Airbnb Reserve Now, Pay Later: Everything Hosts Need to Know

Key Takeaways

Airbnb’s new Reserve Now, Pay Later feature lets eligible guests book without immediate payment, offering flexibility similar to hotel models.

The feature is currently being tested in the U.S. and Canada, with payments automatically charged closer to check-in through Airbnb Payments.

For hosts, payout timelines and cancellation policies remain unchanged, ensuring income stability while potentially attracting more guests.

The main risk for hosts is last-minute cancellations if guests fail to pay on time, leaving gaps in occupancy.

This trial reflects Airbnb’s shift toward hotel-style booking systems and could influence how the short-term rental industry handles future payments.

Airbnb is testing a new feature in the U.S. and Canada: Reserve Now, Pay Later. The option allows eligible guests to secure a booking on the Airbnb platform without upfront payment, adding flexibility that aligns Airbnb more closely with traditional hotel booking models.

In this article we look at how the feature works and what it means for Airbnb hosts and guests as well as the implications for the future of the platform.

What is Airbnb's Reserve Now, Pay Later Feature?

The feature, which is being trialed for bookings in the U.S. and Canada, gives guests the option to delay making the full payment until closer to the date they are scheduled to arrive. Airbnb Payments will automatically charge the original payment method by a later date that is specified, giving guests time to plan their finances.

While Airbnb hasn't publicly shared the criteria bookings must meet to qualify, eligible booking is determined on Airbnb’s side based on internal rules. The new feature is part of Airbnb’s broader strategy to increase conversions by offering travelers greater payment flexibility.

Intriguingly, the update was added to Airbnb's Payments Terms on 26 June 2025 without any comment.

How Reserve Now, Pay Later Works on Airbnb

When guests choose Reserve Now, Pay Later at checkout, Airbnb shows the total price, currency and specified date by which full payment is required.

Airbnb Payments manages the entire process, ensuring guests pay by the relevant due date. Airbnb will automatically charge the original payment method unless the guest updates their payment method beforehand.

Guests can change their payment method before the due date to avoid a failed payment or a canceled Airbnb booking. Guests have 72 hours to update the method if a scheduled payment fails.

The new feature is different to typical buy now, pay later or installment schemes, where the total cost is split into multiple instalments. Instead, Airbnb guests must pay the total closer to the arrival date.

Airbnb Payments will remit payouts based on the host’s cancellation policy, ensuring consistency regardless of how the guest pays.

Airbnb will collect payment by the relevant date even if the host offers free cancellation, but guests can still cancel within the free window and receive a refund.

Benefits of Reserve Now, Pay Later for Airbnb Hosts & Guests

Benefits for Airbnb guests

Greater payment flexibility makes travel more accessible.

Ability to manage finances and payment method better before the date the amount is due.

Clear due date shared at booking so there are no surprises.

While it doesn’t support partial payment up front or installments, it still improves affordability by letting guests commit now and pay closer to check-in.

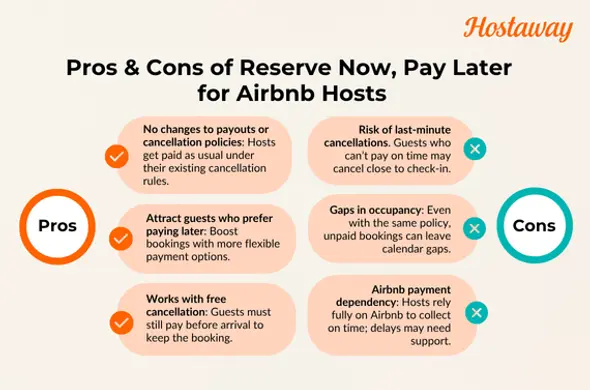

Benefits for Airbnb hosts

No changes to payouts or cancellation policy calls. Hosts still receive funds according to their current policy on cancellation.

Hosts can attract more guests who prefer paying later, potentially boosting bookings.

The model is consistent even for hosts who offer free cancellation — guests must pay what is due before arrival to keep the booking.

Disadvantages of Reserve Now, Pay Later for Airbnb Hosts & Guests

Disadvantages for guests

Guests who don’t update their payment method or fail to have funds available by the relevant date risk a cancelled Airbnb booking.

Unlike true “buy now, pay later” models, there’s no option for paying in installments, over time. Guests still owe the full amount in one go and before check-in.

Disadvantages for hosts

Travelers might commit to trips they can’t ultimately afford, leading to last-minute cancellations if they can’t pay by the specified date.

