Airbnb Rules in Pennsylvania | Laws, Regulations and Taxes

Navigating the legal landscape of short-term rentals is essential for ensuring the success and longevity of your Airbnb business. Without proper adherence to Airbnb laws, including permits, zoning requirements, and tax obligations, you risk facing significant fines or even the closure of your rental operation.

Understanding these Airbnb laws will also help you comply with local laws and governments and meet requirements for your vacation rental or short-term rental property.

Getting to Know Pennsylvania

Pennsylvania, often referred to as the Keystone State is a Middle Atlantic gem offering diverse experiences. Its rich history is deeply rooted in the American story, from the Liberty Bell and Independence Hall in Philadelphia to the Civil War battlefields of Gettysburg.

Pennsylvania's variety of landscapes, from bustling urban centers to tranquil countryside, along with its historical and cultural richness, ensures that there's something for everyone. In Philadelphia, you can indulge in the city's famous cheesesteaks, immerse yourself in sports culture and explore world-class museums. For those seeking natural beauty and outdoor adventure, the Poconos offer a perfect retreat. Easton lays claim to the first Christmas tree in the United States and the Crayola Experience. Traveling westward, in Gettysburg, you'll find a town that preserves its Civil War heritage and offers a charming mix of vineyards, breweries, and cultural experiences.

There are no specific laws and regulations governing Airbnbs imposed through the Pennsylvania state or local government either. Instead, they are specific to the county and city that the Airbnb vacation rental belongs to.

Here are some of the main Airbnb cities in Pennsylvania and the laws and regulations relevant to listing them.

Gettysburg

The Borough of Gettysburg classifies short-term rentals as accommodations available for stays of 30 consecutive nights or fewer. This category includes renting both owner-occupied and proprietor-occupied properties.

In the case of Airbnb vacation rentals where renting a portion of the host's personal residence is offered, it is referred to as renting a homestay. If the owner resides in a separate dwelling or offsite location, the property is defined as a vacation rental.

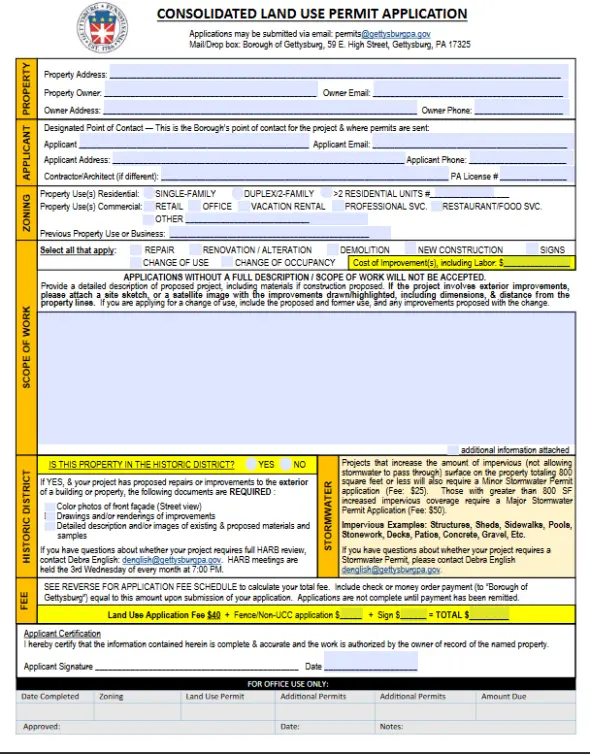

Gettysburg requires both a Land Use Permit and a Certificate of Use & Occupancy.

If you want to operate a homestay, you must obtain a Homestay Residency Certification.

Airbnb vacation rentals can only be legally operated in permitted zones as per the zoning ordinance in many cities and must obtain zoning approval from local governments even for short-term lodging.

Poconos

The Borough of Mount Pocono recognizes a short-term rental as all rentals (Airbnb and otherwise) that are for stays less than 30 consecutive days.

Each individual short-term rental unit license requires its license and licenses are only issued in the name of the owner. Licenses must be renewed annually.

Airbnb short-term rentals are only allowed in areas designated as permitted by Chapter 215 (zoning codes). Each dwelling unit must be situated in a lot of a minimum area of 0.50 acres.

