Airbnb and Short-Term Rental Regulations in Paris

Paris, the city of lights, is one of the world’s most iconic cities and its global popularity has made it a hotspot for Airbnb. In fact, Paris boasts more active listings than any other city in the world.

However, with this surge in short-term rentals, Paris has also become one of the strictest cities when it comes to regulating platforms like Airbnb. The local government has implemented a series of laws to control the impact of short-term rentals on the housing market and preserve the availability of long-term housing for residents. If you're a property manager or host, it's crucial to understand these regulations to avoid hefty fines and ensure that your Airbnb listings are fully compliant with local laws.

In this article, we'll dive into the key short-term rental laws in Paris. From understanding the legal framework to registering your property and staying compliant, we’ll cover everything you need to know to run a successful and legal Airbnb in the French capital.

Airbnb Statistics in Paris

As of September 2024, Paris hosts approximately 95,461 active Airbnb listings, making it one of the top cities for short-term rentals globally. Of these listings, 39% are entire homes or apartments, allowing hosts to earn substantial income. For example, hosts who rent out entire properties can see monthly earnings as high as €3,814, depending on the location and the season.

Paris’s short-term rental market is thriving, with an impressive average occupancy rate of 80%, meaning that on most nights, the majority of Airbnb listings in the city are booked. According to AirDNA, the average daily rate for a rental in Paris stands at €250, with an annual revenue of €40.9K and a RevPAR of €141 making it a lucrative market for property owners and managers. For hosts who rent out their homes or apartments consistently, the financial returns can be substantial.

Take a 2-bedroom apartment as an example. According to data from Airbtics, a reliable source of vacation rental analytics, a 2-bedroom apartment in Paris can generate up to €86,050 in annual income. This figure highlights the potential for significant earnings, particularly for hosts who manage their listings effectively and cater to the continuous stream of tourists visiting the City of Lights throughout the year.

These figures underscore the attractiveness of the Parisian short-term rental market, particularly for those looking to capitalize on the city’s booming tourism industry while staying compliant with local regulations.

Airbnb and Short-Term Rental Laws in Paris

Now that we’ve established that Paris is a lucrative market for short-term rentals let’s look at the laws that govern it.

Understanding primary and secondary residences in Paris

In Paris, the distinction between primary and secondary residences is crucial for short-term rental regulations.

A primary residence is defined as the place where the host lives for at least eight months of the year. For these properties, hosts can rent them out on platforms like Airbnb for a maximum of 120 days per year.

A secondary residence, on the other hand, is any property where the host spends less than 4% of the year. Renting out a secondary residence is subject to stricter regulations, often requiring special authorization from the city and, in some cases, converting the property’s status to a commercial space.

These rules help the city prioritize long-term housing availability for residents while still allowing for some flexibility in the short-term rental market.

Registration of Airbnb properties in Paris

Since October 2017, anyone renting out a short-term rental in Paris—whether it's a primary or secondary residence—must register their property with the Paris City Hall and obtain a unique registration number. This number is a key part of the city’s effort to keep track of short-term rentals and ensure compliance with local laws. You are required to include this number in your listing on platforms like Airbnb. Skipping this step can lead to hefty fines, so it’s crucial to complete the registration before listing your property.

The 120-day limit for short-term rentals in Paris

One of the key rules for Airbnb hosts anywhere in France is the 120-day rental cap. You can rent out your primary residence for up to 120 days annually. This limit applies when you rent out the entire property. However, if you only want to rent out a room in your home, there’s no limit and you can do so all year long without restrictions.

The same goes with secondary If you’re renting out a secondary residence, you’re allowed to do so year-round, but you must inform the city beforehand and follow additional regulations. This ensures that your rental activities are known to the authorities and comply with local laws.

Health and safety requirements

Airbnb hosts in Paris are required to follow certain health and safety guidelines to keep their guests safe. This means equipping the property with essentials like smoke and carbon monoxide detectors, a fire extinguisher and a first-aid kit. Hosts also need to provide clear instructions on what to do in an emergency and ensure the property is well-maintained, free of hazards and safe for guests during their stay. More information from the French Minister of Health can be found on the SantéPubliqueFrance website.

