Everything You Need to Know About Short-Term Rentals in Fort Lauderdale

%20(1).webp?u=https%3A%2F%2Fimages.ctfassets.net%2Fpqmtoyw9z10u%2FHrnZVAyT3cHrmon8me8sa%2F68c3f62f4fd388c5152696506321bae5%2FFL__1___1_.webp&a=w%3D960%26h%3D549%26fm%3Dwebp%26q%3D75&cd=2024-11-05T05%3A17%3A08.374Z)

With its picturesque beaches and lively atmosphere, Fort Lauderdale is a top destination for travelers seeking an authentic Florida experience. Known as the ‘Venice of America,’ the city draws both visitors and hosts eager to capitalize on its thriving short-term rental market.

Like many other cities in Florida, vacation rentals including Airbnbs in Fort Lauderdale are governed by specific short term rental laws, regulations and taxes, so property managers need to stay informed and compliant. Here’s what you need to know about the rules that apply to short-term rentals in Fort Lauderdale.

Fort Lauderdale as a Tourist Destination

Fort Lauderdale offers a more relaxed and affordable alternative to Miami or Orlando, attracting tourists with its beautiful beaches, shopping districts, historic neighborhoods and arts scene. A popular yachting destination, the city has steadily grown in popularity, becoming one of Florida’s top tourism destinations. In 2022, Fort Lauderdale welcomed over half a million tourists, earning its rank as the third most-visited city in Florida and fifth nationwide.

Airbnb Short-Term Rental Potential in Fort Lauderdale

The short-term rental market in Fort Lauderdale has continued to perform well, with average daily rates (ADR) and occupancy rates that underscore its appeal.

According AirDNA data for Fort Lauderdale in October 2024:

Average daily rate (ADR): $299.8

Average occupancy rate: 53%

Annual revenue: $28.3K

Revenue per Available Rental (RevPAR): $153.7

Vacation rentals are projected to maintain this momentum, with Fort Lauderdale’s tourism scene expected to keep thriving into 2024 and beyond.

Airbnb Short-Term Rental Rules in Fort Lauderdale

Vacation rentals in Fort Lauderdale are subject to short-term rental laws, regulations and taxes on the city, county and state levels.

The city defines a vacation rental as a single or multi-family residential unit leased to transient guests for not more than 30 days and not more than three times annually.

Short-term rentals in Fort Lauderdale also fall under the regulatory purview of Fort Lauderdale's Zoning Code and hosts must ensure their use of property is compliant with the code. For example, accessory dwellings cannot be used as vacation rentals in some zoning districts.

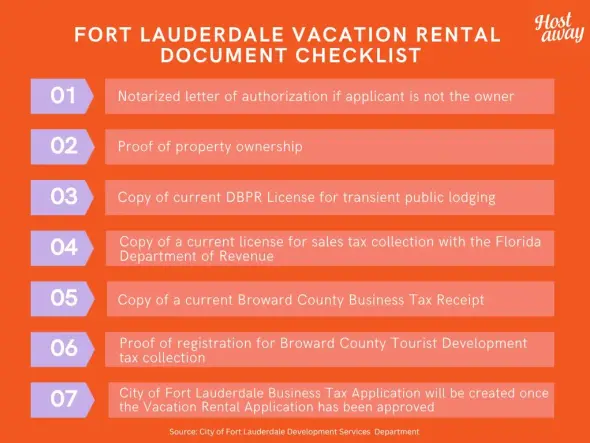

Licensing and registration

To legally operate a short-term rental in Fort Lauderdale, short-term rental hosts must obtain:

State and County licenses

City registration

Department of Business and Professional Regulation (DBPR)

Owner-occupied homestead properties with room rentals are exempt from DBPR licensing requirements. To claim this exemption, property owners must provide a notarized letter confirming eligibility.

Department of Revenue

If you host on a platform like Airbnb that handles state tax collection and remittance on your behalf, submit a notarized letter affirming this arrangement and specifying the State of Florida Sales Tax to the Florida Department of Revenue.

Broward County Business Tax Receipt

Complete the application online or in person at the Broward County Records office.

Broward County Tourist Development Tax

If you host on a booking platform like Airbnb that collects and remits this tax, submit a notarized letter attesting to this and include the name of the platform. The letter must specify Broward County Tourist Development Tax.

Property ownership

Vacation rental managers must provide proof of property ownership from the Broward County Property Appraiser’s website. If you are not the property owner, a notarized letter of authorization from the property owner(s) or managing member of the business is required.

If the short-term rental property is owned by a business entity, provide ownership information found on Sunbiz. If the corporation is an out of state/international entity, registration is required with the State of Florida Division of Corporations.

