Airbnb Rules in New Jersey: Short-Term Rental Laws, Taxes and Regulations

New Jersey boasts vibrant cities, charming beach towns and scenic mountains, making it a prime destination for holiday seekers. Imagine mountain cabins for nature lovers, charming beach towns for sunseekers or vibrant cities for urban explorers.

Nestled in this rich tapestry, your vacation rental will hold unique appeal.

New York City to New Jersey

The recent changes to Airbnb regulations in New York have led to a noticeable trend: travelers seem increasingly keen on booking their stays in New Jersey, opting to visit New York City on day trips.

This shift presents a significant opportunity for Airbnb investors and hosts in New Jersey! Let's explore the impact of NYC's "Local Law 18" on the Garden State:

Increased demand in New Jersey: With stricter regulations and registration requirements in NYC, some travelers may be diverted to New Jersey, seeking alternative short-term rental options. This could lead to increased demand for Jersey Shore rentals, mountain cabins and urban apartments, particularly in areas close to New York City.

Competition heats up: More New Yorkers seeking rentals in New Jersey could intensify competition among existing hosts, putting pressure on pricing and occupancy rates. Be prepared to adapt your listing and pricing strategy to stand out.

Is Airbnb Legal in New Jersey?

Yes! Airbnb is legal in the Garden State! But here's the catch - each spot in New Jersey has its own set of rules for short-term rentals. Generally speaking, New Jersey slaps a state occupancy tax on these rentals.

And guess what? Some places like Paterson don't even make you get a business license to run a short-term rental.

Now, let's dive into some of the short-term rental laws and rules in big New Jersey towns:

Airbnb regulations in Jersey City

Jersey City has set some guidelines for Airbnb and short-term rentals, detailed in Chapter 255 of the city's ordinances. Here's what you need to know:

Tenants aren't allowed to manage short-term rentals.

Rentals are also off-limits in rent-controlled units.

Homeowners can share their primary residence, including up to two additional units in the same building, provided they live there. But, they're limited to hosting for a maximum of 60 nights annually when they're not present. To do this, they need to secure a permit from the Division of Housing Preservation.

To apply for a permit, visit the Division of Housing Preservation at 342 Martin Luther King Drive, Jersey City, NJ, or download the application online.

Remember, you must complete the application process for every short-term rental you operate, even if they're owned by the same person or in the same property.

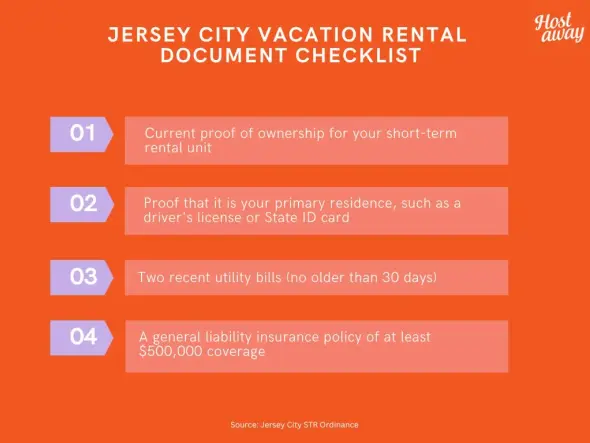

What you'll need to get an STR permit in Jersey City:

A registration fee of $250.

The rental's street address, tax block and lot and ward.

The owner's contact details: name, address, email and phone number.

If a company owns the property you'll need the names and contact info for all partners, officers and/or directors.

The contact info for both the property agent and the responsible party for the vacation rental who must be reachable 24/7.

Details on parking - how many spots you've got for the STR, including legal off-street and on-street parking spots right next to your place.

Additional documentation

A current proof of ownership for the short-term rental unit, like your tax bill.

Something to show it's your primary residence, such as a driver's license or State ID card.

Two recent utility bills (no older than 30 days) as further proof.

A general liability insurance policy covering at least $500,000.

You can find out more about the Jersey City STR ordinance here.

Airbnb regulations in Newark

In Newark, you need to secure a permit from the Department of Engineering before renting out or advertising your space as a short-term rental. This is a crucial first step for all STR property owners.

To get your STR permit, here's what you'll need:

Your contact info (name, address, phone number and email) along with your rental unit's address.

A copy of your driver's license or State ID to prove the property is your primary residence.

Contact details for your short-term rental agent and the responsible party, both of whom should be reachable 24/7.

Info on parking spots available, plus a plan to keep on-street parking hassle to a minimum.

If you're renting out a condo, you'll also need the green light from the Condominium Association.

Additional documentation

Documentation confirming your current ownership of the short-term rental unit.

Evidence of general liability insurance with a minimum coverage of $500,000.