Insurance and liability considerations

As a host, it’s important to think about getting proper insurance for your Airbnb property. While Airbnb offers its Host Guarantee and Host Protection Insurance, these may not cover every situation or type of damage. To make sure you're fully protected, it's a good idea to review your current home insurance policy and speak with an insurance expert to ensure you have the right coverage in place for your short-term rental. This extra step can help avoid any unexpected costs down the road.

Rent control and tenant protection

Paris has strict rent control laws to keep housing affordable. If you're renting and want to sublet your place on Airbnb, you must get written approval from your landlord first. Additionally, the rent you charge on Airbnb can’t be higher than what’s legally allowed for your property. Breaking these rules can result in fines and legal trouble, so it’s important to follow the regulations closely.

Building regulations and co-ownership rules

If your property is in a co-owned building such as an apartment complex, condominium building or a housing cooperative (co-op), you’ll need to follow any rules set by the co-ownership association. These rules might limit or even ban short-term rentals, so it's important to check your co-ownership agreement first. Make sure to get any necessary permissions from the association before listing your place on Airbnb to avoid issues down the line.

Enforcement and penalties for non-compliance

Failing to comply with Paris’s strict short-term rental registration rules can lead to significant financial

penalties and legal consequences. For example, if a host fails to register their property with the city, they could face a fine of up to €5,000. Platforms like Airbnb are also held accountable and can be fined up to €12,500 for non-compliance. More serious violations, such as renting a property that doesn’t meet building safety codes, can result in fines as high as €25,000.

Exceeding the 120-day rental limit for primary residences can also come with severe consequences, leading to fines of up to €10,000. Hosts must be diligent about tracking the days their property is rented to avoid these penalties.

The penalties escalate further for more severe infractions. For instance, providing false information or making fraudulent declarations under French law could lead to imprisonment of up to five years and fines reaching €75,000 under article 441-2 of the Penal Code. This highlights the importance of staying informed and compliant with Paris’s rental regulations to avoid both financial and legal risks.

Paris has been strict in enforcing these rules, so hosts and platforms alike must take these regulations seriously to operate within the law.

Tax Obligations for Airbnb Hosts in Paris

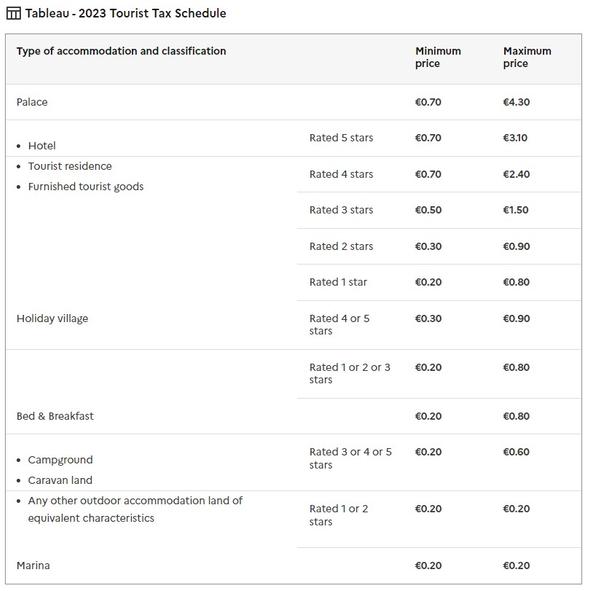

If you're hosting on Airbnb in Paris, you'll need to take care of a few tax responsibilities. First, there's the tourist tax ("taxe de séjour"), which depends on the type of accommodation you're offering and how many guests stay.

On top of that, you’ll need to report your rental income to the tax authorities and pay any required income tax and social contributions. These obligations ensure that you’re fully compliant with French tax laws while benefiting from renting out your space.

Just a heads-up, Airbnb is required by law to report the rental income earned by French tax residents or anyone renting out a property in France through the platform. This rule has been in place since 2019. If the income reported by Airbnb doesn’t match what you declare on your annual tax return, the French tax authorities might reach out to you for clarification. So, it’s important to ensure that the numbers you report align with the information Airbnb provides.

