Airbnb Rules in Marseille | Short-Term Rental Laws, Regulations and Taxes

Marseille, France is where sun, sea and short-term rentals meet. The bustling Mediterranean port city with its historic streets and vibrant culture is a favorite among travelers from around the world. The rise in tourism has led to a similar surge in Airbnbs and short-term rentals which in turn has led to short-term regulations from the city.

In this article we explore what makes Marseille a hotbed for travelers, and the laws, regulations and taxes that apply to short-term rentals in the city.

Airbnb Rules in Marseille| Short-Term Rental Laws and Regulations

Registration

In Marseille, if you want to rent out your property for short-term stays, you have to register your listing with the local authorities. You are exempted if you operate a mobility lease or rent a single room of your primary residence.

The registration process involves obtaining a registration number, which must be displayed on all of your listings. This allows the city to monitor short-term rental activities more easily and enforce regulations accordingly.

You can complete the registration online. The goal of this process is to prevent the excessive conversion of residential homes into tourist accommodations, which can negatively impact the local housing market.

Categories of accommodation

The city of Marseille recognizes three categories of accommodation that can be rented out in the short-term.

Primary residences

Homeowners renting out their primary residence must make sure to live in the home for at least 8 months each year. They can only rent it out for a maximum of 120 days per calendar year and not more than 90 days to a single tenant.

Secondary residences

These are additional properties that are owner-occupied for less than four months each year. The city does not impose a cap on short-term rentals of secondary residences.

Non-residential spaces

These include commercial spaces like hotels, bed and breakfasts, etc.

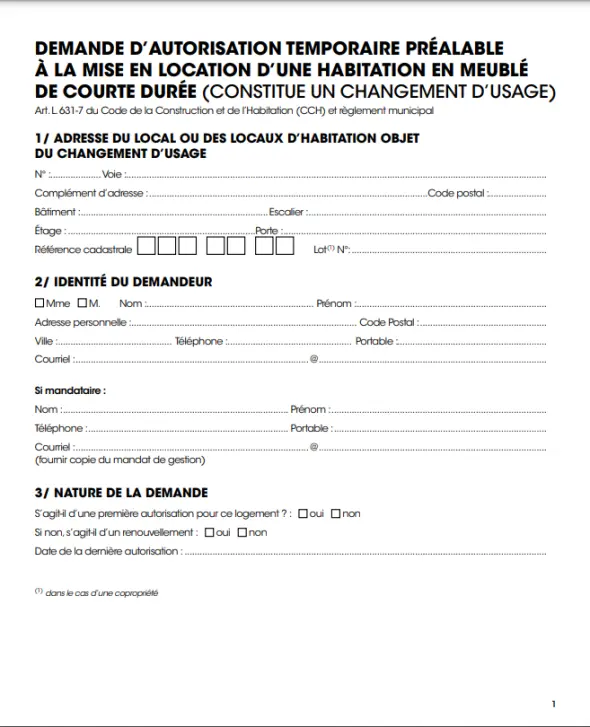

Change of Use

Short-term rental hosts in Marseille looking to rent out their secondary homes have to request for a change of use of their residential premises into a furnished tourist accommodation or furnished seasonal rental accommodation.

Once granted, the authorization is valid for four years.

The city of Marseille only permits change of use authorization for one dwelling per tax household.

A change of use authorization is also required by legal entities such as businesses and associations looking to transform a housing premises into a furnished accommodation.

