries and live music venues.

Short-term rental hosts here earn an average yearly income of $68.7K, with a 65% occupancy rate and a daily rate of $294.40. Properties near beach access, lively entertainment or within three minute walking distance to popular attractions tend to book quickly.

The mix of year-round sunshine and tourist diversity ensures consistent bookings, making it one of the most reliable Airbnb markets in Florida.

4. Pensacola

Pensacola has something for everyone: history buffs love its charming downtown, families flock to its white-sand beaches and culture seekers enjoy its thriving arts scene.

Add attractions like the National Naval Aviation Museum and events such as the Pensacola Seafood Festival, and you’ve got a recipe for tourism success.

With $67.9K in average revenue, 60% occupancy and a daily rate of $343.30, Pensacola is a sweet spot for Airbnb investors.

Properties are still relatively affordable here and the city has a host-friendly reputation, making it an easy market to enter.

5. Miami

Miami doesn’t need an introduction. It’s where glamorous nightlife, stunning beaches, tropical oasis vibes and international culture collide.

Tourists from all over the world come for Art Basel, the Wynwood Walls, South Beach and luxury shopping in the Design District.

Of course, no trip is complete without experiencing the iconic charm of Miami Beach, where vibrant energy and breathtaking ocean views draw in millions every year. Miami’s diversity means a constant flow of travelers looking for everything from budget-friendly rentals to luxury condos.

Miami’s Airbnb properties average $61.1K annually, with a 58% occupancy rate and a daily rate of $295.40. While property prices can be high, the demand for short-term rentals is strong year-round, especially for homes with luxury features like private pools or king-size beds.

6. Orlando

Orlando is every kid’s dream destination, thanks to Walt Disney World, Universal Studios and LEGOLAND Florida.

But it’s not just families — Orlando also draws business travelers attending conventions and events at the Orange County Convention Center. Add natural springs and a lively downtown and it’s easy to see why visitors keep coming.

With $58.4K in annual revenue, 59% occupancy and a daily rate of $284.60, the numbers look great for Airbnb investors. Properties near theme parks or with family-friendly amenities like two bedrooms, smart TVs or game rooms often outperform the market.

Plus, local Airbnb regulations are straightforward, making Orlando a stress-free choice for investors.

7. Tampa

Tampa is the jack-of-all-trades city. From Busch Gardens to Ybor City’s vibrant nightlife and the Tampa Riverwalk, there’s no shortage of popular attractions here. It’s also a hub for business travelers, making it a versatile market for short-term rentals.

With $42.5K in annual revenue, a 59% occupancy rate and a daily rate of $201.60, Tampa offers steady returns. Plus, property prices are more affordable compared to luxury markets like Sarasota or Miami, giving investors a budget-friendly option with reliable income potential.

8. Sarasota

Sarasota is the definition of sophistication. From cultural attractions like the Ringling Museum to the world-renowned Siesta Key Beach, this city caters to upscale travelers, retirees and families looking for vacation rentals with a luxurious touch.

With $91.7K in annual revenue, a 65% occupancy rate and a daily rate of $373.10, Sarasota offers strong ROI for investors. Homes with private pools, tennis courts or proximity to the beach tend to perform exceptionally well.

Sarasota allows short-term rentals with proper permits. However, some neighborhoods and HOAs may have additional restrictions, so it’s important to research before purchasing.

9. Panama City Beach

Panama City Beach is famous for its sugary white sands, outdoor activities and vibrant nightlife. Whether it’s Pier Park shopping or scuba diving in crystal-clear waters, there’s something for everyone.

For short-term rental hosts, the city’s relaxed short-term rental regulations make it an ideal place to invest. Airbnb properties here generate $58.5K annually, with a 57% occupancy rate and a daily rate of $201.60.

Affordable properties and steady demand make this a profitable city, especially for mid-range rentals catering to families or groups of up to four guests.

10. Key West

Key West is a sought-after destination for its laid-back atmosphere, stunning sunsets and historic landmarks like the Ernest Hemingway Home. Travelers love the walking distance to local hotspots, snorkeling and the nightlife on Duval Street.

Airbnb rentals in Key West bring in $117.1K annually, with a 61% occupancy rate and a daily rate of $546.10. Though property prices are among the highest in Florida, the market’s potential for passive income is unmatched.

Key West has strict short-term rental regulations, including a cap on vacation rental licenses. However, licensed properties perform exceptionally well due to high demand.

Choosing the Best Airbnb Market in Florida

Florida is the ultimate vacation destination for Airbnb investments, combining year-round tourism, diverse markets and strong earning potential.

From family homes near theme parks to luxury beachfront villas, there’s a perfect opportunity for every investor. With favorable regulations, a steady stream of visitors, and properties that cater to all types of travelers, Florida offers the ideal mix of profitability and long-term value.

With the right approach, your Airbnb investment in the Sunshine State can become a thriving source of income and a rewarding venture.

FAQs

1. What are the best types of properties to invest in for vacation rentals in Florida?

Beachfront condos are perfect for couples or small families, while family homes near theme parks attract larger groups.

Luxury villas with private pools cater to high-end travelers and urban apartments are ideal for business guests seeking convenience and amenities.

2. Are there restrictions for short-term rental hosts in Florida?

Yes, regulations vary by city. Many areas are Airbnb-friendly, but stricter rules exist in places like Miami and Key West.

Most cities require short-term rental licenses through the DBPR and compliance with zoning laws. Check local regulations before investing.

3. How can I maximize bookings for my Airbnb Florida?

Choose prime locations near beaches or attractions and offer guest-friendly features like private pools, fast Wi-Fi and fully stocked kitchens.

Use seasonal pricing, set premium rates during peak seasons and ensure great reviews with excellent hospitality.

4. What are the upfront costs of starting an Airbnb in Florida?

Upfront costs include purchasing the property, furnishing it with essentials like beds, appliances and décor, and setting up amenities like Wi-Fi or a pool.

Additional expenses include licensing fees, insurance and marketing to attract guests.

5. Is property management necessary for Airbnb in Florida?

It depends on your preference and location. Self-management saves costs but requires time, while professional management handles guest communication and maintenance for a fee.

Tech tools can help streamline operations if you prefer managing on your own.