Each Airbnb property listing must have a designated local contact person, whether it’s the owner, a property manager, or another individual, who will be available to handle issues and remain contactable 24/7. This ensures that any complaints or emergencies related to the short-term rental property can be promptly addressed, as required by the local government.

The Borough of Mount Pocono imposes strict regulations on the number of overnight occupants allowed in each Airbnb short-term rental property. The limit is two people per bedroom, plus two additional guests (e.g., a two-bedroom rental property can accommodate a maximum of six people overnight). To meet zoning and safety requirements, bedrooms must be no less than 70 square feet in area or seven feet in any dimension. For a private room that holds more than one person, the space must measure at least 100 square feet.

The borough enforces several additional local laws and zoning regulations to maintain safety and order in short-term rentals. These include,

Displaying the license notice within the property.

Meeting safety standards, such as installing smoke detectors, fire extinguishers, and sturdy stairs.

Controlling noise levels and regulating guest behavior.

Providing a minimum of one off-street parking space per bedroom.

Philadelphia

The city of Philadelphia recognizes Airbnbs and other short-term rentals as residential property rented for fewer than 30 consecutive days at a time. This property can be a spare bedroom, a rowhouse or an apartment.

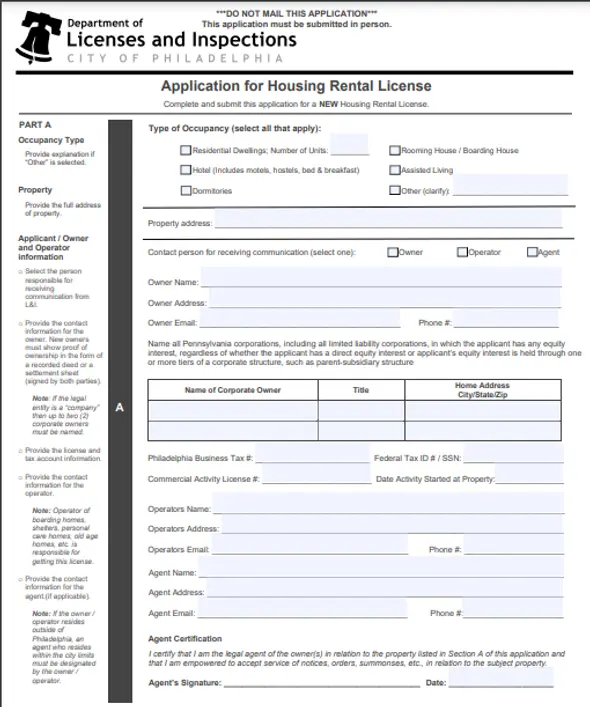

When a primary residence or a room in it is rented out for the short term, they are defined as Limited Lodging and require a Limited Lodging Operator License. Limited lodging operators must live in the residence for at least half of the year.

When you rent a property, entire home or unit that is not your primary residence, you need a Rental License.

If you make reservations or collect payment on behalf of potential guests of a limited lodging operator, you need a Limited Lodging and Hotels Booking Agent License.

Both property owners renting and tenants engaging in rental arbitrage can apply for these licenses except in the Tenth Council District where only the homeowners are eligible.

When a dwelling unit is rented out for the short term by a renter who calls it their primary residence, living there for over half of the year, it is a property type defined as Visitor Accommodations.

Licenses must be renewed annually.

Airbnb host and operators are also required to apply for a commercial activity license. You can apply online make an appointment to visit the Permit and License Center in person. You must also get a zoning permit.

The city requires safety measures such as smoke alarms on every floor and in every bedroom and carbon monoxide alarms.

Signs announcing lodging facilities are not allowed nor is changing the residence so that it no longer resembles a private residence.

Properties must be certified as being lead-free or lead-safe by the Philadelphia Department of Health and owners must certify they are following all rules on lead safety.

Hosts must notify guests of trash and recycling collection days and trash disposal rules, and ensure no excessive noise.

Renters are only allowed to have guests between 8 a.m. and midnight. Guests must also be provided with contact information of the owner, property manager or other designee to handle complaints.

The city also requires property managers to keep records for at least one year showing the home continued to remain a primary residence, the dates the home was rented and the number of guests who stayed.

Easton

The city of Easton requires both a residential vacation rental license and a business license to operate an Airbnb vacation rental within its borders.

