Airbnb vs Furnished Finder: Which is Better for Hosts?

The vacation rental market continues to grow, offering numerous options for property owners to generate income from their assets. While Airbnb has long been a dominant force in the short-term rentals market, Furnished Finder has emerged as an attractive alternative focused on mid-term rentals, especially targeting travel nurses and other traveling professionals.

When comparing Furnished Finder against Airbnb, property managers and owners need to carefully consider factors like audience, fees, booking methods and platform reach. In this article, we’ll analyze the key differences between these two popular rental platforms to help hosts make informed decisions.

Furnished Finder vs Airbnb: What Are the Key Differences?

Features | Airbnb | Furnished Finder |

Platform type | Global | US-focused, niche |

Target audience | Tourists, business travelers, other short-stay guests | Travel nurses and other healthcare workers, other traveling professionals, remote workers, relocating families |

Fees | Hosts and guests pay (split fee) or host only fee | Flat annual fee, no booking fees |

Property types | Short-term, flexible (entire properties, rooms, unique stays) | Furnished apartments/houses for 30 days or longer |

Tenant screening | Airbnb verifies guest identities; hosts can set conditions | Integrated tool for background checks, credit checks, eviction history |

Payment collection | Airbnb-managed (guests charged via Airbnb) | Host-managed, guests pay rent directly |

Listing setup | User-friendly, comprehensive support | Simple, straightforward |

Turnover rate | Frequent, shorter stays | Infrequent, longer stays |

Audience reach | Wide, international audience | Highly targeted, primarily US-based healthcare industry |

Booking method | Instant or manual approval via Airbnb | Direct communication with tenants |

Airbnb vs Furnished Finder: Key Platform Differences

Airbnb overview

Founded as Airbed & Breakfast in 2007 by Brian Chesky, Joe Gebbia and Nathan Blecharczyk, Airbnb initially aimed to offer affordable accommodations by renting out air mattresses in their San Francisco apartment. What began as a simple idea quickly evolved into a groundbreaking travel platform. Officially rebranded as Airbnb in 2009, the company has grown exponentially, fundamentally reshaping the global travel and hospitality industries.

Today, Airbnb is a leading global platform boasting over 8 million active listings across more than 220 countries and regions, maintained by over 5 million hosts. Its offerings range widely from urban apartments, private villas and unique homes to extraordinary stays such as treehouses and houseboats. Airbnb serves diverse travelers including tourists, business travelers families, digital nomads and even long-term renters.

A publicly traded company since its IPO in December 2020 (NASDAQ: ABNB), Airbnb currently holds a market valuation of $81.68 billion. A world leading peer-to-peer accommodation marketplace, it dominating its segment and significantly influences consumer behavior in the hospitality industry.

The platform invests heavily in technology, artificial intelligence and automation, further optimizing booking experiences for guests and hosts. Recently, it relaunched as an "Everything App" offering accommodation, services and experiences through its platform. Airbnb’s continued expansion into broader travel experiences and services indicates long-term sustainable growth opportunities.

Furnished Finder overview

Furnished Finder entered the scene in 2014, founded by Brian Payne to directly address the shortage of affordable, furnished housing specifically tailored to travel nurses and other traveling medical professionals. Recognizing a significant market gap, Furnished Finder quickly carved out a niche as a provider of furnished housing resources exclusively for stays of 30 days or longer.

Initially limited to healthcare professionals, Furnished Finder has recently expanded its focus to include broader segments such as corporate relocations, students, academic, consultants, relocation families, remote workers and other travelling professionals seeking mid-term rentals. With its unique approach to providing stability and affordability, Furnished Finder has gained a loyal user base in the specialized rental market.

As a privately-held company, Furnished Finder’s exact market valuation is undisclosed. However, it’s widely recognized as the premier housing platform for travel nurses and healthcare professionals in the United States, with listings in more than 25,000 U.S. cities. Furnished Finder currently hosts approximately 150,000 monthly users, establishing itself firmly within the niche market of medium-term furnished rentals.

The platform’s focuses heavily on creating an easy, direct booking process free from hidden fees, fostering strong tenant-landlord relationships through clear communication, comfortable housing and transparent financial arrangements.

Different Property Types on Furnished Finder vs Airbnb

Airbnb property types

Airbnb offers an extensive range of options, including:

Entire homes and apartments

Private rooms

Themed properties

Unique properties (treehouses, cabins, etc.)

Luxury properties (Luxe category)

These options appeal broadly to tourists and vacationers looking for short stays of just a few days to a couple weeks.

Furnished Finder property types

Furnished Finder, on the other hand, primarily targets:

Fully furnished apartments and houses

Extended-stay units ideal for travel nurses and medical professionals

Studios and condos suitable for mid-term rentals

This narrower focus helps hosts tailor their property specifically to travelers needing stable, comfortable accommodations for several months.