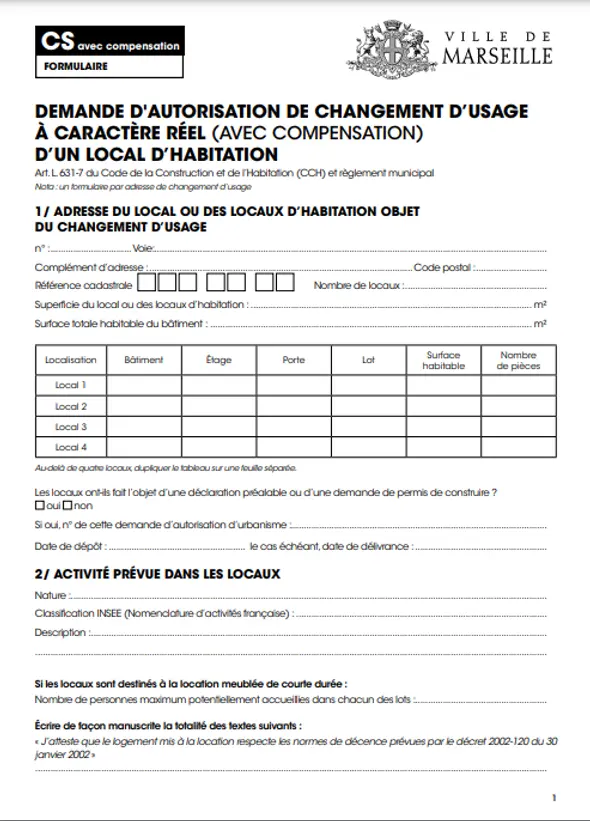

Compensation

Legal entities and individuals who want to request for more than one authorization for change of use are required to provide compensation. This involves purchasing or offering a commercial property of equivalent quality and surface area in the city to be converted into housing.

Co-ownership

If the rental property is located in a building governed by a co-ownership agreement (such as a condominium), hosts must comply with specific building regulations. In some cases, the building’s homeowners’ association may prohibit or restrict short-term rentals.

Make sure to review your co-ownership regulations and ask for permission from the building’s management or association before listing your property on Airbnb or other short-term rental booking platform. Failure to do so could lead to legal disputes or fines.

Rental arbitrage

If you are a renter trying to sublet your residence for short-term stays, make sure you have written permission for your landlord.

You also can’t rental arbitrage social housing and other types of subsidized housing.

Fines and penalties

Failure to comply with Marseille’s Airbnb regulations can result in fines. For example, exceeding the 120-day limit for renting out a primary residence or failing to register a rental property can lead to penalties starting from €5,000. Additionally, not adhering to co-ownership rules or listing a secondary residence without proper authorization can result in even steeper fines, as high as €50,000.

The city of Marseille actively monitors Airbnb listings to ensure that hosts comply with these rules, and authorities have the right to remove listings or pursue legal action against non-compliant hosts.

Airbnb Taxes in Marseilles | Short-Term Rental Taxes

Marseille tourist tax

Marseille imposes a tourist tax (taxe de séjour) on short-term rentals, which is paid by the guest. The amount varies depending on the type of accommodation and is charged per night per person.

For Airbnb properties, the platform automatically collects and remits this tax to the city on behalf of the host.

Income tax

Short-term rental hosts in Marseille are required to report their rental income to the French tax authorities as part of their annual tax returns. This includes both resident and non-resident vacation rental hosts in Marseille. Airbnb, in turn, is obligated to report the income earned by hosts with properties in France to the tax authorities.

French residents can benefit from certain tax exemptions if their rental income remains below a specific threshold.

Tourism in Marseille

A top Mediterranean hotspot, Marseille continues to draw more visitors each year, recording 16.2 million overnight stays in 2023 and over 1,100 business tourism-linked events. Its vibrant port, rich history, cultural diversity and proximity to natural attractions like the Calanques National Park draws a wide array of visitors.

Events such as the annual Marseille Jazz des Cinq Continents and its designation as the European Capital of Culture in 2013 have further boosted its tourism profile, making it a magnet for domestic and international tourists alike.

Sustainable Airbnb Hosting in Marseille

As Marseille grapples with the challenges of balancing tourism and housing needs, the city’s Airbnb regulations are crucial for maintaining a fair and sustainable rental market.

Understanding the local laws, regulations and tax obligations is essential for anyone looking to operate a short-term rental in Marseille.

By following these guidelines, Airbnb vacation rental hosts can avoid penalties, grow their business and contribute to the city’s economy.