Once you register with the city of Easton, an authorized agent of the city will conduct an inspection and then a re-check inspection to ensure all corrections have been completed. Additional re-inspections will incur additional fees.

The residential rental license will only be issued once the inspections have been passed, any overdue taxes and fees to the city have been paid in full, and a business license has been obtained. These permits must be renewed annually, and an inspection will be conducted once a year by a Code Enforcement Officer. Staying compliant with local laws is crucial to avoid penalties or disruptions to your Airbnb business.

Violation of city codes can lead to significant penalties or even the revocation of the license. This includes safety and hygiene violations, or failing to remain contactable by the Code Enforcement Officer when issues arise. Ensuring the property complies with zoning regulations and other local laws will help hosts maintain their license.

For guests, specific requirements must also be met. Each guest must be provided an off-street parking space, and no signage advertising or identifying the property as a short-term rental is permitted. Furthermore, short-term rentals are not allowed if they are located within 500 feet of another short-term rental property, per the city’s zoning codes.

Other Rules

Apart from short-term rental laws house rules and regulations relevant to your location, make sure you check with other rules related to your property, such as contracts, leases, condo board, co-op and HOA rules as well as tenant organization rules.

Airbnb Taxes in Pennsylvania

Taxes apply at the state, county, and city levels for Airbnb hosts in Pennsylvania, and understanding your obligations is essential to avoid penalties or missed payments. Airbnb simplifies this process for hosts by collecting and remitting some taxes directly to local authorities, but it’s always a good idea to verify that all necessary tax payments have been made. This ensures compliance with Pennsylvania’s tax laws and protects your Airbnb business.

State taxes for Airbnb hosts

The state of Pennsylvania levies two key taxes on Airbnb and other short-term rental properties:

Hotel Occupancy Tax: A 6% tax on the total listing price, including cleaning fees.

Local Sales Tax: A 1% tax that applies in addition to the occupancy tax.

These state-level taxes apply uniformly across Pennsylvania, regardless of the location of the Airbnb property. Hosts should remember that these taxes are often automatically collected by Airbnb when guests book their stays, but verifying the amounts is still recommended.

County and city-level taxes

In addition to state taxes, Airbnb hosts may be responsible for paying local taxes specific to the city or county where their short-term rental is located. These taxes vary widely and depend on local regulations. Below are some examples of city and county taxes in Pennsylvania:

Easton (Northampton County): A 4% Hotel Room Rental Tax applies to all short-term rentals, including Airbnbs.

Mount Pocono (Monroe County): Hosts are subject to a 3% Hotel Excise Tax.

Philadelphia: The city imposes an 8.5% Hotel Tax, making it one of the highest local taxes for Airbnb hosts in the state.

Gettysburg (Adams County): A 5% Hotel Room Rental Tax applies to vacation rentals in this historically significant borough.

These local taxes are crucial for hosts to account for when calculating their overall costs and pricing their listings competitively.

Verification and compliance

While Airbnb collects and remits many of these taxes, hosts should actively review their tax obligations to ensure compliance. For example, some taxes or fees might not be automatically handled by Airbnb, especially if local governments have specific reporting requirements. Hosts are encouraged to:

Check the full list of tax collections handled by Airbnb in Pennsylvania on the platform’s website.

Consult with a tax advisor or accountant familiar with short-term rental laws to ensure no payments are overlooked.

Keep detailed records of earnings, tax collections, and remittances for at least one year, as required by some local governments, like Philadelphia.

Why staying tax-compliant matters

Understanding and adhering to these tax obligations is not just a legal requirement but also an integral part of being a responsible Airbnb host. Non-compliance with tax laws can result in fines, penalties, or even restrictions on your ability to operate a short-term rental. Moreover, paying the correct taxes helps maintain the infrastructure and tourism services that make Pennsylvania an attractive destination for Airbnb guests.

Mastering the Legal Landscape of Airbnb in Pennsylvania

Successfully operating an Airbnb requires staying informed about the various Airbnb laws and regulations at the state, county, and city levels. While Pennsylvania doesn’t have statewide short-term rental rules, individual municipalities enforce their own Airbnb laws, ranging from zoning restrictions to licensing requirements.

By complying with these Airbnb laws and regulations, hosts ensure their rental property is not only legally compliant but also meets the standards for visitor accommodations and limited lodging operator licenses.