Airbnb vs Furnished Finder: Differences in the Host Experience

Airbnb for hosts

Airbnb allows property owners to create a listing quickly, adding photos, basic info, amenities and house rules. Airbnb processes payments and collects and submits taxes (in most places) on the host's behalf.

Hosts benefit from the flexibility of short stays but face more frequent turnovers and potentially higher operational demands.

Furnished Finder for hosts

With Furnished Finder, hosts pay a flat, annual service fee to list their property, with no additional commissions or booking fees cuts from rents.

The platform emphasizes long-term relationships with tenants, meaning fewer turnovers and predictable monthly income. However, hosts typically handle their own rental agreement and collections directly with the tenant.

Which Has Bigger Reach: Furnished Finder or Airbnb?

Airbnb’s Reach

Airbnb’s status as a global platform provides unmatched visibility, significantly increasing potential for more bookings. The platform has active listings in over 150,000 cities and towns across more than 220 countries and regions and has logged over two billion guest arrivals.

Airbnb hosts reach diverse audiences, from casual vacationers and business travelers to families, solo travelers, couples, luxury travelers and digital nomads. Airbnb properties appear in broad, international search results, offering extensive exposure.

Furnished Finder’s reach

Only available in the U.S., Furnished Finder is much smaller than Airbnb but excels at targeted reach. It specializes in connecting property owners with travel nurses and other traveling employees as well as relocating families. Additionally, Furnished Finder maintains direct relationships with hospitals and corporate HR departments, making it easier for hosts to secure stable occupancy from vetted potential tenants.

Furnished Finder offers listings across all 50 U.S. states and has over 300,000 properties listed serving over a million travelers.

Airbnb vs Furnished Finder: How Do Service Fees and Revenue Work?

Airbnb service fees

Airbnb offers two main fee structures for hosts: The split fee model and the host only fee.

In the split fee system, hosts pay around 3% and Airbnb guests cover the remainder (up to 14% of the booking subtotal). Conversely, the host only fee charges around 14–16% of the subtotal entirely to hosts, providing clearer pricing for guests.

Airbnb's commission is based on the total revenue generated by the host, including additional fees such as for cleaning and upgrades.

Furnished Finder service fees

Unlike Airbnb, Furnished Finder charges hosts a flat annual fee (currently around $179 per property) with no additional charges. Hosts retain 100% of the rent they collect.

This transparent fee structure makes cash flow predictable and appealing for property owners focusing on stable revenue.

How Tenant Screening Works on Both OTAs

Airbnb guest screening

Airbnb handles guest verification but hosts are responsible for doing their own background checks of guests if desired. Hosts can impose certain requirements including adherence to house rules, but the platform does not offer detailed background checks or credit checks on guests beyond basic identity verification. Instead, Airbnb hosts will have to reach for external guest screening tools integrated through their vacation rental software.

Furnished Finder tenant screening

Furnished Finder offers robust tenant-screening tools directly integrated into the platform through KeyCheck.

This service allows landlords to conduct comprehensive background checks, including detailed credit reports, criminal records and eviction histories, providing significant peace of mind particularly when hosting mid-term rentals.

Furnished Finder vs Airbnb: Rental Management and Payments

Airbnb rental management

Airbnb collects payments from guests on behalf of guests and submits it to hosts minus its commission. It also takes on management of refunds and other payment processing.

Airbnb requires guests to conduct all financial through the platform and guests who want to book direct will have to go through the host's direct booking website.

Furnished Finder rental management

Furnished Finder doesn't charge booking fees of any kind so hosts must directly manage contracts and process payments themselves. While this requires more involvement, it offers control over the payment methods and direct financial dealings with tenants, enhancing flexibility.

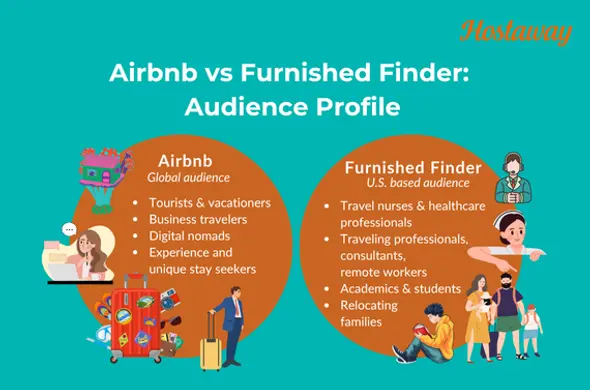

Furnished Finder vs Airbnb: What Are the Target Audiences?