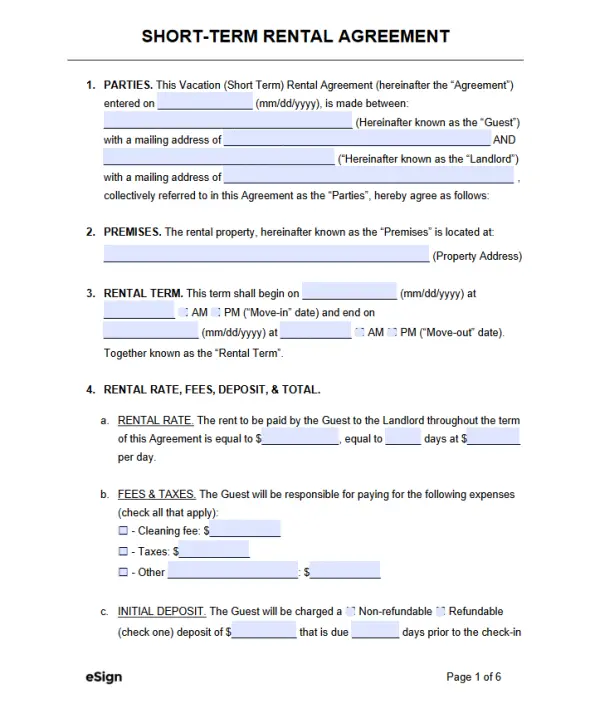

Lease agreement

Provide a blank/sample copy of the short-term rental agreement you will ask your guests to sign.

Sample leases can be found here, here and here.

Make sure the required information found in the Vacation Rental Ordinance is a part of the agreement. Also include a sketch or photograph of the off-street parking spaces with the following statement, "No on-street parking permitted".

Registration process

All short-term rental businesses must be registered with the city after obtaining the State and County licenses.

Complete the application on LauderBuild and await processing. Expect an email containing your vacation rental account number and an invoice for registration payment.

After approval, a Business Tax account will be generated, and an invoice for the business tax issued.

Schedule and complete an inspection to verify property compliance.

A Certificate of Compliance will be issued within three business days upon passing inspection. If the property fails inspection, a re-inspection is conducted in 10 days.

Operational requirements and restrictions

Noise

Noise must not be plainly audible beyond 25 feet from 10:00 pm to 7:00 am or 50 feet during the rest of the day.

Vacation rental hosts must inform owners and guests of noise violations, and each rental must include a noise detection device with a 180-day data retention period. Property managers are obliged to hand over this data to the city upon request.

Parking

On-site parking only Parking must be within the property or designated areas.

No street parking Guests are not allowed to park on the street.

Blocking driveways Parking must not obstruct other driveways.

Occupancy limits

Sleeping occupancy: Two persons per bedroom. (The number of legal bedrooms is verified during the inspection.)

Gathering occupancy: Maximum occupancy for gatherings is set at 1.5 times the sleeping occupancy, capped at 20 people.

Trash disposal

Trash must be placed in city-approved receptacles and may not be set outside before 6:00 pm on pickup days. Carts must be removed by midnight on the same day.

Violations

A $250 civil penalty is imposed for each uncontested violation and $325 for each contested violation

The maximum penalty for operating a vacation rental during a suspension is $5,000 per day for repeat violations and $15,000 per day if the special magistrate finds the violation irreparable.

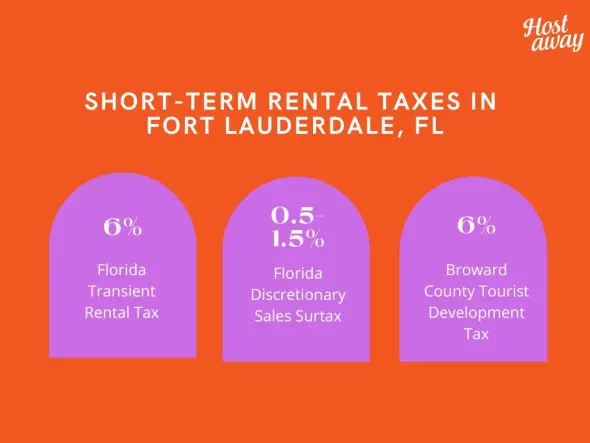

Tax obligations

Airbnb vacation rental hosts must adhere to various tax obligations for short-term rentals, which include:

Florida Transient Rental Tax: 6% of the total listing price, including cleaning fees, for stays up to 182 nights

Florida Discretionary Sales Surtax: Ranges from 0.5% to 1.5%

Broward County Tourist Development Tax: An additional 6% on the listing price, also including cleaning fees

When you list your short-term rental on Airbnb, the platform automatically collects and remits these taxes to the appropriate authorities on your behalf.

Compliance and Success in Fort Lauderdale’s Short-Term Rental Market

Fort Lauderdale’s short-term rental market is vibrant and rewarding for both property owners and managers, but only if they are prepared to navigate its regulatory landscape with diligence and care. Following city, county and state guidelines, ensuring registration and adhering to occupancy, noise and parking rules are key to running a successful short-term rental business in Fort Lauderdale.