Even though the cancellation policy remains the same, bookings canceled due to guests not paying on time would leave hosts wit gaps in occupancy close to the check-in date.

Hosts are entirely dependent on Airbnb Payments to enforce and collect the payment on time. Any hiccup in processing could delay payouts or require Airbnb support intervention.

How Reserve Now, Pay Later Differs from Other Payment Options

It’s important to distinguish this update from typical buy now, pay later financing:

No partial payment up front or installments over time.

No third-party lenders or interest charges.

Focuses on payment timing, not splitting the amount.

Instead, Airbnb simply collects the total payment closer to the check-in date. Guests get the flexibility to reserve now but pay later, while hosts may benefit from more bookings.

Comparing Airbnb's reserve now, pay later with other payment models

Feature | Airbnb Reserve Now, Pay Later | Traditional Buy Now, Pay Later (BNPL) | Standard Airbnb Payment |

Initial payment required | No | Sometimes (usually partial upfront) | Yes (full or partial upfront) |

Installments | No | Yes | No |

Payment deadline | Set by Airbnb before check-in | Spread over multiple due dates | At booking or per host's cancellation policy |

Third-party financer | No | Yes (e.g., Klarna, Affirm) | No |

Interest charged | No | Sometimes | No |

Guest flexibility | Medium (pay later but in full) | High (pay over time) | Low (pay now) |

Host payment schedule | Unchanged | May vary based on provider | Unchanged |

Risk to host | Moderate (possible non-payment cancellations) | Low to moderate | Low |

What Does Reserve Now, Pay Later Bode for the Future of Airbnb?

Airbnb testing Reserve Now, Pay Later shows the platform is moving closer to hotel-like payment models, where paying on arrival is far more common. This is yet another signal of the shift in the short-term rental industry to hotel-like experiences to meet guest expectations.

If the trial proves popular among guests and nets Airbnb more earnings, the platform is likely to roll out the feature more broadly and extend it further shore than just North America. The move shows Airbnb is paying attention to consumer behavior during uncertain economic times and acquiescing to their expectations for flexible payment arrangements similar to the retail industry.

Success of the feature on perhaps the best-known online booking platform will also determine if it gets incorporated by competitors such as Booking.com.

What This Means for Your Airbnb Strategy

The trial signals Airbnb’s ongoing evolution to meet guest expectations. By letting travelers reserve now pay later, Airbnb offers flexibility while maintaining reliable payment for hosts.

Whether you're an experienced Airbnb property manager or a host who is just starting out, understanding these shifts can help you adapt your listing strategy and stay ahead. Keep an eye on Airbnb’s updates. If Reserve Now, Pay Later becomes widely available, it can transform how guests plan and pay for stays on the Airbnb platform, having a significant impact on your Airbnb and overall vacation rental business strategy.

Frequently Asked Questions (FAQ)

1. Can I opt out of accepting Reserve Now, Pay Later bookings as a host?

Currently, Airbnb does not allow hosts to opt in or out of this payment feature. The eligibility and payment method selection is controlled by Airbnb at the guest checkout stage. Hosts will continue to receive payouts based on their cancellation policy regardless of the payment method the guest chooses.

2. Will Reserve Now, Pay Later affect how far in advance guests book?

Yes, potentially. Guests who were hesitant to commit due to upfront payment may now book earlier. This could lead to longer booking lead times, which may help hosts plan more efficiently—but it may also increase the likelihood of future cancellations if guests' plans or finances change.

3. Does Reserve Now, Pay Later affect Airbnb’s cancellation coverage for hosts?

No, but it may affect guest behavior. While your cancellation policy remains the same, guests may book more speculatively, increasing the chances of late cancellations or no-shows due to failed payments. Hosts should monitor trends closely and adjust minimum stay requirements or pricing strategies if necessary.

4. Can guests choose Reserve Now, Pay Later for last-minute bookings?

It’s unlikely. Since the feature is designed to delay payment until closer to the check-in date, it would not apply to bookings made within that same window. Airbnb has not publicly outlined cutoff dates, but short-lead bookings are typically charged immediately.

5. Is Reserve Now, Pay Later available for long-term stays?

Airbnb hasn’t confirmed this. However, since long-term stays (28+ nights) often involve monthly payments under a different policy structure, this feature may not apply or may be handled differently. Hosts offering extended stays should stay updated on Airbnb’s payment policy announcements.

Ready to find out how Hostaway can transform your business?