Airbnb’s target audience

Airbnb's user base is diverse, encompassing a wide range of demographics and travel preferences. This ties into Airbnb's offering of Categories, allowing travelers to choose between property and destination types such as camping vs Arctic.

A significant portion of Airbnb guests (77%) choose Airbnb to experience living like locals, seeking authentic and unique accommodations. Additionally, 86% prefer Airbnb's locations over traditional hotels and 95% appreciate the platform's ease and security of payment

This diversity contributes to the platform's global appeal and high occupancy potential, though it also results in frequent turnovers and variable revenue for hosts.

Furnished Finder’s target audience

Furnished Finder's biggest audience is travel nurses and other traveling medical professionals. However, it also caters to traveling and remote working professionals of all kinds such as consultants, academics and even students. It's also marketing its furnished accommodations to relocating families and other groups.

The most in-demand properties on the platform are 1–2-bedroom units, with the most common booking request including 1-2 travelers. In a recent tenant survey, 82% of tenants shared they prefer renting an entire space to themselves rather than shared accommodations like room rentals.

Furnished Finder hosts benefit from longer-term occupancy, stable income and fewer turnovers. This focused target audience means consistent occupancy, with less frequent demands on hosts.

Additional Services Offered

Airbnb as an "Everything App"

Airbnb has expanded beyond traditional accommodations to become a holistic travel platform, positioning itself as an “everything app” where guests can not only book accommodations but also local experiences, activities, and even additional services like cooking classes, nail appointments and more.

This comprehensive offering significantly increases the platform's user base, potentially enhancing the value proposition for hosts.

Furnished Finder’s scope of services

In contrast, Furnished Finder maintains a straightforward focus on furnished housing, specifically tailored for mid-term rentals and mainly serving a niche group.

The platform doesn't offer additional services or experiences. Hosts on Furnished Finder exclusively market their rental units and handle tenant interactions directly, without opportunities to upsell additional experiences or services through the platform.

This simplified approach appeals to property owners who prefer minimal management complexity and stable rental relationships.

Additional Fees to Look Out For

Airbnb’s approach to additional fees

Airbnb allows hosts significant flexibility in charging additional fees, such as cleaning fees, pet fees, extra guest charges or even resort fees. When hosts set these fees, Airbnb calculates them as part of the booking subtotal presented clearly to guests during the booking process.

Since Airbnb charges its commission on the booking subtotal, it takes a cut from any additional charges.

Furnished Finder’s approach to additional fees

Unlike Airbnb, Furnished Finder does not directly involve itself in handling or taking a percentage from additional fees like cleaning fees or pet fees. Instead, hosts must independently outline such charges clearly in their rental agreements, setting terms directly with tenants.

While hosts can absolutely charge these fees, the platform itself doesn’t collect or manage payments, meaning hosts retain full control and responsibility over their implementation. Hosts typically include such fees in their rental agreement, clearly communicated during the tenant screening and application process. Since Furnished Finder charges only a flat annual listing fee, no additional percentage or commission is deducted from these extra charges, allowing hosts to keep 100% of any supplementary revenue.

However, it also requires property owners to handle all negotiations, collections, and enforcement independently, increasing administrative workload compared to Airbnb’s streamlined model.

Pros and Cons for Property Owners and Vacation Rental Managers: Furnished Finder vs Airbnb

Pros of Airbnb for property managers and owners

Large audience and visibility

Flexibility with short-term, mid-term and long-term rentals

Airbnb manages guest payments

Booking and guest management features

Cons of Airbnb for property managers and owners

Higher turnover rates

Higher service fees for guests and hosts

Greater platform control over hosts and operations

Pros of Furnished Finder for property managers and owners

Predictable income from mid-term rentals

Flat fee structure without additional commissions

Extensive tenant screening and background checks support

Less turnover and operational overhead

Cons of Furnished Finder for property managers and owners

Smaller, niche audience

Direct involvement required for rent collection and contracts

US-only based reach means no international visibility

Furnished Finder vs Airbnb: Which is Better?

Choosing between Airbnb and Furnished Finder largely depends on the host’s objectives. For those prioritizing stable, predictable income from longer stays, Furnished Finder offers unmatched advantages. Alternatively, hosts aiming for broad visibility, flexibility in short-term rentals, and less direct management responsibilities might find Airbnb more beneficial despite higher fees.

Hosts who clearly understand the differences between Airbnb and Furnished Finder can make informed decisions, optimizing their investment potential, occupancy rates and overall satisfaction in the vacation rental market. Ultimately, savvy hosts leverage multiple platforms, maximizing income and occupancy by adapting their property strategy according to seasonal trends and target audience needs. With an all-in-one vacation rental software like Hostaway, property owners and managers can easily list on and manage their properties and guests across multiple platforms.

Ready to find out how Hostaway can transform your business?