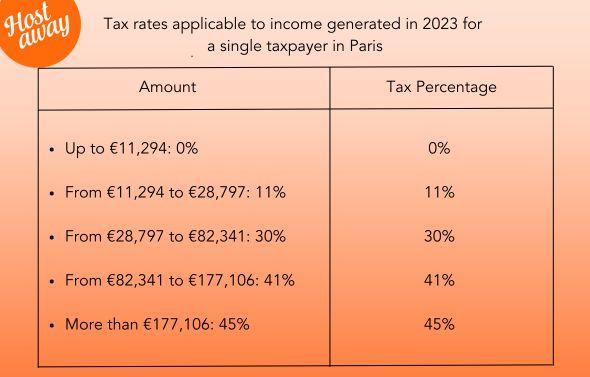

Income tax and social contributions

General Rule:

Income from renting furnished properties (including Airbnb listings) in France is considered as industrial and commercial income ("Bénéfice Industriel et Commercial" or BIC).

Tax Regimes:

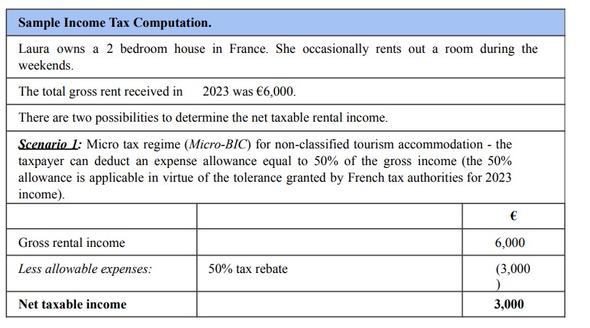

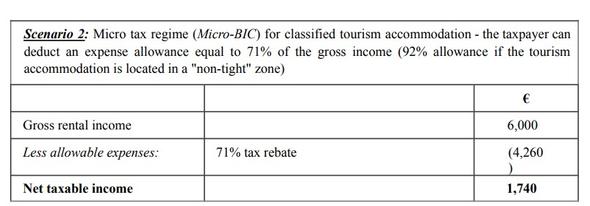

Micro-BIC Regime

If your annual gross rental income is below certain thresholds (€77,700 for non-classified accommodations or €188,700 for classified accommodations), you qualify for this regime. You can deduct a flat rate for expenses (50% or 71% respectively).

Régime Réel (actual expenses regime)

If your income exceeds these thresholds or if you opt out of Micro-BIC, you must use the "régime réel." Under this, you can deduct actual rental expenses (maintenance, repairs, property tax, etc.) to calculate net income.

Social Contributions:

Social surtaxes of 17.2% generally apply. However, self-employed social security contributions may apply if your gross rental income exceeds €23,000, depending on certain criteria.

Value-Added Tax (VAT)

VAT thresholds: For small businesses, VAT does not apply unless annual turnover exceeds €91,900 (set to reduce to €85,000 by 2025).

VAT exemption: Short-term rentals are typically exempt from VAT, unless the host provides additional services akin to hotel accommodations (e.g., breakfast, linen and reception services). In such cases, VAT would apply.

Collection: If VAT applies, hosts must register for VAT, collect VAT from guests and remit it to the French tax authorities.

Find more information on this here.

Reporting and Payment Deadlines

Tax forms: Forms such as "2042 C PRO" for self-employed income and "2031" for rental income are required for tax reporting.

Payment: Taxes are typically paid in installments based on previous years' liabilities, with final balances settled in the following year.

Deadlines: Rental income from the previous year must be declared by early May (for regime réel) or by mid-May (for other forms of income).

Property Taxes

Taxe Foncière: This property tax is levied on the cadastral value of the property and is payable by the property owner.

Contribution Foncière des Entreprises (CFE): This tax applies to businesses and individuals engaged in renting or subletting furnished properties.

Real Estate Wealth Tax (IFI): Applicable to real estate assets exceeding €1.3 million.