Written agreements from both the short-term rental property agent and the responsible party, confirming their commitment to fulfill their roles.

Beyond obtaining the permit, owners are also required to apply for a Certificate of Code Compliance. It's important to note that both the permit and the certificate need to be renewed annually, with a renewal fee of $250.

Airbnb regulations in Atlantic City

In Atlantic City, if you plan to rent out any living spaces, rooms or other areas for short-term or seasonal use, you must get an annual permit through a registration and inspection process. To get through registration smoothly, ensure your taxes, as well as water and sewer charges, are fully paid up and your property has no outstanding maintenance issues.

Here's what you'll need to get an STR permit:

Fill out and submit the application form with a $150 application fee.

Provide the address of your rental, including block, lot and unit numbers.

Share your contact details: name, address, phone number and email.

Give the contact info for a local contact person available 24/7, including their name, address, phone number and email.

Include proof of general liability insurance that covers short-term rental activities.

Attach Land Use Certification, Pest Certification and Fire Certification.

Learn more about Atlantic City's short-term rental regulations here.

Airbnb regulations in Asbury Park

In Asbury Park, following adjustments made in February 2020 in response to a lawsuit, the city has updated its regulations governing short-term rentals. This ensures both the safety of the community and the rights of property owners. To legally operate a short-term rental in Asbury Park for stays of 30 days or less, hosts must secure a Short-term Rental Permit.

Here's what hosts need to know:

Fill out the permit application form and submit it with the required fee.

Provide the full address of the rental property, including block, lot and unit numbers, as well as your contact information.

Designate a local contact person who is available 24/7, including their contact details.

Submit an Occupant Change Form for each new guest to keep local authorities informed.

Ensure your property passes an annual inspection.

For long-term rentals over 30 days, different regulations apply.

For more detailed information and to view the full ordinance, visit the City of Asbury Park's official website.

Is Airbnb Profitable in New Jersey?

Absolutely! New Jersey's charm is hard to ignore, and some of its cities are becoming the go-to places for those looking to invest in short-term rentals. With its booming economy, a steady stream of renters and bustling tourist scene, it's no wonder why.

Buying an Airbnb spot in one of New Jersey's top cities is a smart move. Not only do you get a vacation home, but you also have the chance to rake in some sweet passive income by renting it out!

Let's dive into the Airbnb scene in New Jersey. Data from Airbtics shows that investing in most New Jersey cities pays off. Take Jersey City, for example, where the average host can pocket about $36,529 a year from a 1-bedroom place thanks to an impressive 81% occupancy rate.

Looking at Atlantic City? Hosting there could net you around $29,954 a year for a 1-bedroom property with the occupancy rate hovering around 50%.

And in Newark, the deal's good, too. Hosting a 1-bedroom can bring in about $27,595 annually with an average occupancy rate of 65%. Plus, Newark has a reputation as one of the friendliest cities in the US for short-term rentals!

Stay Informed to Make Smarter Decisions

By keeping up-to-date with the newest Airbnb rules in New Jersey and choosing the best spots, hosts can ensure their short-term rental (STR) ventures run smoothly and profitably.

Given Airbnb's tight restrictions in NYC, New Jersey is a more appealing choice for STR listings, especially in cities close to New York. This proximity means tourists might prefer booking in New Jersey for a better experience. That said, it's important to note that places like Jersey City have been tightening their STR rules lately. Despite this, the overall legal landscape for STRs in the area remains hopeful and shouldn't be significantly impacted.

FAQs

Is Airbnb legal in all parts of New Jersey?

Yes, Airbnb is legal across New Jersey, but each city or town may have its own specific rules and requirements for short-term rentals. It's important to check local regulations before listing your property.

What are the general requirements for running an Airbnb in New Jersey?

Generally, hosts need to comply with state occupancy taxes and in some cities, securing a permit or business license may be necessary. Additionally, hosts must ensure they meet all safety and zoning regulations.

What documents do I need to obtain a short-term rental permit in Jersey City?

In Jersey City, you'll need a registration fee, your property's details, contact information, proof of ownership, proof of residence, utility bills and a general liability insurance policy. Specific details and forms can be accessed through the city's Division of Housing Preservation.

Can I rent out my property if it's rent-controlled or I'm a tenant?

In many New Jersey cities, such as Jersey City, short-term rentals are not allowed in rent-controlled units and tenants are generally prohibited from subletting via Airbnb without explicit permission from the landlord.

How often do I need to renew my short-term rental permit in New Jersey?

The renewal frequency can vary by city. For instance, in Newark and Atlantic City, permits and certificates of code compliance must be renewed annually. Be sure to check your local regulations for specific renewal requirements.