Reporting Requirements

Airbnb has a legal obligation to report the rental income earned by its French users or anyone renting property in France through its platform. Failure to report can lead to penalties, interest and possibly criminal prosecution.

Paper tax forms:

Form 2042: General tax form

Form 2042 C PRO: Self-employed income (Furnished property - "régime micro or régime réel")

Form 2044: Rental income (unfurnished property)

Form 2031 - 2033: Rental income (Furnished property - "régime réel")

Form 2047 - To report foreign income received by French tax resident

Form 2048-IMM - Capital gains (filled by the French notary at the time of the sale of the property)

Online tax forms:

All required forms can be accessed online through the official French tax website, www.impots.gouv.fr. However, for first-time filers, online tax return submissions are generally not available.

Taxation for non-residents

Non-resident investors need to be aware of a few key tax obligations when renting property in France:

French income tax: Non-residents are taxed on rental income earned in France. The tax rate is calculated depending on the income level and there’s a simplified option for reporting without itemizing expenses.

Double taxation treaties: France has agreements with many countries to prevent being taxed twice on the same income.

Wealth tax: High-value properties may be subject to a wealth tax, which applies to the net value of assets in France. It’s important to assess if your property exceeds this threshold.

Potential Future Changes

A major reform on rental taxation is expected in 2024, which may change some aspects of the tax rules for short-term rentals such as:

For non-classified tourism accommodations, the fixed deduction for expenses will be reduced from 50% to 30%.

The income threshold for eligibility to the micro-BIC regime for non-classified accommodations will be lowered from €77,700 to €15,000 in turnover (excluding VAT).

Classified tourism accommodations will continue to benefit from the 71% deduction and the turnover threshold remains at €188,700.

For more information on calculating taxes in France refer to this tax guide (Tax guide in French | Tax guide in English) which covers general tax information in France in detail. Or contact the relevant tax authorities using the details on www.impots.gouv.fr/portail/contacts.

Thriving in the Short-Term Rental Industry in Paris

Navigating the short-term rental market in Paris presents both opportunities and challenges. To operate legally, hosts must comply with regulations like the 120-day rental cap, registration rules and health and safety guidelines. Properly handling taxes—including income tax, social contributions and VAT—is also crucial. Staying informed, ensuring appropriate insurance and adhering to local laws will help you maximize earnings while avoiding penalties. By following these guidelines, you can run a successful and compliant Airbnb business in the City of Lights.

FAQ: Airbnb and Short-Term Rental Laws in Paris

1. What is the difference between primary and secondary residences in Paris for short-term rentals?

A primary residence is where the host lives for at least eight months of the year. These properties can be rented out for a maximum of 120 days per year on platforms like Airbnb.

A secondary residence is any property where the host spends less than 4% of the year. Renting out secondary residences requires additional permissions from the city and may involve converting the property to commercial status.

2. Do I need to register my property for short-term rental in Paris?

Yes, since October 2017, you are required to register your property with the Paris City Hall and obtain a unique registration number, which must be included in your Airbnb listing. Failing to do so can result in fines of up to €5,000.

3. What is the 120-day rental limit for Airbnb hosts in Paris?

For primary residences, you can rent out the entire property for up to 120 days per year. However, if you are only renting out a room, there are no such limits. For secondary residences, there is no rental cap, but you must follow additional city regulations.

4. How do Paris rent control laws affect Airbnb hosts?

If you are subletting your rental property on Airbnb, you must obtain written permission from your landlord. You are also restricted from charging more rent on Airbnb than what is allowed by Paris’s rent control laws.

5. What taxes do I need to pay as an Airbnb host in Paris?

You are required to pay the tourist tax (taxe de séjour) and report all rental income to the tax authorities. Depending on your income, you will fall under either the Micro-BIC or Régime Réel tax regime, which impacts how much you can deduct in expenses. Social contributions and VAT may also apply under specific circumstances.

6. Are non-residents subject to the same tax obligations for Airbnb rentals in Paris?

Yes, non-residents who rent properties in Paris are subject to French income tax on rental income and must comply with double taxation treaties where applicable. High-value properties may also be subject to the Real Estate Wealth Tax (IFI).